This office lease states the conditions of the annual rental rate currently specified to be paid by the tenant (the "Base Rent"). This shall be used as a basis to calculate additional rent as of the times and in the manner set forth in this form to be paid by the tenant.

Minnesota Consumer Price Index

Description

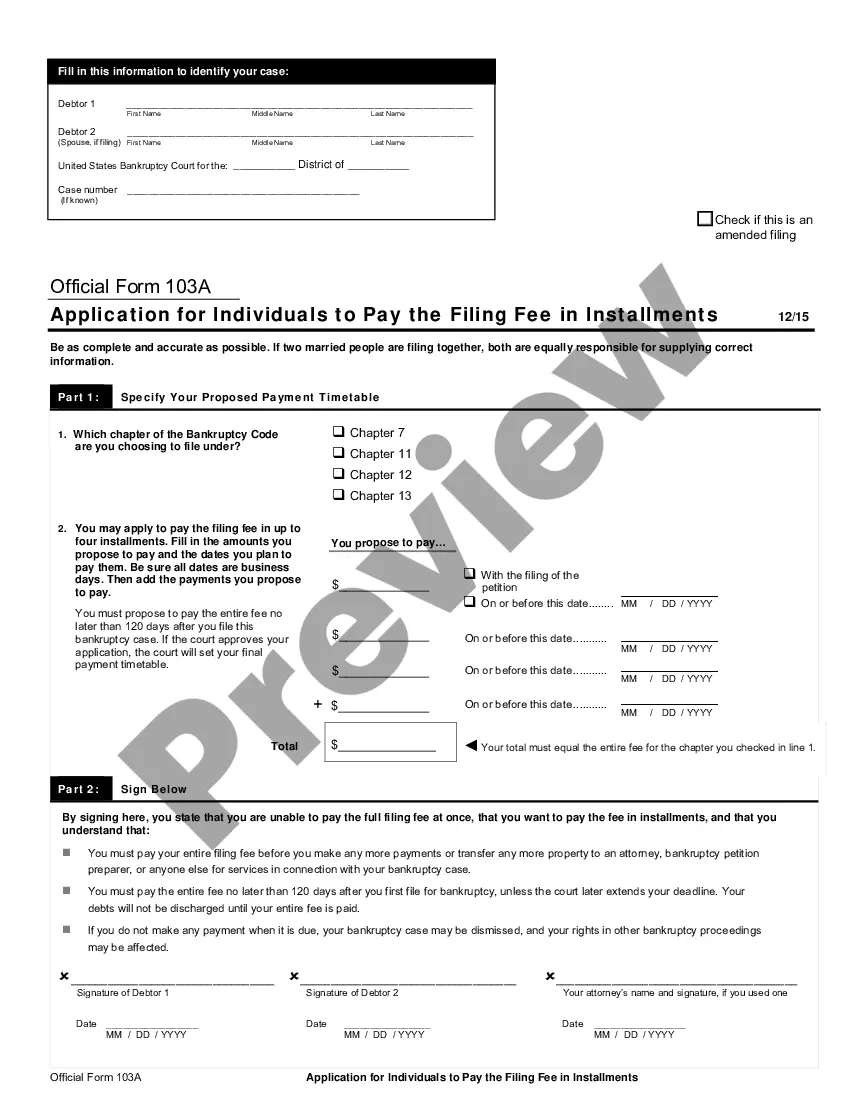

How to fill out Consumer Price Index?

It is possible to invest several hours on the web attempting to find the legitimate document template that fits the state and federal specifications you need. US Legal Forms provides 1000s of legitimate types which can be evaluated by specialists. You can easily down load or produce the Minnesota Consumer Price Index from your assistance.

If you already possess a US Legal Forms profile, you may log in and click the Download switch. Next, you may full, revise, produce, or sign the Minnesota Consumer Price Index. Each legitimate document template you buy is the one you have eternally. To acquire an additional copy for any acquired kind, visit the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms internet site the first time, adhere to the basic instructions under:

- Very first, make sure that you have chosen the correct document template for that county/town that you pick. See the kind outline to ensure you have picked the correct kind. If offered, use the Preview switch to appear from the document template at the same time.

- If you would like locate an additional version in the kind, use the Look for discipline to get the template that meets your requirements and specifications.

- When you have found the template you would like, click Purchase now to continue.

- Pick the costs strategy you would like, key in your accreditations, and register for a free account on US Legal Forms.

- Total the deal. You can use your Visa or Mastercard or PayPal profile to cover the legitimate kind.

- Pick the formatting in the document and down load it in your product.

- Make modifications in your document if possible. It is possible to full, revise and sign and produce Minnesota Consumer Price Index.

Download and produce 1000s of document layouts utilizing the US Legal Forms site, which provides the biggest selection of legitimate types. Use expert and state-distinct layouts to take on your business or specific requires.

Form popularity

FAQ

Consumer Price Index Overview Table ? Midwest Area (Links provide news releases)Jun 2023Percent change to Sep 2023 fromSep 2022Middle Atlantic(3)120.4233.2Midwest region(4)283.7413.2Midwest - Size Class A (over 2.5 million)282.7532.847 more rows

Not seasonally adjusted CPI measures The Consumer Price Index for All Urban Consumers (CPI-U) increased 3.7 percent over the last 12 months to an index level of 307.789 (1982-84=100). For the month, the index increased 0.2 percent prior to seasonal adjustment.

Consumer Price Index Overview Table ? Midwest Area (Links provide news releases)Sep 2023Minneapolis-St. Paul-Bloomington, MN-WI296.730Riverside-San Bernardino-Ontario, CA(3)131.372San Diego-Carlsbad, CA367.18548 more rows

The consumer price index , reported Tuesday by the Bureau of Labor Statistics, climbed 3.2% year over year in October?a slower pace than the 3.7% rate recorded in September and August. Economists surveyed by FactSet expected October's inflation rate to slow to 3.3% year over year.

Consumer Price Index, Los Angeles area ? September 2023 MonthAll itemsAll items less food and energyDec 20224.94.5Jan 20235.84.5Feb 20235.14.5Mar 20233.74.333 more rows

Consumer Price Index, Los Angeles area ? September 2023 MonthAll itemsAll items less food and energyDec 20224.94.5Jan 20235.84.5Feb 20235.14.5Mar 20233.74.333 more rows

Not seasonally adjusted CPI measures The Consumer Price Index for All Urban Consumers (CPI-U) increased 3.7 percent over the last 12 months to an index level of 307.789 (1982-84=100). For the month, the index increased 0.2 percent prior to seasonal adjustment.

The annual headline inflation rate rose from 4.7% in July 2023 to 4.8% in August 2023. The Consumer Price Index (CPI) increased by 0.3% month-on-month in August 2023. Food prices decreased from 10% in July 2023 to 8.2% in August 2023. Transport inflation increased to 0.8% in August 2023 from -2.6% in July 2023.

Prices in the Minneapolis-St. Paul-Bloomington area, as measured by the Consumer Price Index for All Urban Consumers (CPI-U), increased 1.5 percent for the two months ending in September 2023, the U.S. Bureau of Labor Statistics reported today.