Missouri Third Party Lender Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Third Party Lender Agreement: This is a legal document between a borrower, a lender, and a third party where the third party agrees to fulfill certain obligations of the borrower under the terms laid out. Common in finance and real estate, these agreements ensure that a third party can intervene to service the loan if the borrower fails to comply with the terms.

Step-by-Step Guide to Engaging a Third Party Lender

- Evaluate Needs: Determine why a third party lender is necessary for your situation.

- Research Potential Lenders: Look for lenders experienced in handling agreements within your specific industry or financial requirements.

- Consult Legal Advice: Have an attorney review or help draft the agreement to ensure all legal bases are covered.

- Negotiate Terms: Work closely with the lender to agree on the terms that match your financial capacities and needs.

- Finalize the Agreement: Sign the contract after ensuring that all parties agree with the terms and understand their responsibilities.

Risk Analysis of Third Party Lender Agreements

- Default Risk: Risk of borrower defaulting, potentially leaving the third party with financial responsibility.

- Legal Risks: Possible legal complications if not properly drafted or if the agreement violates regulations.

- Reputational Risks: Working with an unreliable third party could harm your business reputation.

- Operational Risks: The involvement of an additional party can complicate loan management and monitoring.

Pros & Cons of Third Party Lender Agreements

- Pros:

- Allows for broader access to financing.

- Can provide specialized lending not available directly from traditional banks.

- May offer more flexible terms.

- Cons:

- May come with higher interest rates depending on the credit risk.

- Additional legal and financial risks due to the complexity of having a third party involved.

- Requires careful management and clear communication among all parties.

Best Practices

- Due Diligence: Always perform comprehensive due diligence on potential third party lenders to ensure credibility and reliability.

- Understand the Terms: Clearly understand all the terms and conditions before agreeing to a third party lender agreement.

- Consistent Monitoring: Consistently monitor the conditions of the loan and maintain active communications among all parties involved.

Common Mistakes & How to Avoid Them

- Not reading the fine print: Always read and understand every detail of agreement documents to avoid unforeseen obligations.

- Ignoring legal advice: Hiring a competent attorney can prevent legal pitfalls in the future.

- Lack of due diligence: Skipping thorough checks on the third party lender's background could lead to partnering with unreliable entities.

FAQ

- What is a third party lender agreement? It's a contract involving a principal borrower, a lender, and a third party who agrees to meet the borrower's obligations under specific circumstances.

- What are the risks involved in a third party lender agreement? Risks include default, legal complications, reputational damage, and operational challenges.

- Can third party lender agreements be customized? Yes, terms can often be negotiated to suit the specific needs of the parties involved.

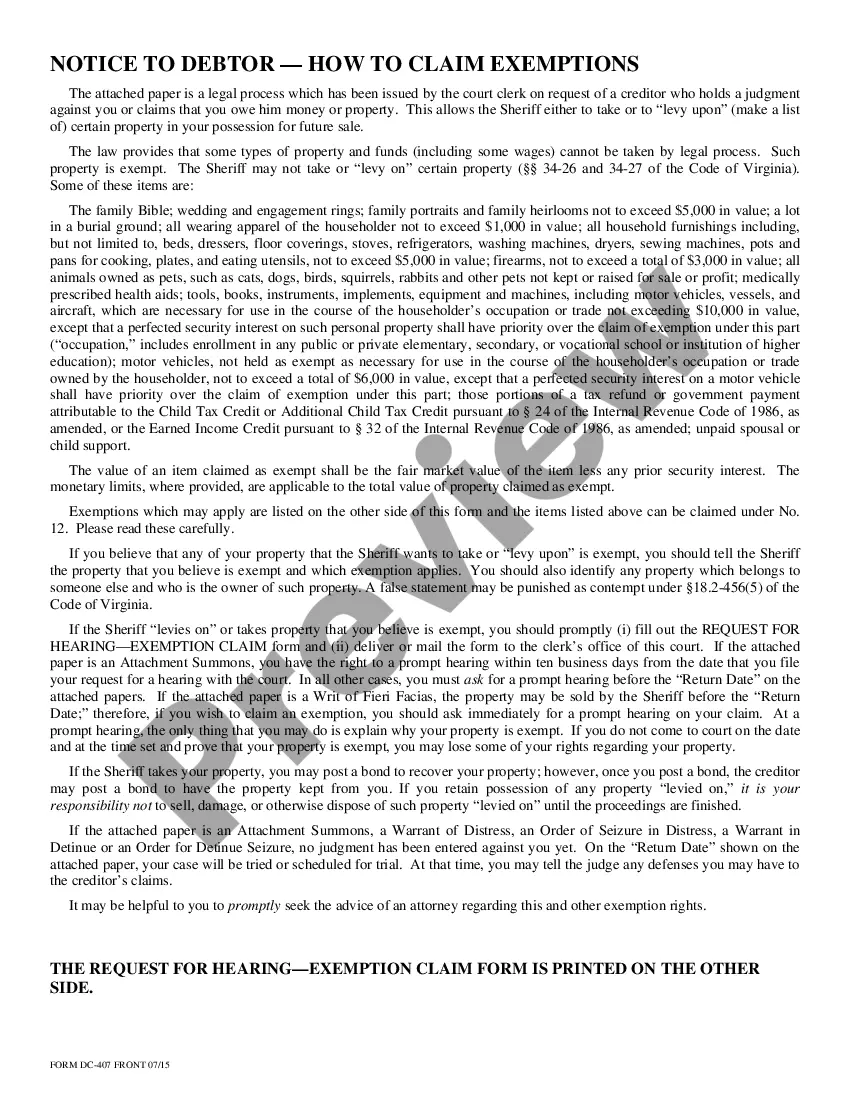

How to fill out Missouri Third Party Lender Agreement?

Obtain any template from 85,000 legal documents like the Missouri Third Party Lender Agreement available through US Legal Forms. Each template is crafted and refreshed by state-authorized attorneys.

If you possess a subscription, Log In. Once you arrive at the form’s page, click the Download button and navigate to My documents to gain access to it.

If you haven't subscribed yet, adhere to the steps below: Check the state-specific prerequisites for the Missouri Third Party Lender Agreement you wish to utilize. Review the description and examine the template preview. When you’re assured the template meets your needs, click on Buy Now. Select a subscription plan that fits your financial plan. Establish a personal account. Make a payment using one of two convenient methods: by credit card or through PayPal. Choose a format for downloading the file; two choices are available (PDF or Word). Download the document to the My documents section. Once your reusable template is downloaded, print it out or store it on your device.

- With US Legal Forms, you will consistently have fast access to the relevant downloadable sample.

- The service grants you access to documents and categorizes them to facilitate your search.

- Utilize US Legal Forms to acquire your Missouri Third Party Lender Agreement effortlessly and promptly.

Form popularity

FAQ

A third party lender is an entity that provides loans to individuals or businesses but does not take part in the transaction directly. For instance, a peer-to-peer lending platform acts as a third party lender by connecting borrowers with investors. In the context of a Missouri Third Party Lender Agreement, these lenders play a crucial role in facilitating loans while ensuring compliance with state regulations. Using platforms like USLegalForms can help you draft a solid agreement that outlines the terms and conditions clearly.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

In the lending industry, third-party mortgage originators can be broad in scope and may be loosely defined as any person or company involved in the process of marketing mortgages, gathering borrower information for a mortgage application, underwriting, closing, or funding a mortgage loan.

Load the loan agreement template. Fill in the lender and borrower information. Specify the loan amount and the date of the loan. Specify the loan delivery method. Fill in the details of the loan repayment schedule and regular payment options.

Third Party Lender agrees that the Common Collateral will only secure its Third Party Loan and the Common Collateral is not currently, and will not be used in the future, as security for any other financing provided by Third Party Lender to Borrower that purports to be in a superior position to that of the CDC Lien,

It may be noted that while a normal standard home loan Agreement does not require registration with the office of the sub registrar of assurances Under Registration Act, it will be mandatory in the case of a Mortgage Loan.

Usually, an IOU and a promissory note form are only signed by the borrower, although they may be signed by both parties. A loan agreement is a single document that contains all of the terms of the loan, and is signed by both parties.

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

State the purpose for the loan. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back.

Generally speaking, there is no requirement for a witness or notary public to witness the signing of the Loan Agreement.Even if it is not required, having an objective third party witness the signing of the loan agreement will be better evidence when you need to enforce the repayment of the loan.