A sales contract is an agreement between a buyer and seller covering the sale and delivery of goods, securities, and other personal property. Goods are classified as equipment if they are used or bought for use primarily in business (including farming or a profession).

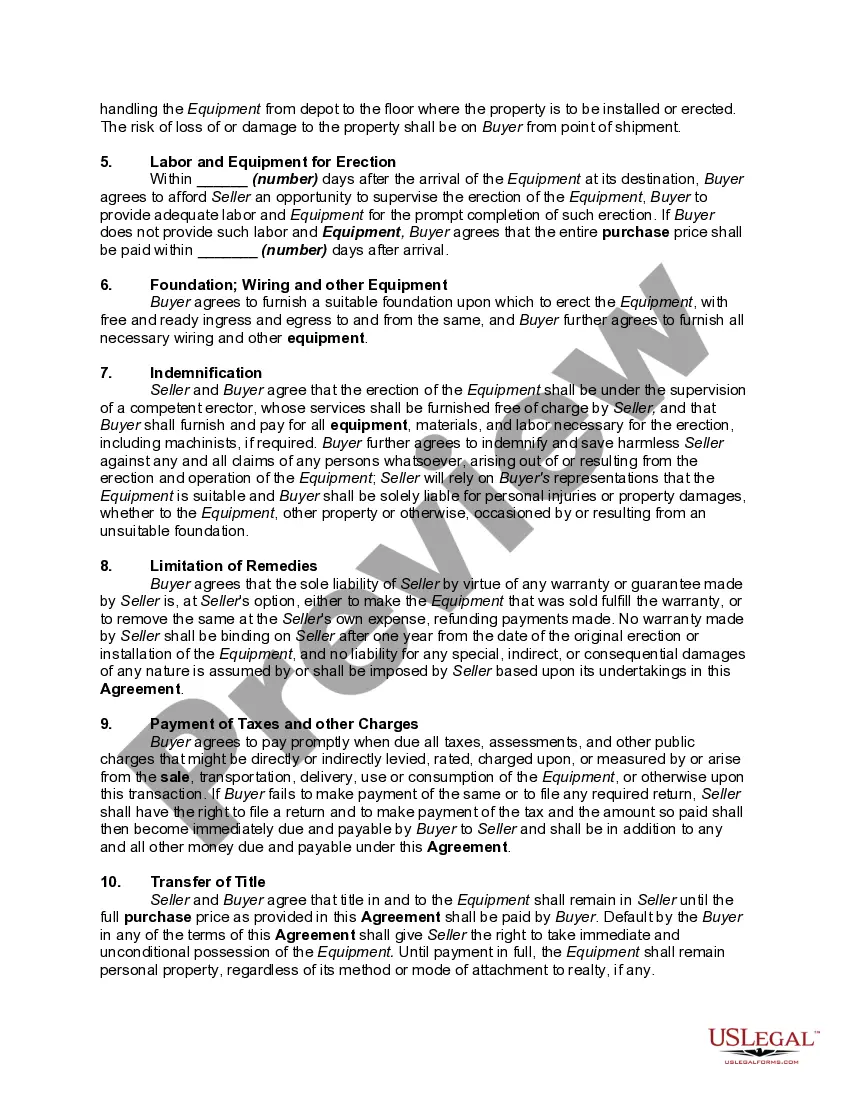

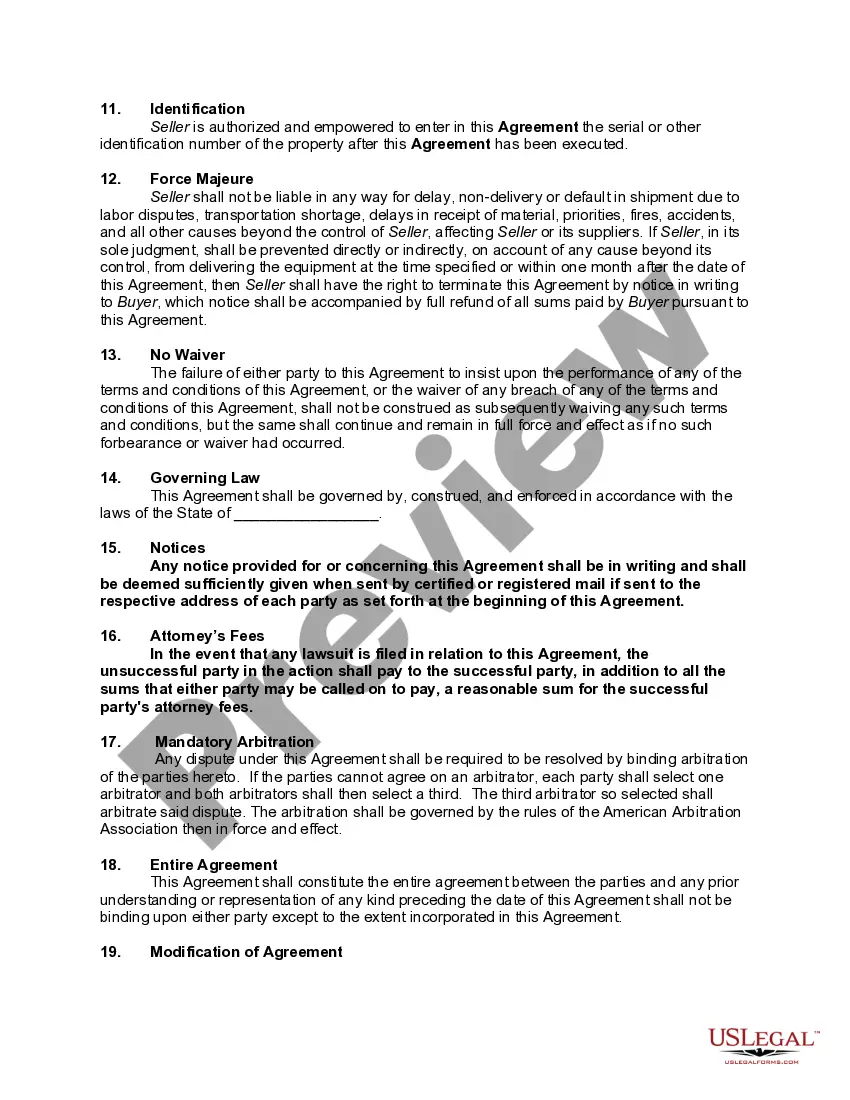

Missouri Basic Agreement for Sale of Machinery or Equipment

Description

How to fill out Basic Agreement For Sale Of Machinery Or Equipment?

Are you currently in a role that requires documents for possibly business or personal reasons almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not simple.

US Legal Forms offers a vast selection of form templates, such as the Missouri Basic Agreement for Sale of Machinery or Equipment, designed to meet state and federal regulations.

If you discover the correct form, click on Buy now.

Choose the pricing plan you prefer, complete the required information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Missouri Basic Agreement for Sale of Machinery or Equipment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct state/region.

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that suits your needs and requirements.

Form popularity

FAQ

Entities that qualify for tax-exempt purchases in Missouri include non-profit organizations, government agencies, and certain businesses that deal in manufacturing. It's vital to ensure you have the appropriate documentation to claim tax-exempt status. The Missouri Basic Agreement for Sale of Machinery or Equipment can assist you in confirming your eligibility for such purchases.

Certain types of equipment can be classified as tax-exempt in Missouri, depending on their use and the nature of the transaction. If the equipment is used in manufacturing or other qualifying sectors, you may benefit from sales tax exemptions. Utilizing the Missouri Basic Agreement for Sale of Machinery or Equipment allows you to navigate these exemptions effectively.

Yes, equipment rental is generally subject to sales tax in Missouri. This includes rentals of machinery and equipment used for various purposes. However, tax regulations may vary based on the specific use of the rented equipment, so consider reviewing the Missouri Basic Agreement for Sale of Machinery or Equipment for specific guidance.

In Missouri, specific items may be exempt from sales tax, including certain machinery and equipment used for manufacturing. Also, agricultural and certain medical equipment can qualify for tax exemption. When working with the Missouri Basic Agreement for Sale of Machinery or Equipment, you can identify which items may be eligible for sales tax exemption.

Labor charges for services can be taxable in Missouri, particularly if the service results in the transfer of property, such as installation or repair. It's important to understand the specific nature of the service being provided. The Missouri Basic Agreement for Sale of Machinery or Equipment can offer insights into whether labor charges should be taxed.

In Missouri, a bill of sale does not necessarily need to be notarized for it to be valid. However, notarization can provide an additional layer of verification and is often recommended for significant transactions, such as the sale of machinery or equipment. The Missouri Basic Agreement for Sale of Machinery or Equipment can help clarify these details.

The labor tax rate in Missouri is generally aligned with the state's sales tax rate, which varies by location. Typically, services related to machinery transactions may not incur a separate labor tax. However, understanding how labor charges and sales tax intersect can be simplified by using the Missouri Basic Agreement for Sale of Machinery or Equipment.

exempt asset refers to certain types of property that are not subject to sales tax in Missouri. This may include certain machinery and equipment if they meet specific criteria. When you use the Missouri Basic Agreement for Sale of Machinery or Equipment, it's essential to understand which items qualify as taxexempt under state law.

A simple contract agreement should start with the names of the parties and the date. Clearly state the purpose of the contract, including all key terms, conditions, and obligations for each party. Additionally, ensure the contract is dated and signed by all involved parties. If you're looking for a Missouri Basic Agreement for Sale of Machinery or Equipment, consider using specialized templates from U.S. Legal Forms to ease the drafting process and protect your interests.

To write up a land contract, first, identify the parties involved in the agreement and describe the property in detail. Next, outline the terms of the sale, including payment structure, interest rates, and any contingencies. Make sure to include signatures from all parties to validate the contract. For those interested in a Missouri Basic Agreement for Sale of Machinery or Equipment, using a professional template can simplify the process and ensure compliance with state laws.