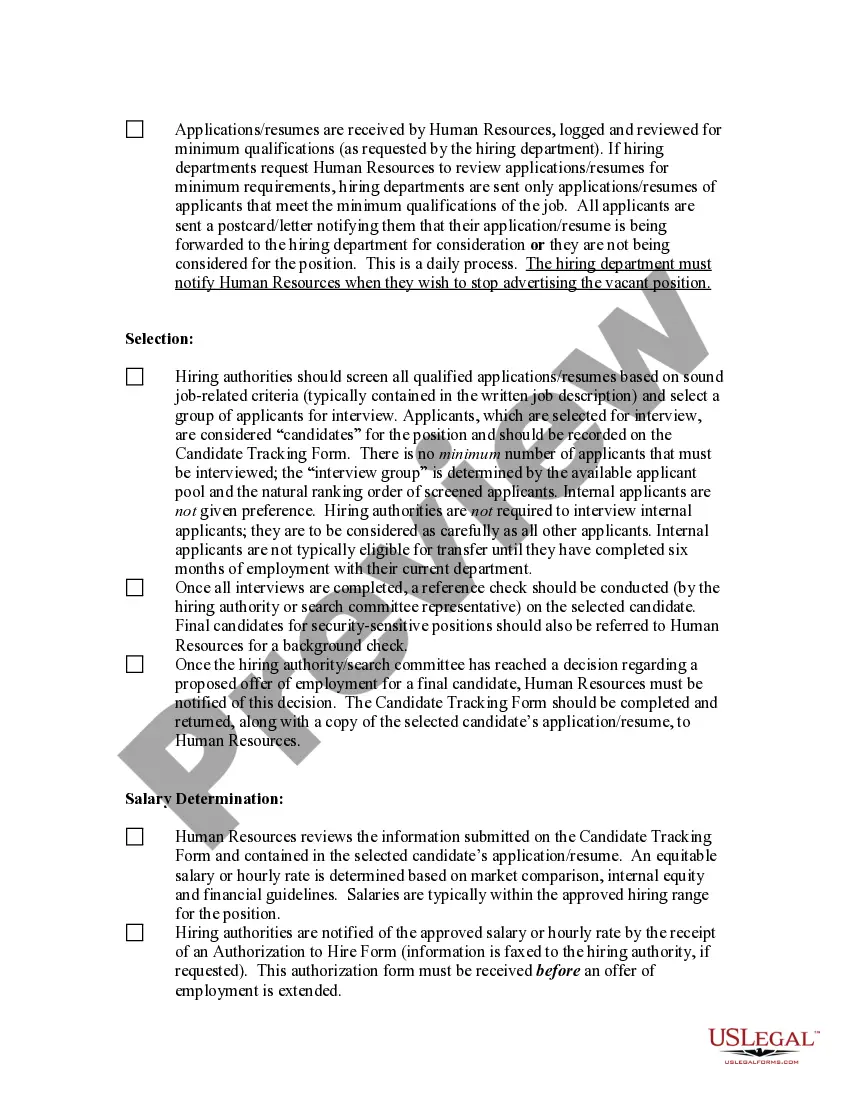

Missouri Checklist for Legal Hiring Process

Description

How to fill out Checklist For Legal Hiring Process?

Have you found yourself in a position where you require documentation for various business or personal needs almost every working day.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides a wide array of template forms, including the Missouri Checklist for Legal Hiring Process, which are designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and begin making your life a bit simpler.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Missouri Checklist for Legal Hiring Process template.

- If you do not possess an account and wish to utilize US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and specifications.

- If you locate the correct form, click Acquire now.

- Select the pricing plan you desire, fill in the required details to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents menu. You can request another copy of the Missouri Checklist for Legal Hiring Process at any time if needed. Just access the necessary form to obtain or print the document template.

Form popularity

FAQ

Steps to Hiring your First Employee in MissouriStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

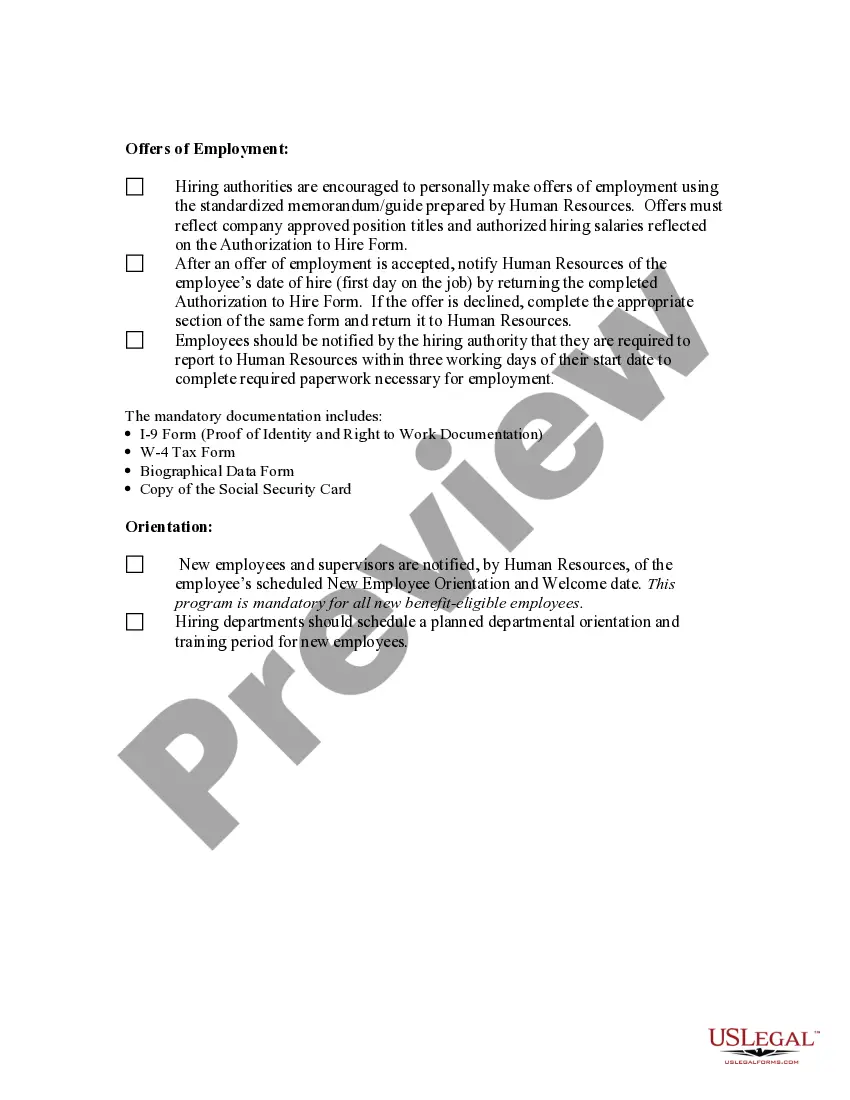

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

The following documents are vital when it comes to the recruitment process,Offer Letter.Manpower Requisition.Job Description.Employment Agreement and contract.Recruitment Tracker.Candidate Evaluation Form.Reference Check Guide.07-Jan-2022

Form I-9 and E-Verify System for Employment Eligibility As an employer, it is your responsibility to document the eligibility of new employees to work in the U.S. For this you'll use Form I-9, Employment Eligibility Verification, which must be completed by each new hire.

In this Article Get an Employer Identification Number (EIN) Set Up Records for Withholding Taxes, and File/Pay Taxes. Verify Eligibility to Work in the U.S. Register with Your State's New-Hire Reporting Program. Get Workers' Compensation Insurance. Post Labor-Law Notices.More items...?

You may also call 1-888-663-6751....You may use one of the following reporting methods:Mail the W-4 or equivalent form to the Missouri Department of Revenue, PO Box 3340, Jefferson City, MO 65105-3340;Fax copies of the W-4 or equivalent form to (573) 526-8079;Electronically report employees via Secure File Transfer.

Employers are required to report newly hired employees within 20 calendar days of the hire date. If an employee is required to fill out a W-4 form, that employee must be reported.

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

The recruitment process involves finding the candidate with the best skills, experience, and personality to fit the job. It requires a series of collecting and reviewing resumes, conducting job interviews, and finally selecting and onboarding an employee to start working for the organization.