Minnesota Certificate of Formation for Limited Liability Company LLC

Description

How to fill out Certificate Of Formation For Limited Liability Company LLC?

Choosing the best legal document template can be a battle. Naturally, there are a lot of templates accessible on the Internet, but how can you get the legal develop you require? Make use of the US Legal Forms site. The services offers thousands of templates, for example the Minnesota Certificate of Formation for Limited Liability Company LLC, that you can use for business and private requires. Each of the varieties are checked by professionals and meet federal and state demands.

Should you be presently signed up, log in for your bank account and then click the Obtain option to have the Minnesota Certificate of Formation for Limited Liability Company LLC. Use your bank account to appear with the legal varieties you have ordered earlier. Go to the My Forms tab of the bank account and obtain another copy from the document you require.

Should you be a whole new end user of US Legal Forms, allow me to share basic instructions that you can adhere to:

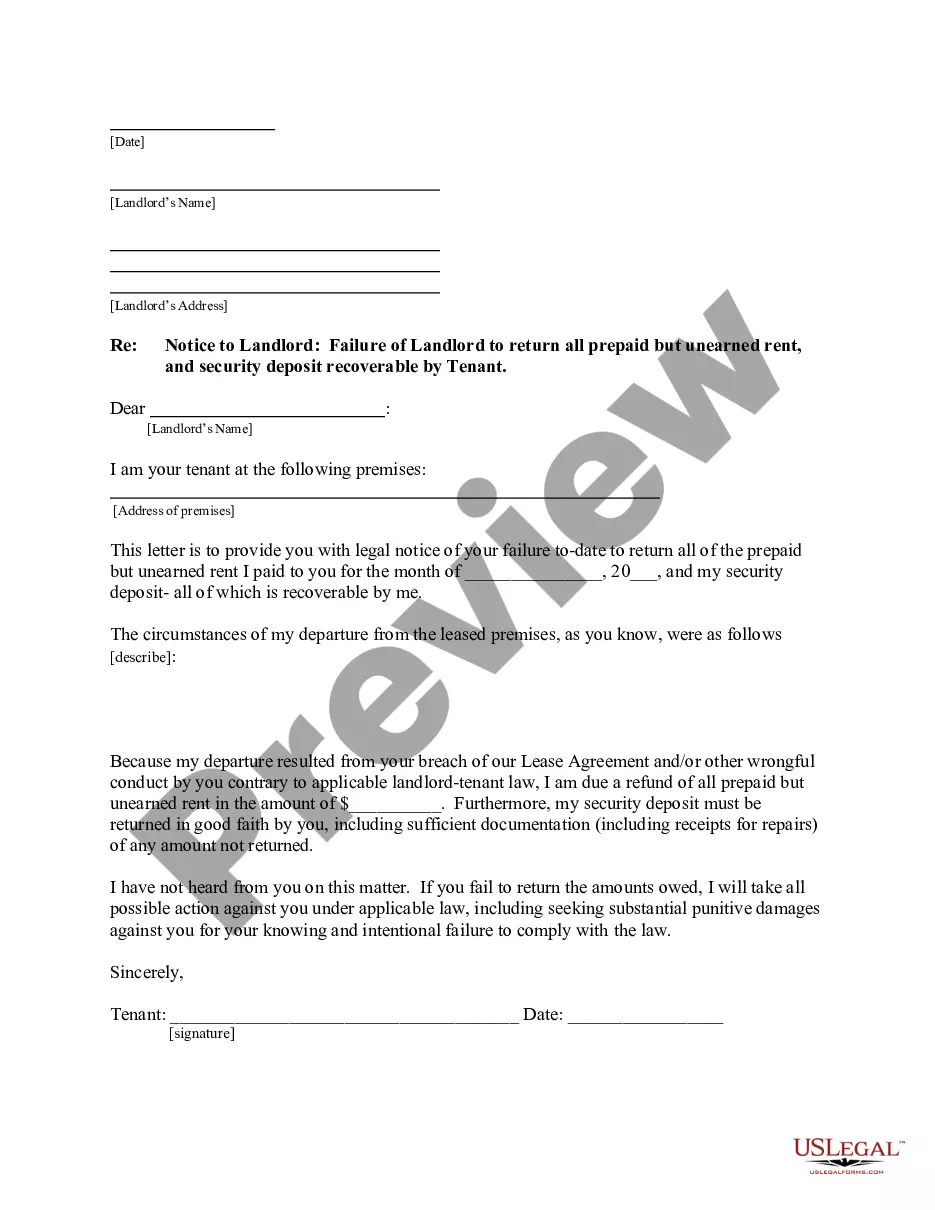

- First, make certain you have selected the proper develop for your personal city/area. You can check out the shape utilizing the Review option and look at the shape outline to make certain it will be the right one for you.

- If the develop fails to meet your needs, make use of the Seach area to find the correct develop.

- When you are certain that the shape is suitable, click on the Acquire now option to have the develop.

- Select the pricing prepare you want and enter the essential information and facts. Design your bank account and pay for the order utilizing your PayPal bank account or Visa or Mastercard.

- Pick the file formatting and acquire the legal document template for your system.

- Comprehensive, edit and produce and indicator the received Minnesota Certificate of Formation for Limited Liability Company LLC.

US Legal Forms may be the largest library of legal varieties where you can find numerous document templates. Make use of the service to acquire professionally-manufactured files that adhere to status demands.

Form popularity

FAQ

For tax purposes, LLCs must apply for a federal Employer ID Number from the Internal Revenue Service (IRS), and a Minnesota Tax ID Number from the Minnesota Department of Revenue.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

How much does it cost to form an LLC in Minnesota? The Minnesota Secretary of State charges $135 to file the Articles of Organization by mail and $155 to file online or in-person. You can file an LLC name reservation for $50 if filed by mail and $55 if filed online or in-person.

Name your Minnesota LLC. You'll need to choose a name to include in your articles before you can register your LLC. ... Your LLC must establish a registered office. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number.

A Minnesota LLC isn't legally obligated to have an operating agreement. Minnesota Statute § 322C. 0110 outlines what an operating agreement may cover but doesn't state that LLCs must have one.

Delaware does NOT require an operating agreement. However, it is highly recommended to have a LLC operating agreement even if you are only a single member LLC. The state of Delaware recognizes operating agreements and governing documents.

How much does it cost to form an LLC in Minnesota? The Minnesota Secretary of State charges $135 to file the Articles of Organization by mail and $155 to file online or in-person. You can file an LLC name reservation for $50 if filed by mail and $55 if filed online or in-person.

Steps to Start an LLC Choose a Name for Your LLC. Appoint a Registered Agent. File Your Articles of Organization. Decide Whether Your LLC Should Be Member-Managed or Manager-Managed. Create an LLC Operating Agreement. Comply With Tax and Regulatory Requirements. File Your Annual Reports. Register to Do Business in Other States.