Missouri Assignment of Shares

Description

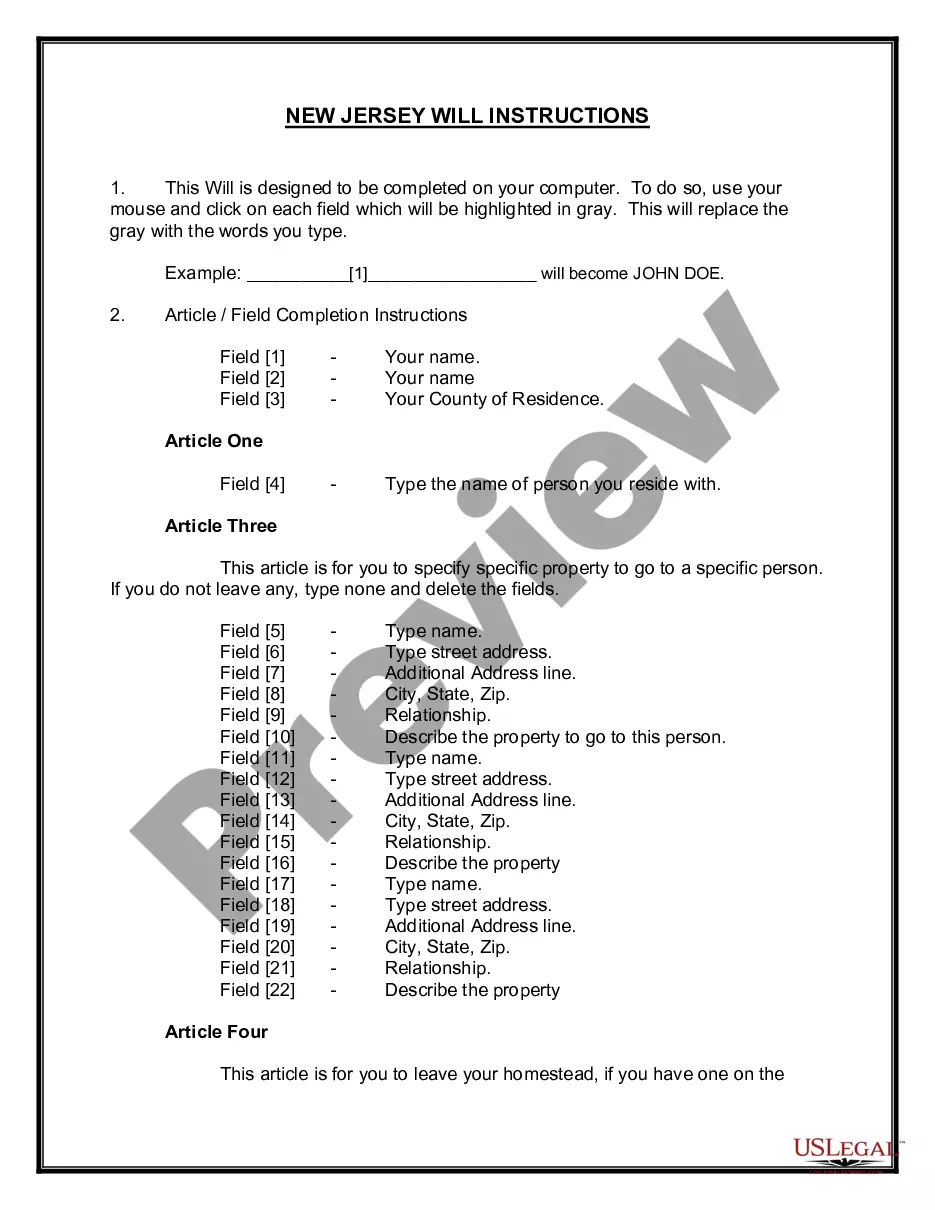

How to fill out Assignment Of Shares?

If you need to comprehensive, acquire, or produce authorized papers layouts, use US Legal Forms, the largest assortment of authorized types, which can be found online. Take advantage of the site`s simple and easy hassle-free research to find the paperwork you want. Different layouts for organization and specific functions are sorted by classes and says, or key phrases. Use US Legal Forms to find the Missouri Assignment of Shares in a few clicks.

When you are presently a US Legal Forms customer, log in to your bank account and then click the Down load switch to find the Missouri Assignment of Shares. You can even access types you earlier downloaded from the My Forms tab of your bank account.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for that proper city/land.

- Step 2. Take advantage of the Preview method to look through the form`s information. Do not forget to see the explanation.

- Step 3. When you are not satisfied together with the develop, use the Lookup discipline near the top of the display screen to find other models from the authorized develop design.

- Step 4. When you have located the shape you want, click on the Get now switch. Opt for the costs prepare you like and put your credentials to sign up on an bank account.

- Step 5. Method the transaction. You should use your Мisa or Ьastercard or PayPal bank account to accomplish the transaction.

- Step 6. Find the file format from the authorized develop and acquire it on your gadget.

- Step 7. Full, modify and produce or sign the Missouri Assignment of Shares.

Each authorized papers design you purchase is your own property permanently. You have acces to every single develop you downloaded inside your acccount. Select the My Forms segment and pick a develop to produce or acquire yet again.

Contend and acquire, and produce the Missouri Assignment of Shares with US Legal Forms. There are thousands of professional and express-particular types you may use for your personal organization or specific needs.

Form popularity

FAQ

Both Kansas and Missouri have adopted a Uniform Transfer to Minors Act (UTMA), which provides a simplified way to irrevocably gift or transfer property to be held in custodianship for the benefit of a child. For the purposes of these laws, a child is any person under the age of 21.

Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.

A person is guilty of animal trespass if a person having ownership or custody of an animal knowingly fails to provide adequate control for a period equal to or exceeding twelve hours.

The age of majority for an UTMA is different in each state. In most states, the age of majority is 21 ? which means that when a child turns 21, the custodianship of assets will end. But in other states, the age of majority is either 18 or 25. The custodian can also sometimes choose between a selection of ages.

The custodian normally controls the account until the child attains the age of 21. Accounts established under the Missouri Transfers to Minors Law are not considered as an available resource until the child is 21 years of age.

In Missouri, as in all states, a child cannot inherit property in their own name until they reach the age of eighteen. An adult will need to manage that property until the child can manage it for themselves.

A merger is when one or more businesses combines with another business. A consolidation is when two or more businesses combine into a brand new business entity. Under Missouri law, each party to a merger/consolidation must enter into a detailed written agreement containing the information required in RSMo 347.128.