Missouri Assignment of Contract as Security for Loan

Description

How to fill out Assignment Of Contract As Security For Loan?

Locating the appropriate legitimate document format can be somewhat of a challenge.

Naturally, there are countless templates accessible online, but how can you find the legitimate document you require.

Use the US Legal Forms website. This service offers thousands of templates, such as the Missouri Assignment of Contract as Security for Loan, that can serve both business and personal needs.

If the document does not fulfill your specifications, utilize the Search field to find the appropriate document.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are currently registered, sign in to your account and click on the Acquire button to obtain the Missouri Assignment of Contract as Security for Loan.

- Employ your account to browse through the legal forms you have purchased previously.

- Navigate to the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are straightforward instructions that you can follow.

- Initially, verify that you have chosen the correct document for your city/state. You can explore the form using the Preview feature and read the form description to ensure it is suitable for you.

Form popularity

FAQ

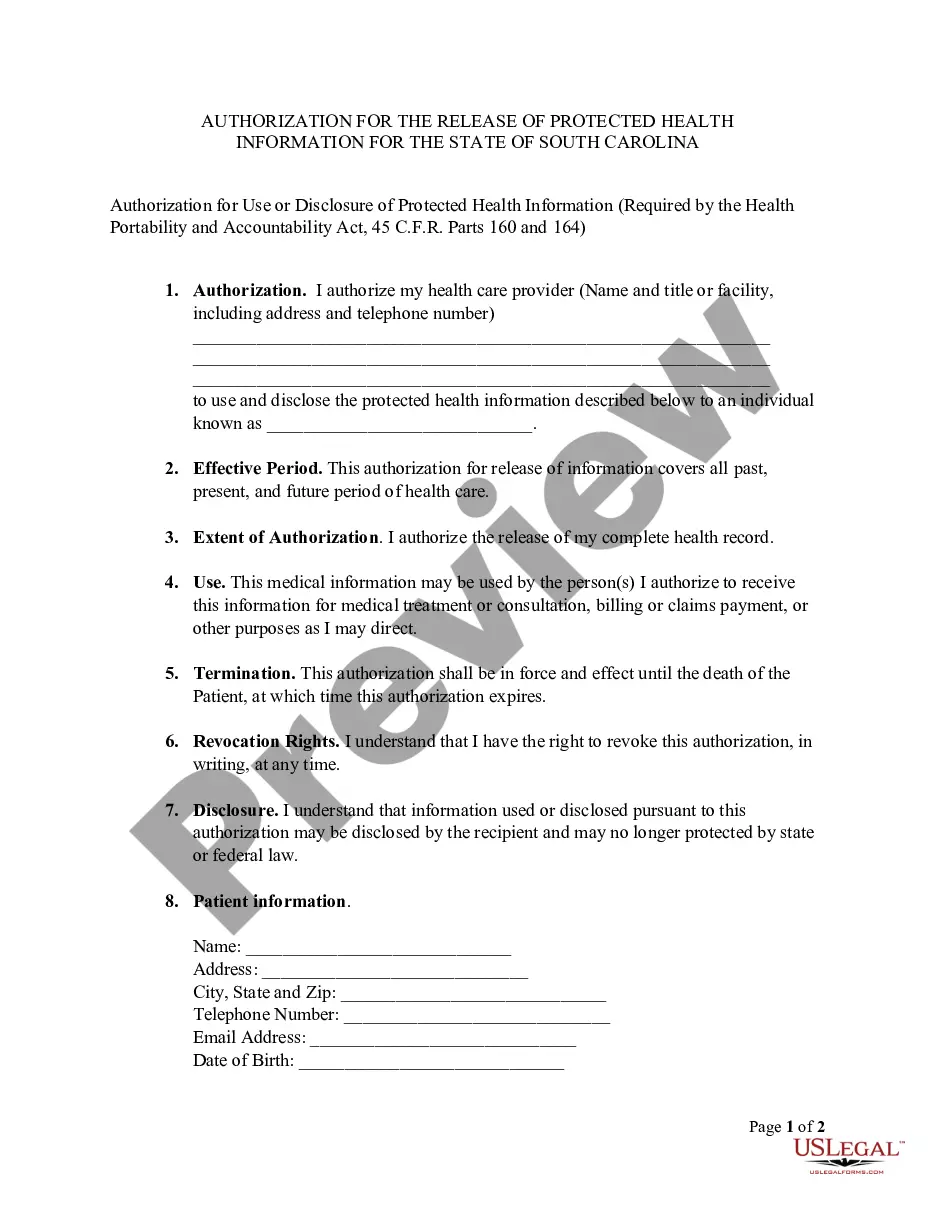

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

Companies that operate by contractually agreeing to provide services or products for a specific project or event can use the contract as collateral to secure necessary funding.

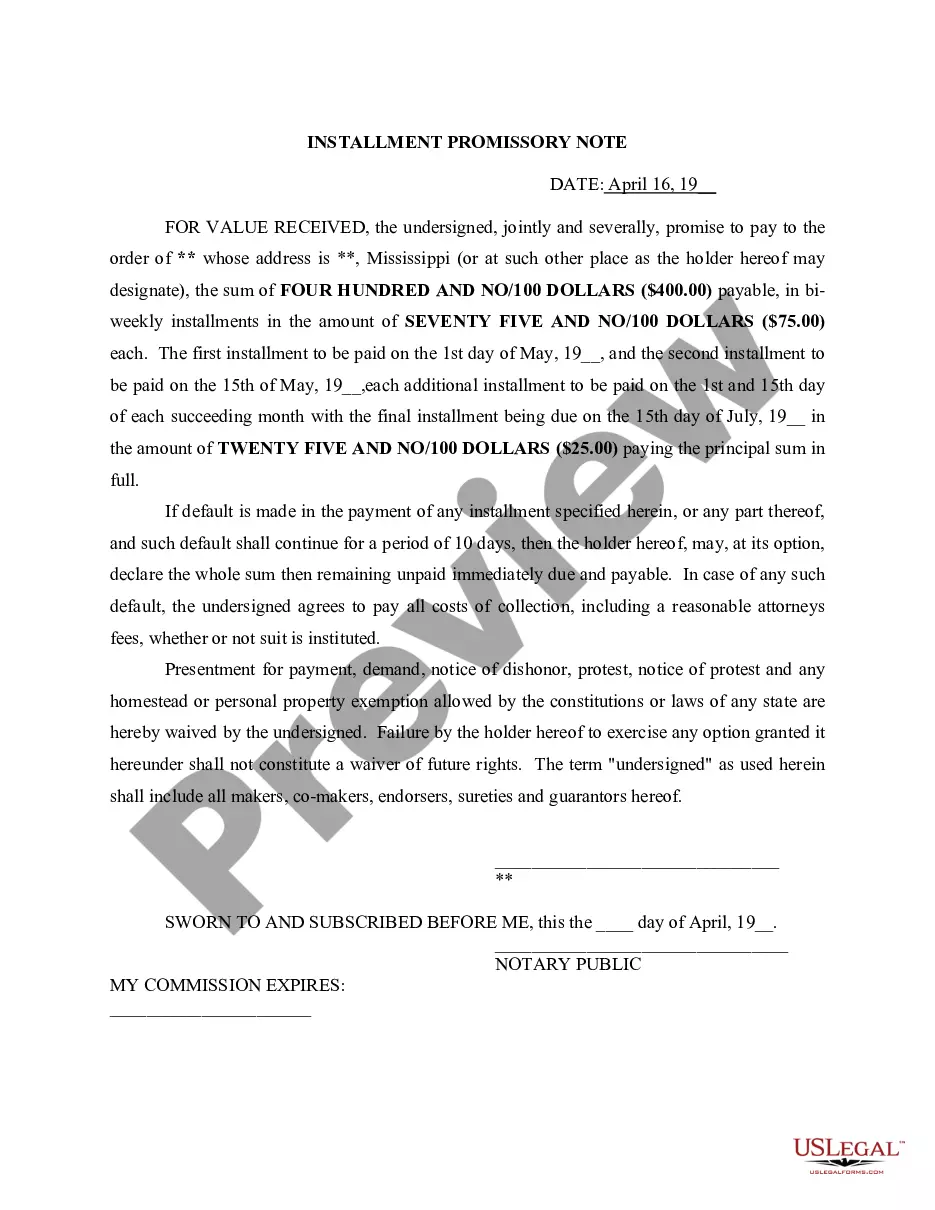

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Collateral on a secured personal loan can include things like cash in a savings account, a car or even a home.

An assignment of contract occurs when one party to an existing contract (the "assignor") hands off the contract's obligations and benefits to another party (the "assignee"). Ideally, the assignor wants the assignee to step into his shoes and assume all of his contractual obligations and rights.

What is an Assignment Of Loan? Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned.

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

A standard form deed of assignment under which a lender (the assignor) assigns its rights relating to a facility agreement (also known as a loan agreement) to a new lender (the assignee).