Missouri Employment of Executive with Stock Options and Rights in Discoveries

Description

How to fill out Employment Of Executive With Stock Options And Rights In Discoveries?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal form templates you can download or print. By using the website, you are able to locate thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Missouri Employment of Executive with Stock Options and Rights in Discoveries within minutes.

If you are registered, Log In and download the Missouri Employment of Executive with Stock Options and Rights in Discoveries from the US Legal Forms collection. The Acquire button will be available on every form you view. You have access to all previously downloaded forms in the My documents tab of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Missouri Employment of Executive with Stock Options and Rights in Discoveries. Every template you added to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Missouri Employment of Executive with Stock Options and Rights in Discoveries with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your region/area.

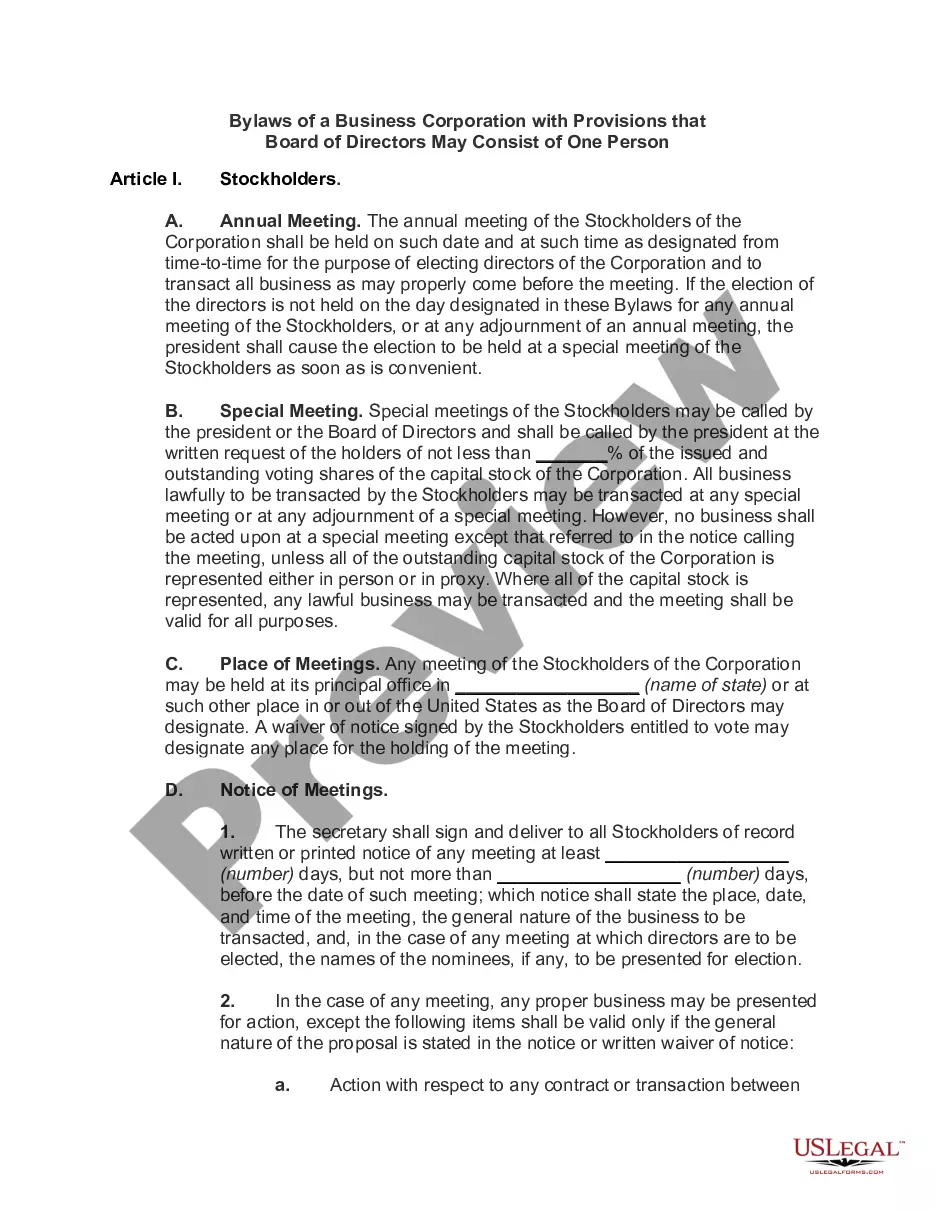

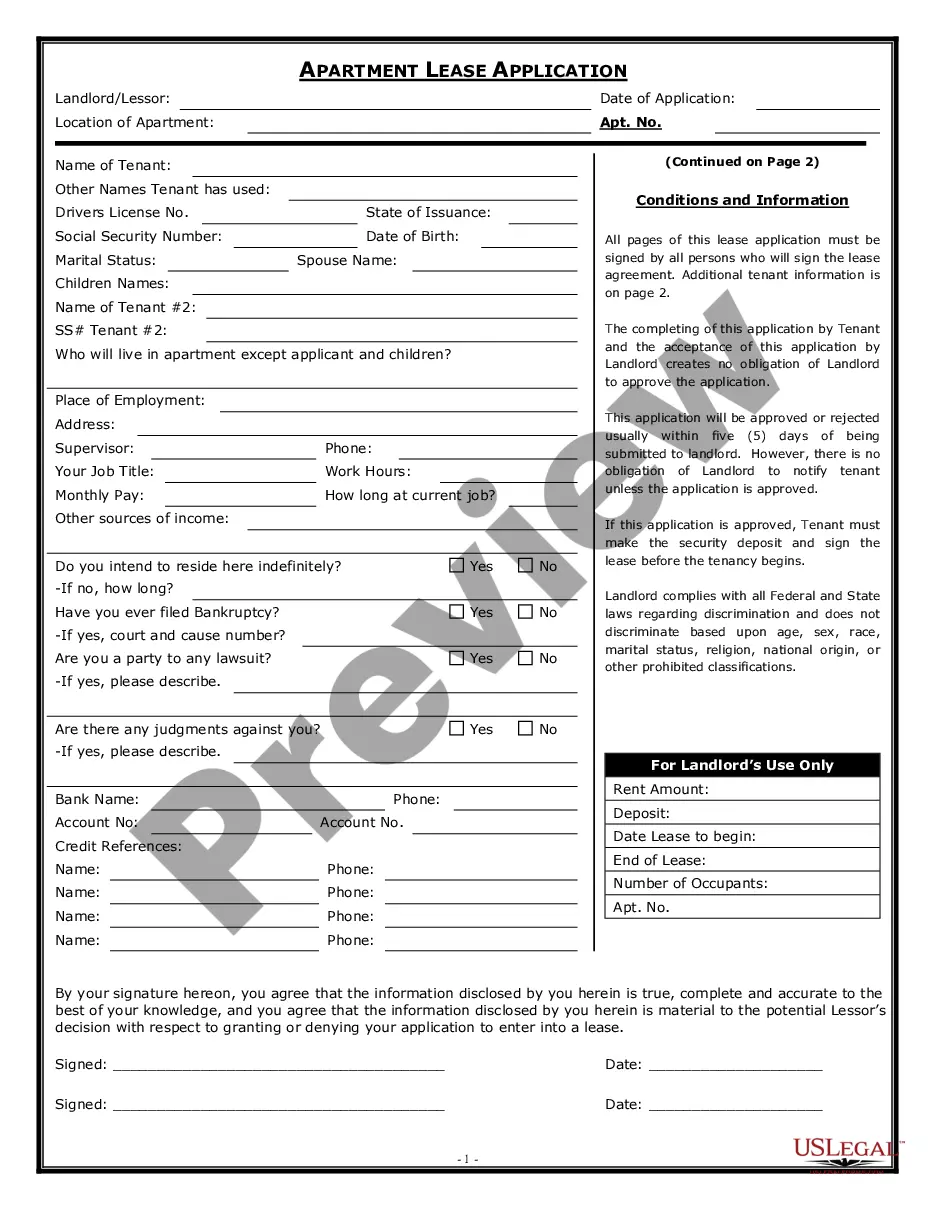

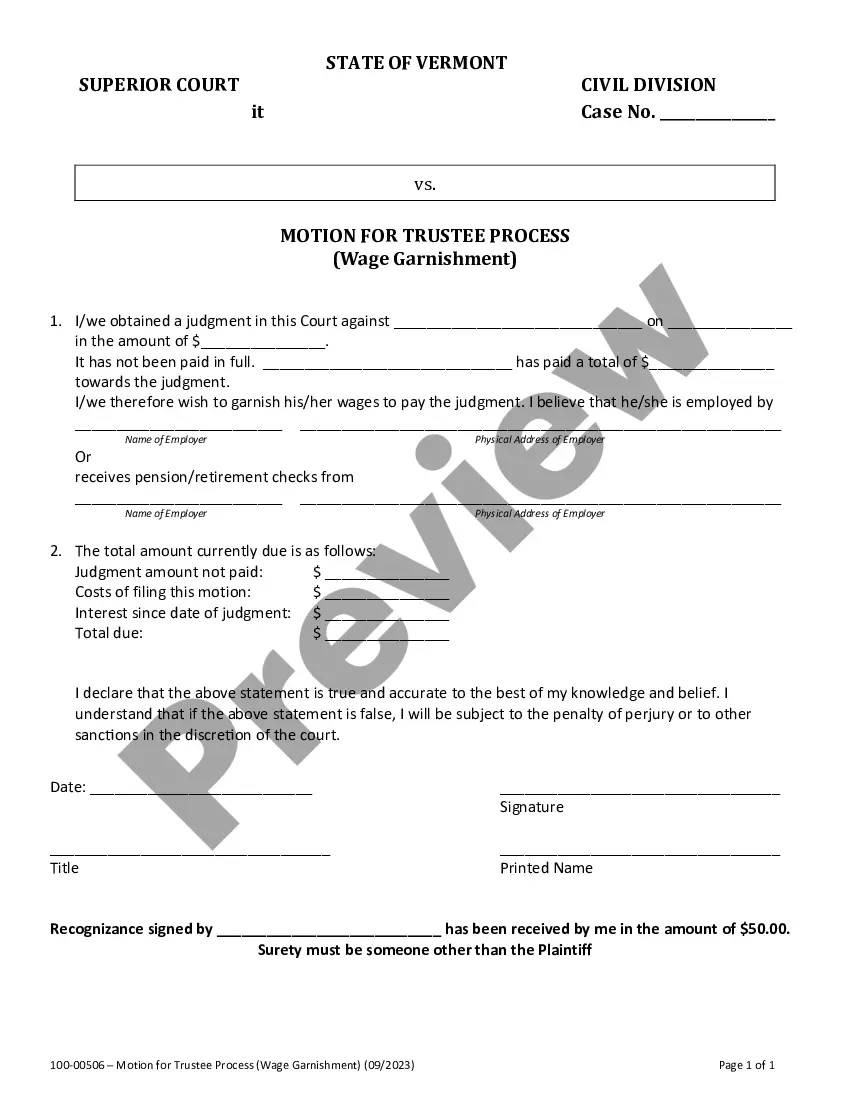

- Click the Preview button to review the form’s details.

- Check the form information to ensure you have chosen the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

In Missouri, while employment is generally considered at-will, there are notable exceptions. Employers cannot terminate employees for discriminatory reasons, retaliation, or violating public policy. Knowing these exceptions can empower you as a worker. To understand how these apply to your circumstances, consider using the tools available at USLegalForms.

The strike price of $70 means that the stock price must rise above $70 before the call option is worth anything; furthermore, because the contract is $3.15 per share, the break-even price would be $73.15. When the stock price is $67, it's less than the $70 strike price, so the option is worthless.

Overview of Three Types of ESOPsNonleveraged ESOP. This first type of ESOP (Diagram 1) does not involve borrowed funds to acquire the sponsoring employer's stock.Leveraged Buyout ESOP.Issuance ESOP.

Typically, stock options expire within 90 days of leaving the company, so you could lose them if you don't exercise your options. Most companies accept this as standard practice based on IRS regulations around ISOs' tax treatment after employment ends.

The Employee Stock Option Plan (ESOP) is an employee benefit plan. It is issued by the company for its employees to encourage employee ownership in the company. The shares of the companies are given to the employees at discounted rates. Any company can issue ESOP.

It may sound complicated, but accepting your stock grant should be a no-brainer for anyone who's starting at a new company. It's low-risk and can provide measurable benefits down the road. To get started on the ins and outs of stock options, check out part 1 of our series Equity 101: Startup Employee Stock Options.

There are two key types of employee stock options: incentive stock options, or ISOs, and nonqualified stock options, called NSOs.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Options are derivatives of financial securitiestheir value depends on the price of some other asset. Examples of derivatives include calls, puts, futures, forwards, swaps, and mortgage-backed securities, among others.

An employee stock option is the right given to you by your employer to buy ("exercise") a certain number of shares of company stock at a pre-set price (the "grant," "strike" or "exercise" price) over a certain period of time (the "exercise period").