Missouri Transfer of Property under the Uniform Transfers to Minors Act

Description

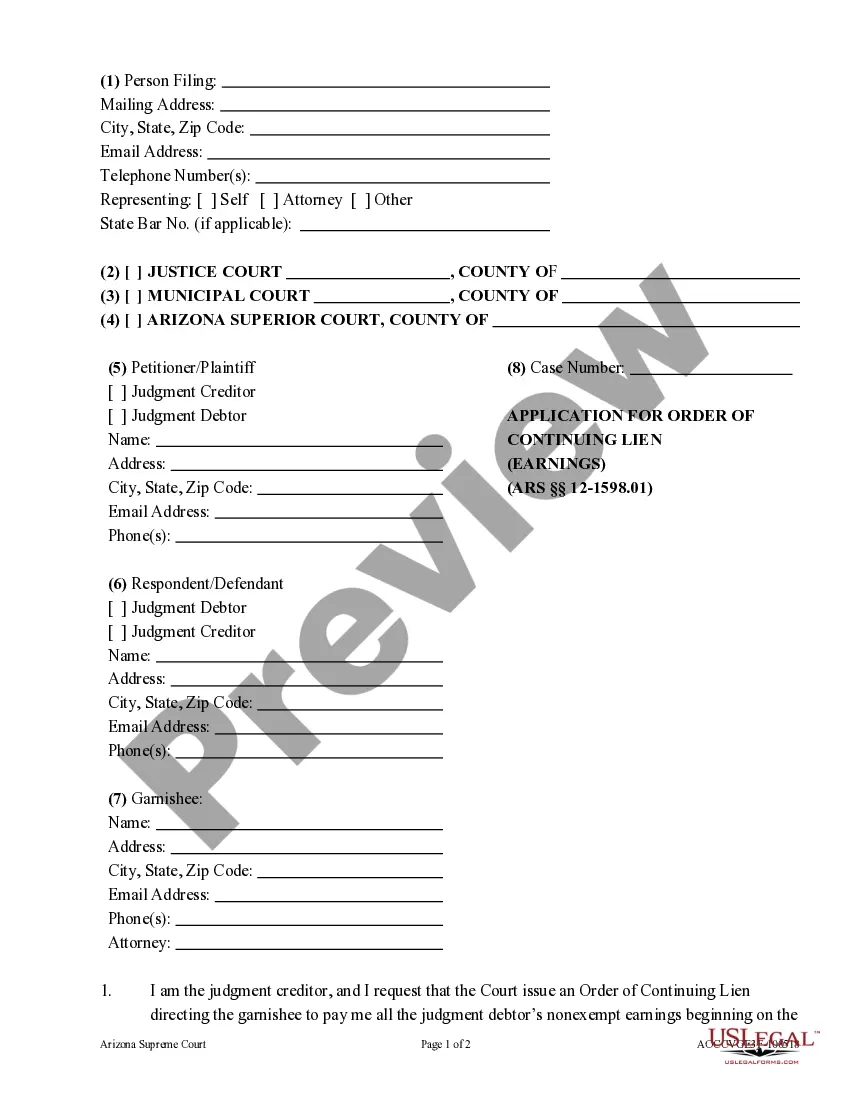

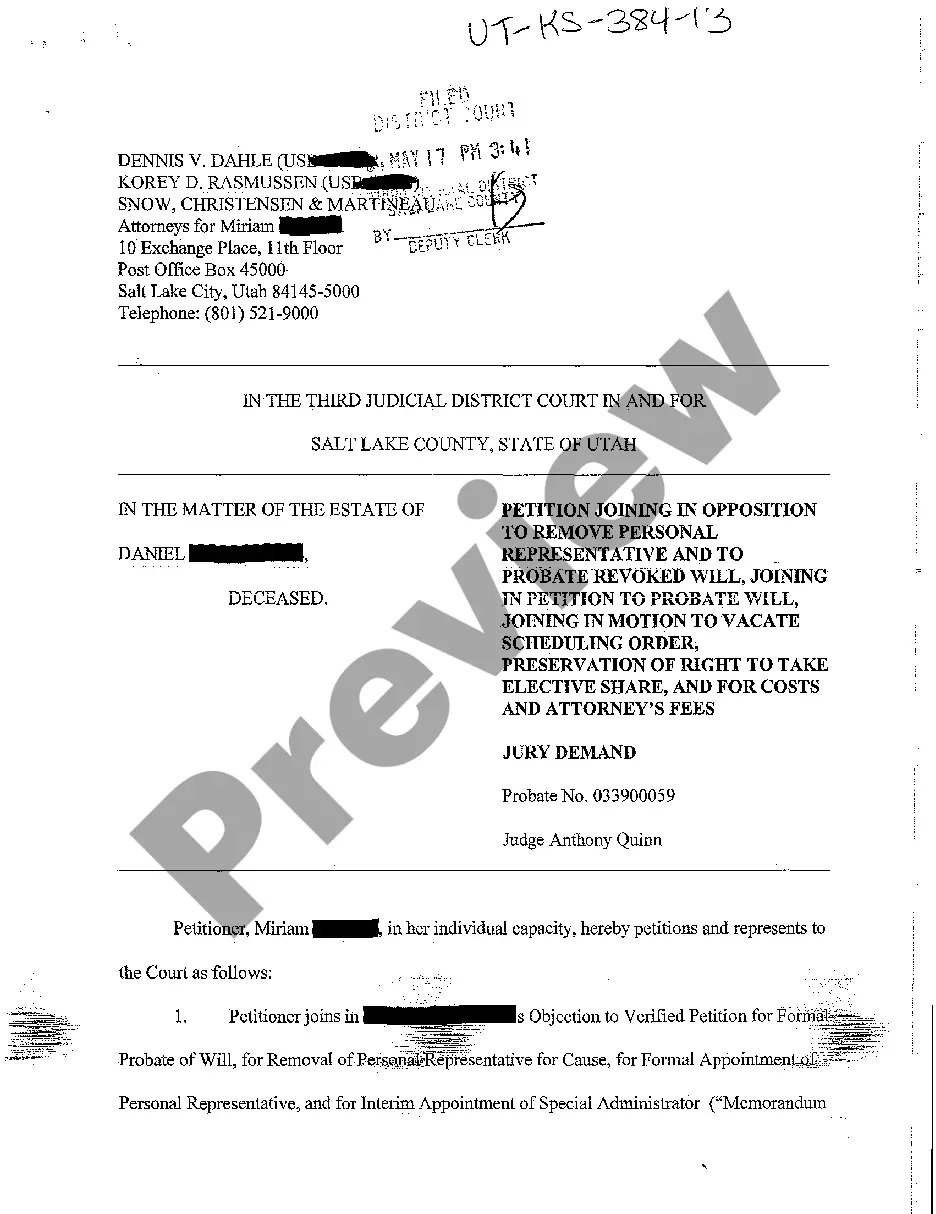

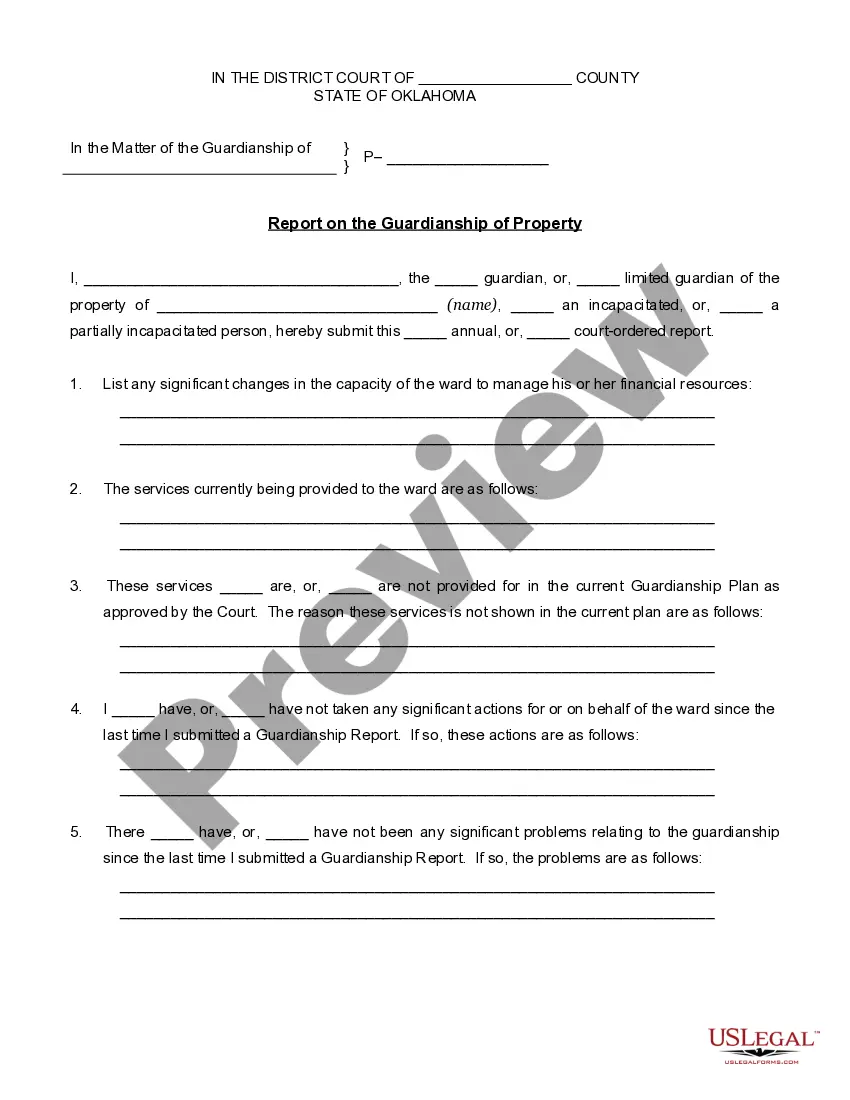

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

You can spend hours online searching for the legal template that meets the federal and state requirements you need.

US Legal Forms offers a multitude of legal documents that are verified by experts.

You can download or print the Missouri Transfer of Property under the Uniform Transfers to Minors Act from this service.

If available, utilize the Preview button to view the template as well. If you need to obtain another version of the document, use the Search field to find the format that fulfills your requirements and needs. Once you have found the template you require, click Purchase now to proceed. Choose the pricing plan you want, enter your credentials, and create an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Select the format of the document and download it to your system. Make modifications to your document if needed. You can complete, edit, sign, and print the Missouri Transfer of Property under the Uniform Transfers to Minors Act. Download and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Use professional and state-specific templates to handle your business or personal needs.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Missouri Transfer of Property under the Uniform Transfers to Minors Act.

- Each legal template you purchase is yours indefinitely.

- To obtain another copy of a purchased document, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct template for your area/region.

- Review the document description to confirm you have chosen the right template.

Form popularity

FAQ

13 Uniform Gift to Minor Accounts. A custodial account is an account for the benefit of a minor child and managed by a parent or another designated custodian. The custodial account is established under Sections 404.005 to 404.094 Revised Statutes of Missouri, the Missouri Transfers to Minors Law.

The Missouri Transfers to Minors Law provides one method for transferring money or property to a minor. For the purpose of this chapter minor is defined as an individual who has not attained the age of twenty-one years.

A Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) account is an account into which property is set aside for a minor's benefit. Whether a UGMA or UTMA account is used depends on the law of the state in which the account is established.

The Uniform Gifts to Minors Act (UGMA) allows individuals to give or transfer assets to underage beneficiaries. The act, which was developed in 1956 and revised in 1966, is commonly used to transfer assets from parents to their children.

What happens when the custodian dies prior to distribution to the minor is extremely problematic. In this case no one has access the account and the minor must wait until the stated age to claim the property. It may require a court order to a new custodian.

Because money placed in an UGMA/UTMA account is owned by the child, earnings are generally taxed at the child's?usually lower?tax rate, rather than the parent's rate. For some families, this savings can be significant. Up to $1,050 in earnings tax-free. The next $1,050 is taxable at the child's tax rate.

Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.

The Uniform Gift to Minors Act (UGMA) was created to provide a means by which title to property could be passed to minors by use of a custodian. The nature of property which could be transferred under the UGMA was limited to securities, cash or other personal property.