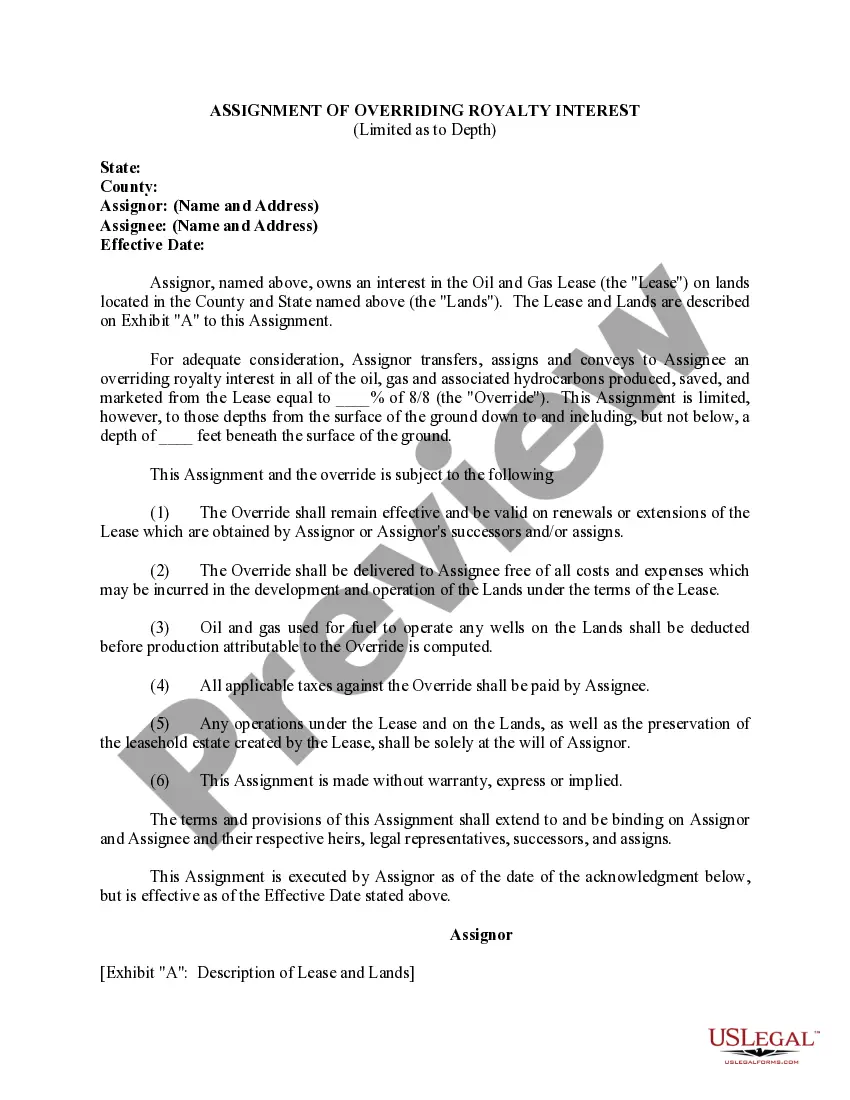

Minnesota Assignment of Overriding Royalty Interest Limited As to Depth

Description

How to fill out Assignment Of Overriding Royalty Interest Limited As To Depth?

US Legal Forms - one of the biggest libraries of authorized varieties in the United States - offers a variety of authorized papers layouts you are able to download or produce. Making use of the site, you will get a large number of varieties for enterprise and personal purposes, sorted by categories, says, or key phrases.You can find the most recent models of varieties such as the Minnesota Assignment of Overriding Royalty Interest Limited As to Depth within minutes.

If you have a monthly subscription, log in and download Minnesota Assignment of Overriding Royalty Interest Limited As to Depth from your US Legal Forms catalogue. The Acquire key can look on every single kind you look at. You have access to all in the past delivered electronically varieties in the My Forms tab of the bank account.

If you wish to use US Legal Forms the very first time, listed below are simple instructions to get you started:

- Ensure you have selected the proper kind for the town/region. Select the Preview key to review the form`s articles. See the kind outline to actually have chosen the appropriate kind.

- If the kind doesn`t satisfy your needs, take advantage of the Look for field on top of the display to discover the one who does.

- When you are satisfied with the form, verify your choice by clicking the Purchase now key. Then, opt for the costs program you like and offer your references to register on an bank account.

- Method the purchase. Use your credit card or PayPal bank account to accomplish the purchase.

- Pick the structure and download the form in your gadget.

- Make modifications. Load, change and produce and indication the delivered electronically Minnesota Assignment of Overriding Royalty Interest Limited As to Depth.

Every format you included in your money does not have an expiry date and is also your own forever. So, if you want to download or produce an additional duplicate, just proceed to the My Forms area and then click around the kind you want.

Gain access to the Minnesota Assignment of Overriding Royalty Interest Limited As to Depth with US Legal Forms, probably the most extensive catalogue of authorized papers layouts. Use a large number of professional and express-certain layouts that meet your business or personal needs and needs.

Form popularity

FAQ

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) Endeavor Energy Resources, LP ? 2019/07 Endeavor Energy Resources, LP ? 2019/07 PDF

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12. Information and Procedures for Transferring Overriding Royalty ... blm.gov ? article ? Information-and-Procedu... blm.gov ? article ? Information-and-Procedu...

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.