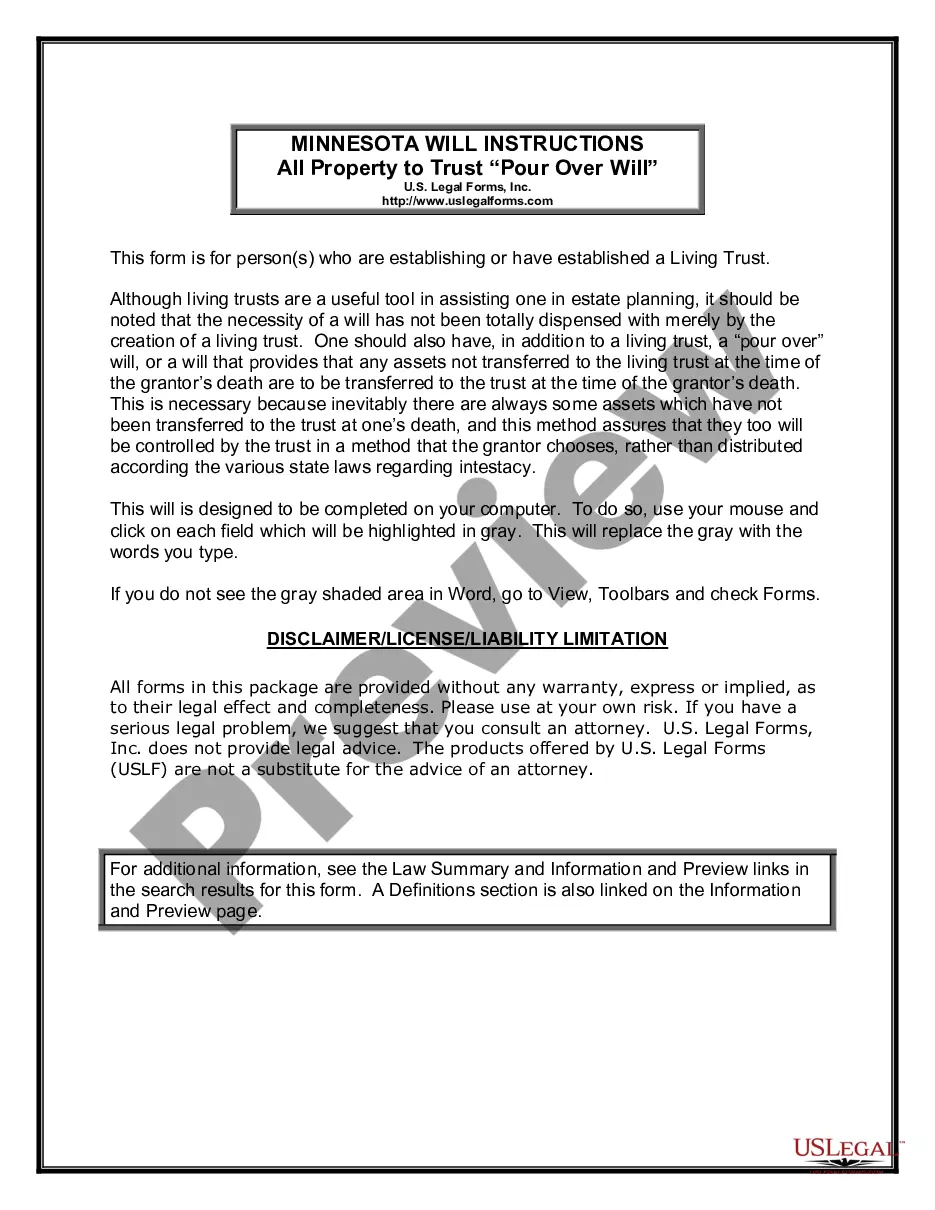

Minnesota Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Minnesota Last Will And Testament With All Property To Trust Called A Pour Over Will?

Have any form from 85,000 legal documents such as Minnesota Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will online with US Legal Forms. Every template is prepared and updated by state-licensed lawyers.

If you have already a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the steps below:

- Check the state-specific requirements for the Minnesota Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will you would like to use.

- Read description and preview the sample.

- When you’re confident the sample is what you need, click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay in just one of two appropriate ways: by card or via PayPal.

- Select a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have quick access to the right downloadable template. The platform gives you access to documents and divides them into categories to simplify your search. Use US Legal Forms to obtain your Minnesota Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will fast and easy.

Form popularity

FAQ

A significant advantage of a revocable living trust over a will is that it can prepare your estate in the event you become mentally incapacitated, not just when you die. Your successor trustee can also step in if you become mentally incompetent to the point where you can no longer handle your own affairs.

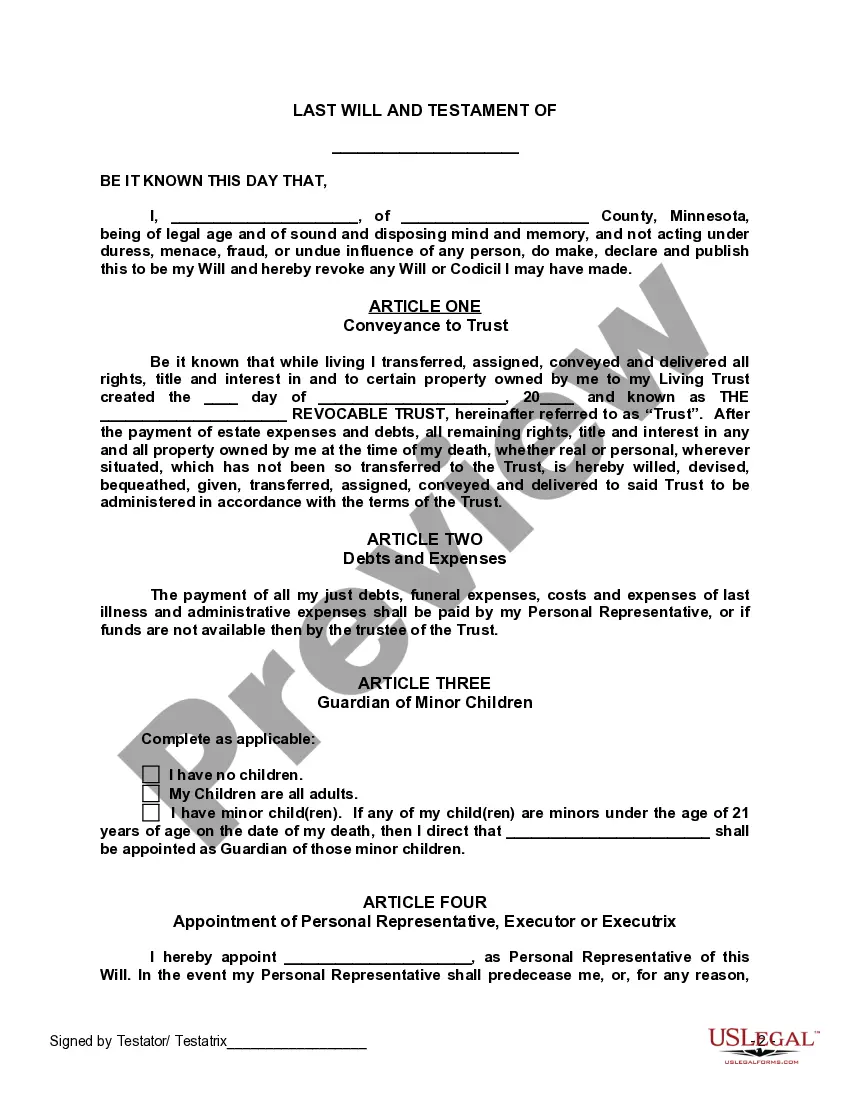

When people make revocable living trusts to avoid probate, it's common for them to also make what's called a "pour-over will." The will directs that if any property passes through the will at the person's death, it should be transferred to (poured into) the trust, and then distributed to the beneficiaries of the trust.

A pour-over will is a legal document that ensures an individual's remaining assets will automatically transfer to a previously established trust upon their death.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

Pour-over wills act as a backstop against issues that could frustrate the smooth operation of a living trust. They ensure any assets a grantor neglects to add to a trust, whether by accident or on purpose, will end up in the trust after execution of the will.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

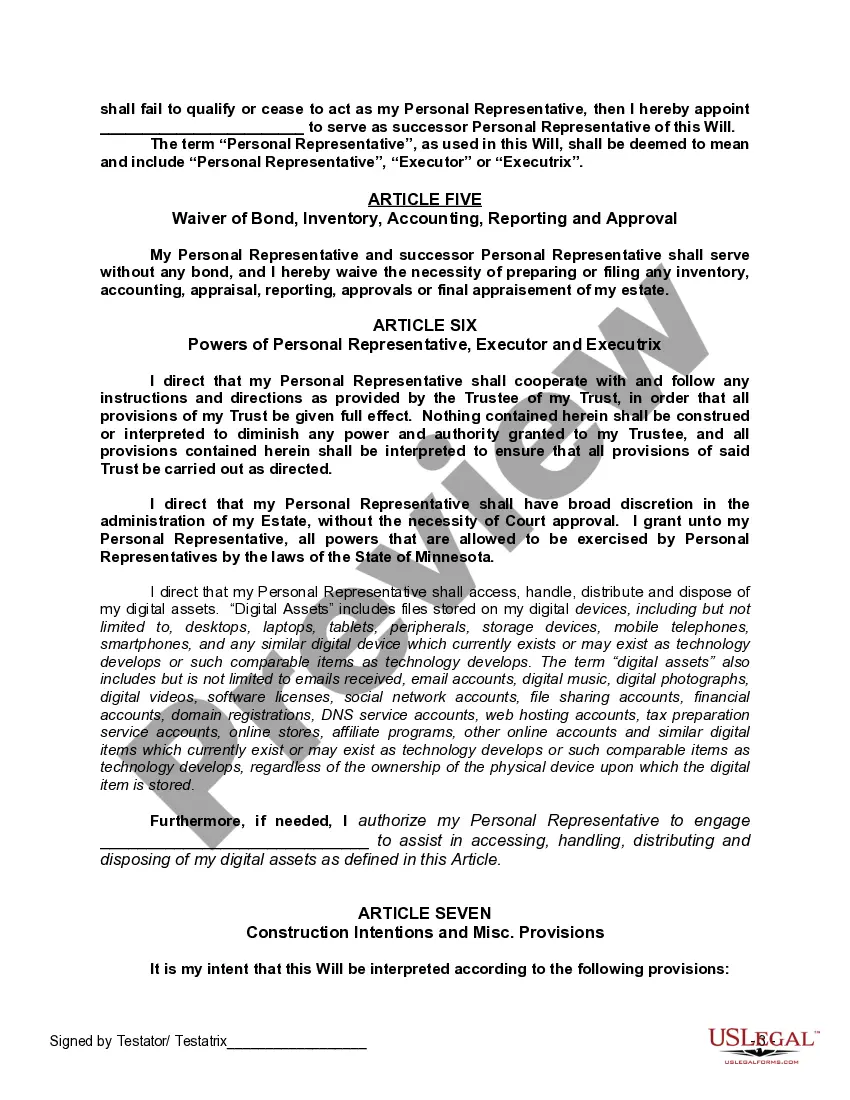

The trustee is the legal owner of the property in trust, as fiduciary for the beneficiary or beneficiaries who is/are the equitable owner(s) of the trust property. Trustees thus have a fiduciary duty to manage the trust to the benefit of the equitable owners.