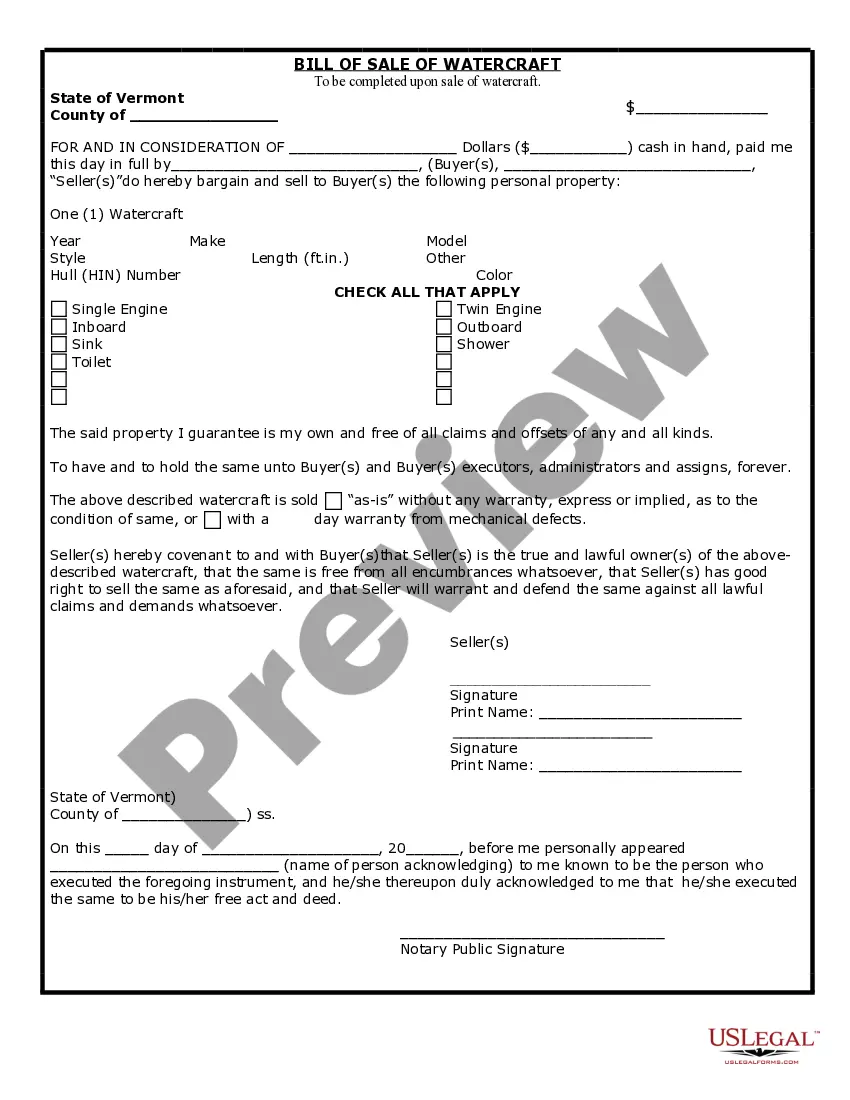

In this form, the beneficiary of a trust acknowledges receipt from the trustee of all monies due to him/her pursuant to the terms of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Missouri Receipt for Payment of Trust Fund and Release

Description

How to fill out Receipt For Payment Of Trust Fund And Release?

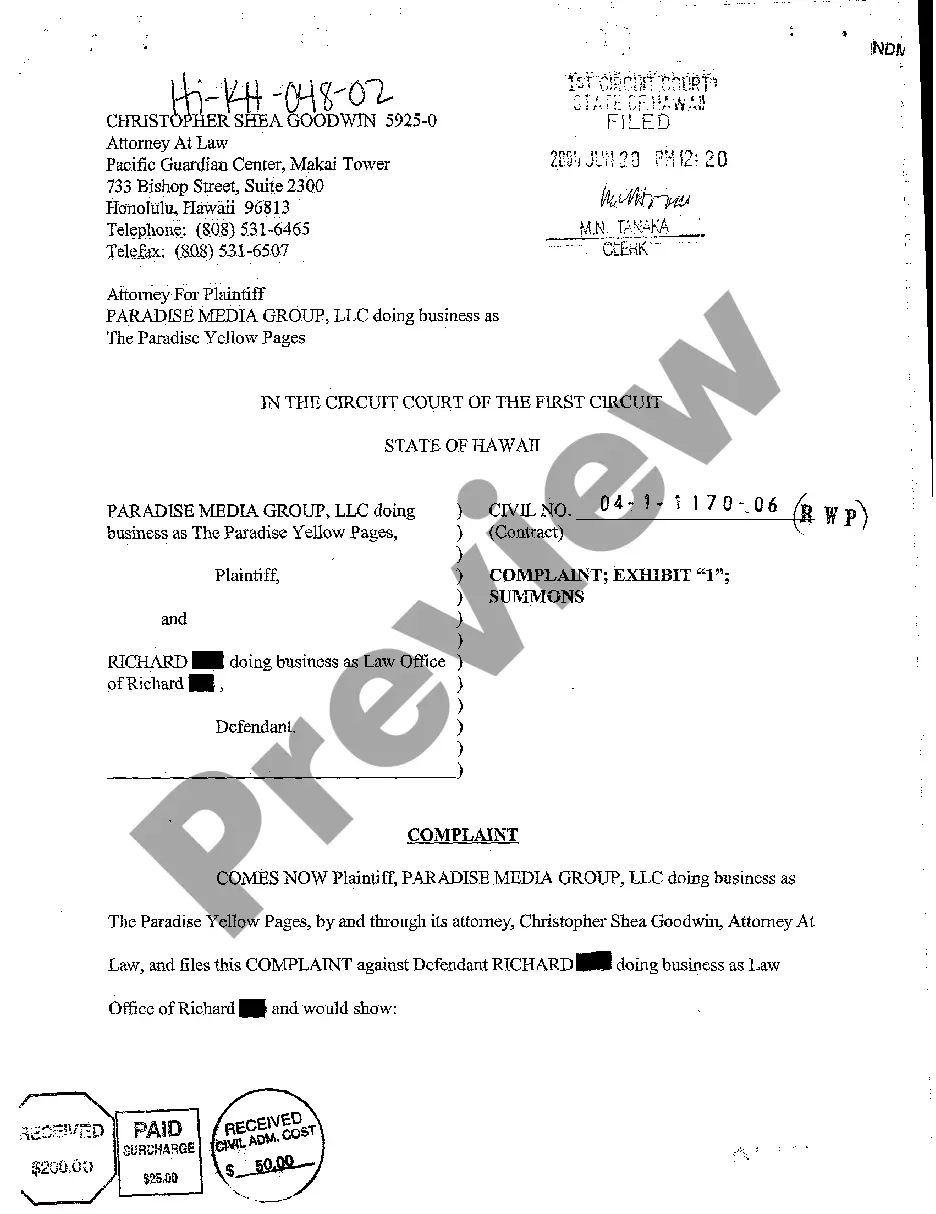

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal template files that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest editions of forms like the Missouri Receipt for Payment of Trust Fund and Release in no time.

If you already have an account, Log In and download the Missouri Receipt for Payment of Trust Fund and Release from the US Legal Forms library. The Download button will appear on every form you view. You have access to all of your previously saved forms in the My documents section of your account.

If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select your preferred payment method and provide your details to create an account.

Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device.Make edits. Fill out, modify, print, and sign the saved Missouri Receipt for Payment of Trust Fund and Release.

- If you want to use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to view the form's details.

- Read the form information to ensure you've selected the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

Form popularity

FAQ

You can obtain Missouri state tax forms directly from the Missouri Department of Revenue's website. If you need the Missouri Receipt for Payment of Trust Fund and Release, it's crucial to access the correct forms to ensure timely processing. The website offers various downloadable forms and guidance, making it user-friendly for anyone. Additionally, you can visit local government offices or libraries to find printed versions of these essential documents.

The income limit for the Missouri Property Tax Credit (PTC) varies depending on your filing status and household composition. For those seeking the Missouri Receipt for Payment of Trust Fund and Release, it's essential to stay informed about these limits, as they can affect your eligibility. Typically, individual income limits fall around $30,000 for single filers and $34,000 for married couples. Understanding these thresholds helps you navigate your financial opportunities effectively.

The MO tax extension form allows taxpayers to request additional time to file their Missouri tax returns. By using this form, you can obtain an automatic six-month extension, giving you the flexibility to gather your documents. This process can help ensure you meet all requirements, including those related to the Missouri Receipt for Payment of Trust Fund and Release. For detailed instructions on completing the extension form, UsLegalForms is a helpful resource.

A resident trust in Missouri refers to a trust that is established and maintained within the state. It is subject to Missouri state tax laws and may have different filing requirements than non-resident trusts. Being informed about resident trusts is essential for managing your finances and securing the necessary documentation, such as the Missouri Receipt for Payment of Trust Fund and Release. UsLegalForms provides valuable insights into trust management in Missouri.

MO tax refers to the state income tax imposed on individuals earning income in Missouri. It is based on taxable income, with rates that can vary based on income levels. Understanding MO tax is crucial for maintaining compliance and acquiring documents like the Missouri Receipt for Payment of Trust Fund and Release. UsLegalForms can aid you in navigating the state's tax requirements effectively.

Any individual who earns income in Missouri is generally required to file a MO tax return. This includes full-time residents, part-time residents, and non-residents with Missouri source income. Ensuring compliance can simplify obtaining your Missouri Receipt for Payment of Trust Fund and Release. If you have uncertainties about your filing status, UsLegalForms provides comprehensive resources to help clarify your situation.

The MO 1040 form is Missouri's individual income tax return. It is used by residents and part-year residents to report their income and determine the amount of state tax they owe. Filing this form may be necessary to obtain your Missouri Receipt for Payment of Trust Fund and Release. For guidance on completing the form, you can consult resources available through UsLegalForms.

Missouri does not impose a state-level estate tax. However, federal estate tax laws still apply, which may affect your planning. If you handle a trust, understanding these dynamics is vital, especially regarding documentation like the Missouri Receipt for Payment of Trust Fund and Release. For comprehensive estate planning solutions, uslegalforms can offer substantial resources.

Yes, MO-PTE estimates may be required for certain pass-through entities in Missouri. These estimates help ensure compliance with Missouri tax laws, particularly regarding any income generated by the entity. In cases where trusts are involved, the Missouri Receipt for Payment of Trust Fund and Release may also come into play. For clarity on obligations, consulting uslegalforms can provide valuable insights.

Missouri does require estimated tax payments for individuals and entities that expect to owe a certain amount in taxes. This includes some trusts and estates that anticipate significant tax obligations. It is crucial to keep this in mind, especially when preparing the Missouri Receipt for Payment of Trust Fund and Release. Check with uslegalforms for detailed guidelines to fulfill this requirement.