Grantor assigns all of his/her rights in a real estate purchase contract to a certain trust department. Grantor also directs the trust department to apply escrowed funds held under the exchange agreement to the purchase of property covered by the assigned contract.

Missouri Assignment and Instruction to Apply Escrowed Funds

Description

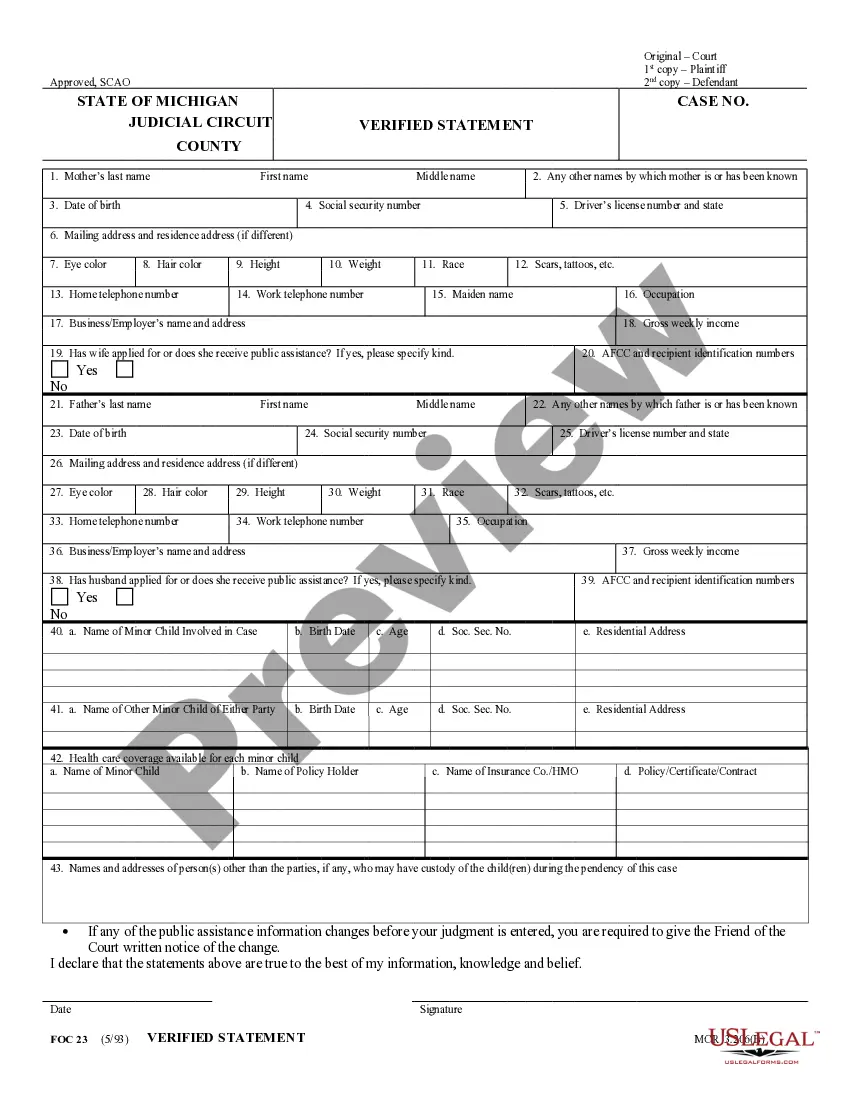

How to fill out Assignment And Instruction To Apply Escrowed Funds?

If you require to complete, download, or print lawful document templates, utilize US Legal Forms, the foremost collection of legal documents that are available online.

Utilize the site’s straightforward and user-friendly search to locate the documents you need.

Various templates for business and individual purposes are organized by categories and jurisdictions, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other variations of the legal document template.

Step 4. Once you’ve found the form you need, click the Download now button. Choose your preferred pricing plan and enter your details to register for an account.

- Use US Legal Forms to locate the Missouri Assignment and Instruction to Apply Escrowed Funds in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download option to obtain the Missouri Assignment and Instruction to Apply Escrowed Funds.

- You can also access forms you have previously saved in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow these instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the View option to review the form's content. Always take time to read the details.

Form popularity

FAQ

The MO-1040P has been eliminated for 2021. Please use MO-1040, MO-A, and MO-PTS if applicable. The Department has eliminated the MO-1040P Property Tax Credit and Pension Exemption Short Form for tax year 2021, see MO-1040 Instructions for more details.

This is your Missouri resident credit. Enter the amount on Form MO-1040, Line 29Y and 29S. (If you have multiple credits, add the amounts on Line 11 from each MO-CR). Your total credit cannot exceed the tax paid or the percent of tax due to Missouri on that part of your income. Information to complete Form MO-CR.

Form MO-NRI: Form MO-NRI is used when a nonresident elects to pay taxes on the percentage of income (Missouri income percentage) earned in Missouri, or when a part-year resident chooses to pay taxes on the percentage of income earned while a Missouri resident.

How to Sign Your Title in Missouri (MO)Back of the title top right - sign name(s) in the box where it reads "Signature(s) of All Seller(s)."Back of the title right below where you signed name(s) - print name(s) in the box where it reads "Hand Printed Name(s) by Seller(s)."More items...

IT IS UNLAWFUL FOR ANY PERSON/DEALER TO SKIP AN ASSIGNMENT OR BE IN POSSESSION OF AN OPEN TITLE. An open title is a title that has the seller's signature in the title assignment area but the purchaser's name area is blank. Below is a copy of Section 301.210, RSMo concerning the sale and transfer of vehicles.

If you or your spouse earned Missouri source income of $600 or more (other than military pay), you must file a Missouri income tax return by completing Form MO-1040 and Form MO-NRI. Be sure to include a copy of your federal return.

Form MO-A - 2020 Individual Income Tax Adjustments.

Just like the federal level, Missouri imposes income taxes on your earnings if you have a sufficient connection to the state if you work or earn an income within state borders. You may not have to file a Missouri return if: You are a resident and have less than $1,200 of Missouri adjusted gross income.

Transferring the Title of a Vehicle That Was Given As a GiftA signed Application for Missouri Title and License (Form DOR-108)Proof of a valid MO vehicle insurance policy.Proof of a passed VIN inspection and odometer inspection (if the vehicle was transferred from out of state)11-Jan-2022

Gifting Your VehicleProperly assigned Certificate of Title (see instructions) with the word "GIFT" placed in the sale price area (Do not use a sale price of $1);A safety inspection certificate, less than 60 days old;An emissions inspection not more than 60 days old, if the recipient resides in St.More items...