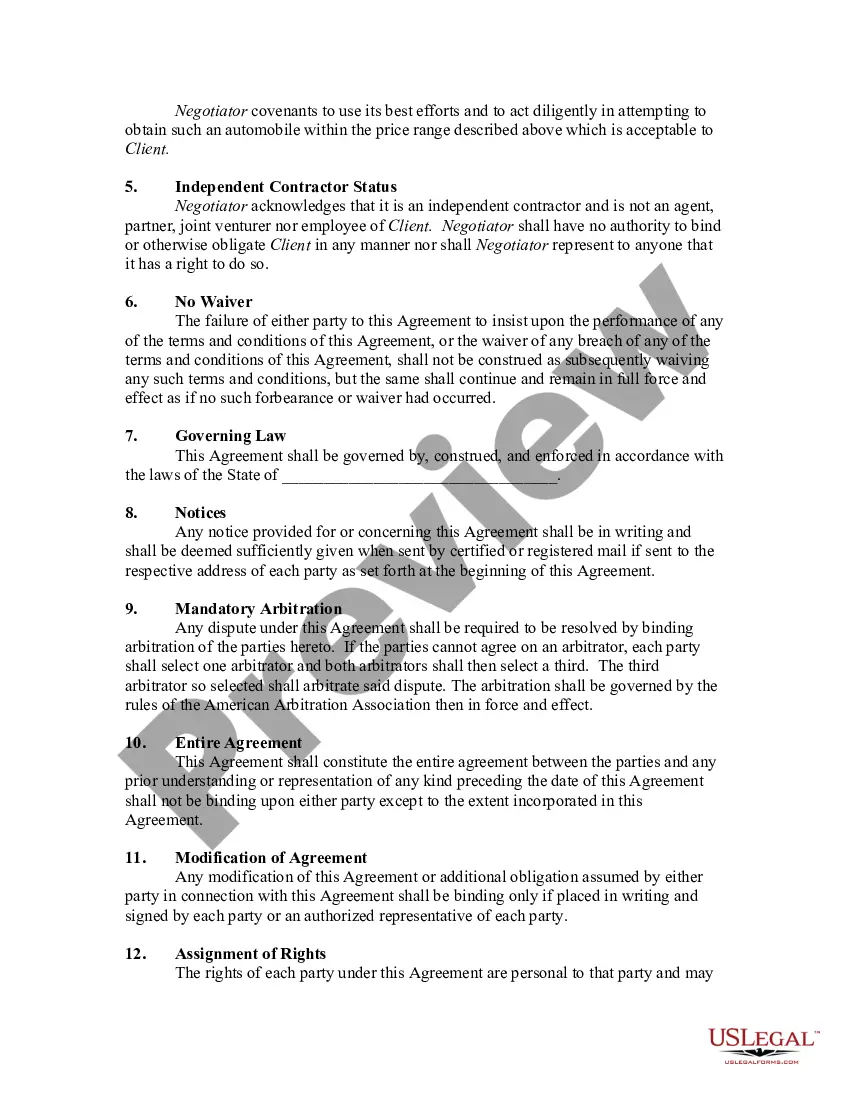

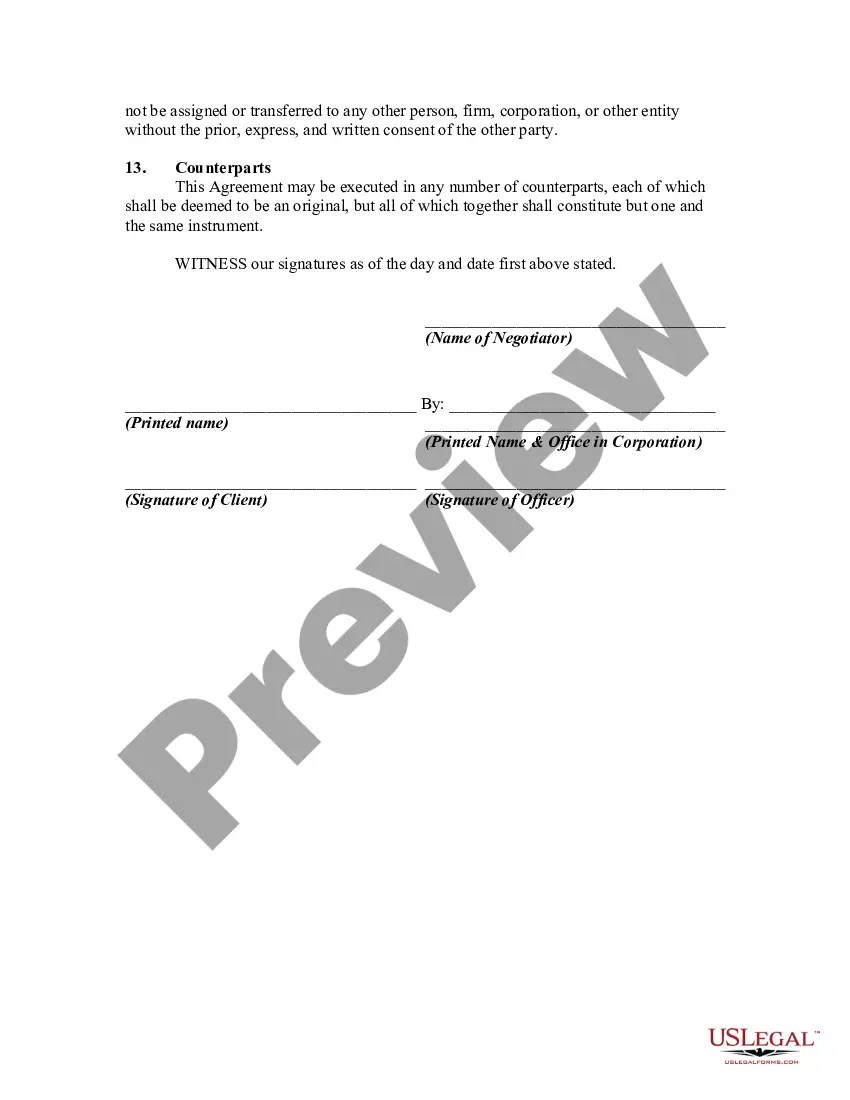

This form is a generic agreement appointing a company to negotiate the purchase of an automobile for a consumer client.

Missouri Negotiation Agreement for Purchase of an Automobile - Selling Car

Description

How to fill out Negotiation Agreement For Purchase Of An Automobile - Selling Car?

You might spend time online trying to locate the legal document template that meets the state and federal requirements you will need.

US Legal Forms offers a plethora of legal forms that can be evaluated by experts.

You can effortlessly download or print the Missouri Negotiation Agreement for Purchase of an Automobile - Selling Car from my support.

First, ensure that you have selected the correct document template for the region/area of your choice. Review the form description to confirm that you have chosen the proper type. If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, modify, print, or sign the Missouri Negotiation Agreement for Purchase of an Automobile - Selling Car.

- Every legal document template you receive is yours indefinitely.

- To acquire an extra copy of any purchased form, visit the My documents tab and click on the respective button.

- If you are accessing the US Legal Forms site for the first time, follow the straightforward instructions below.

Form popularity

FAQ

Any social, civic, religious, political subdivision, or educational organization can apply for a sales tax exemption by completing Form 1746PDF Document, Missouri Sales Tax Exemption Application.

There are several ways that you can avoid paying state sales tax in Missouri. One of the options is to purchase the vehicle out of state and pay out-of-state sales tax. You can also be gifted a vehicle and avoid having to pay the state sales tax.

You Will Pay:State sales tax of 4.225 percent, plus your local sales tax Document on the purchase price, less trade-in allowance, if any; $8.50 title fee; Registration (license plate) fees, based on either taxable horsepower or vehicle weight; $6 title processing fee; and.

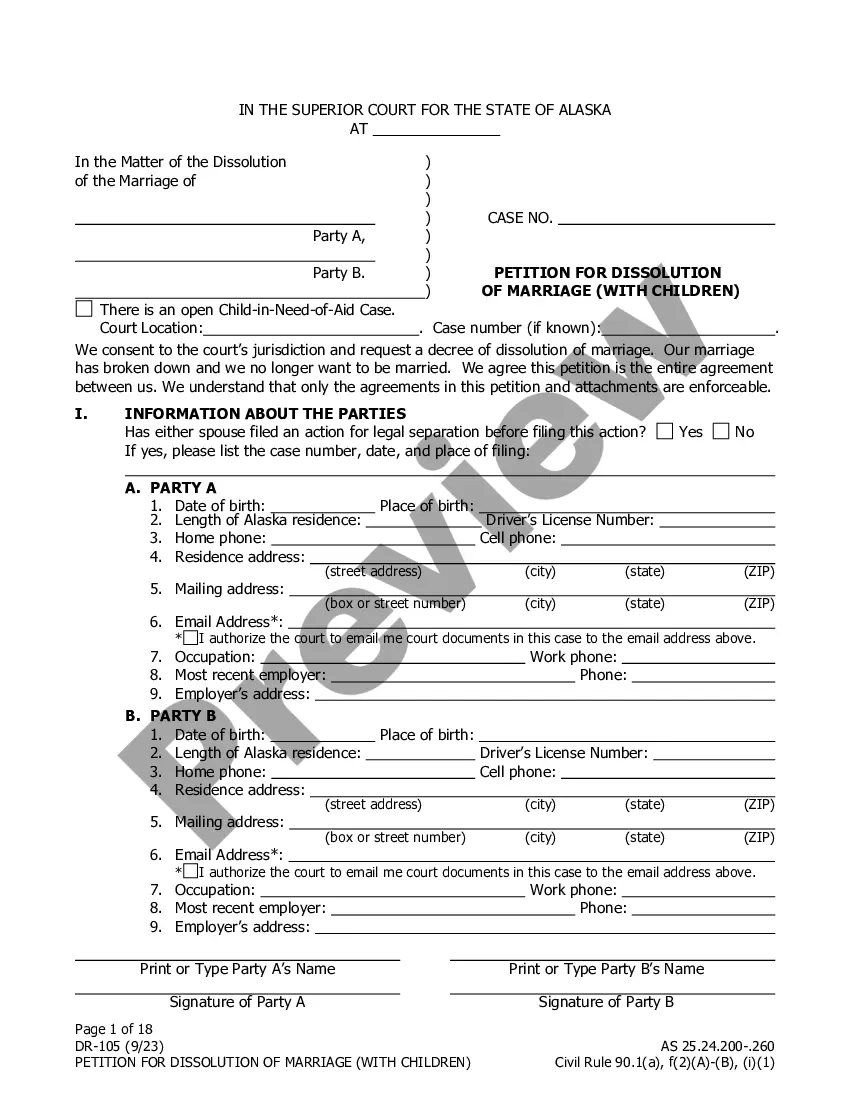

If the state does not require a title, you must obtain a bill of sale. The bill of sale must include the buyer's and seller's names, addresses, signatures; and the purchase date, purchase price, year, make, and vehicle identification number of the vehicle being sold.

To take advantage of no sales tax cars, you would have to purchase the vehicle in another state that doesn't charge a sales tax. Several different states don't charge sales tax on a used car. These states include Alaska, Montana, Delaware, Oregon, and New Hampshire.

There are several ways that you can avoid paying state sales tax in Missouri. One of the options is to purchase the vehicle out of state and pay out-of-state sales tax. You can also be gifted a vehicle and avoid having to pay the state sales tax.

The seller must complete all applicable information and sign this form. The Bill of Sale or Even-Trade Bill of Sale must be notarized when showing proof of ownership on major component parts of a rebuilt vehicle or when specifically requested to be notarized by the Department of Revenue.

The seller must complete all applicable information and sign this form. The Bill of Sale or Even-Trade Bill of Sale must be notarized when showing proof of ownership on major component parts of a rebuilt vehicle or when specifically requested to be notarized by the Department of Revenue.

Missouri Form 5049 requires the following details:Purchaser's full name, signature, address, driver license number, and date of birth;Description of the vehicle.Seller's full name, address, and dealer number (if applicable).

Yes. A Missouri bill of sale is required to register your vehicle. The bill of sale should be turned over to the Department of Revenue by the seller. The seller will also need to complete a Notice of Sale (Form 5049).