"Instructions for Completing Mortgage Deed of Trust Form" is a American Lawyer Media form. The following form is for instructions for completing mortgage deed of trust.

Minnesota Instructions for Completing Mortgage Deed of Trust Form

Description

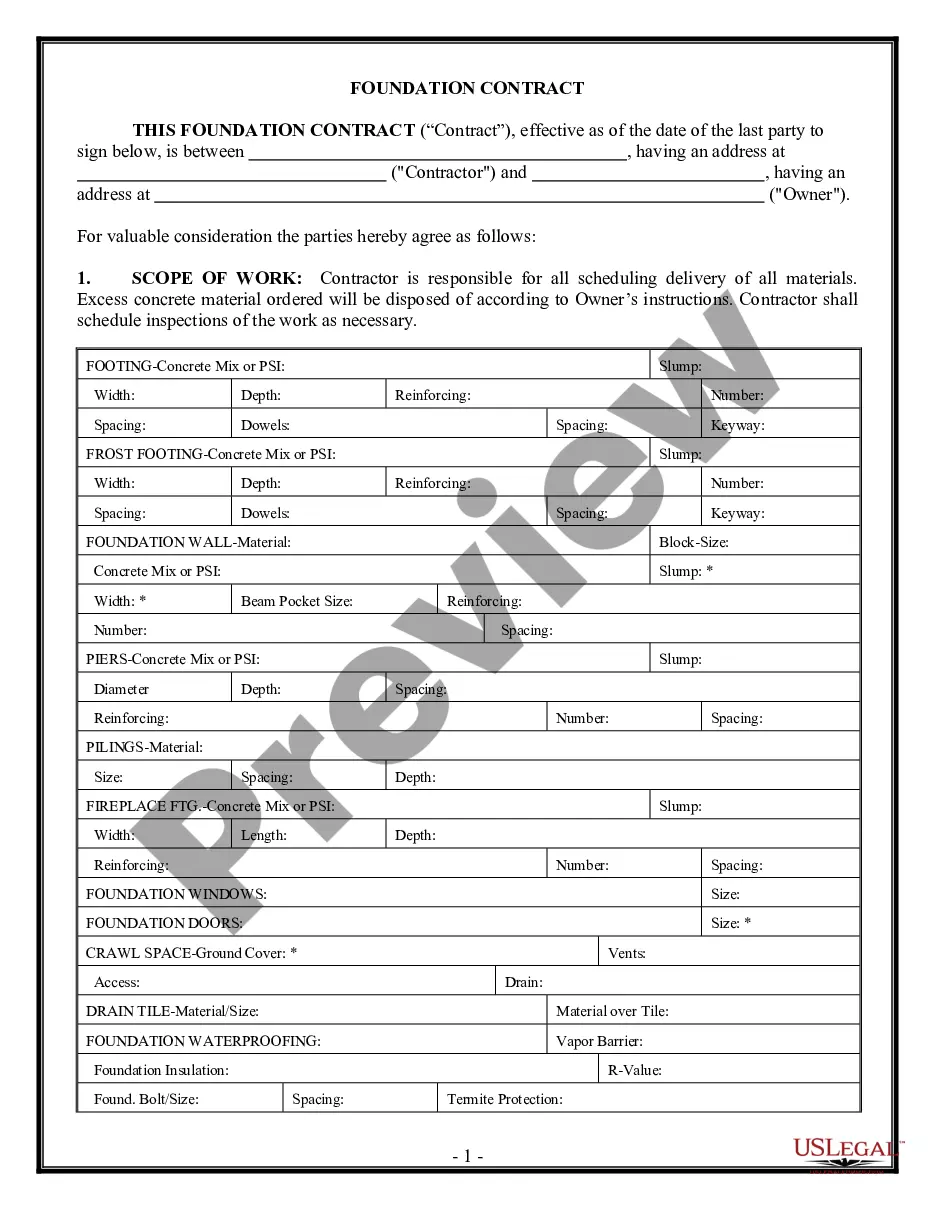

How to fill out Instructions For Completing Mortgage Deed Of Trust Form?

Choosing the best legal document format can be a battle. Naturally, there are a variety of web templates available on the Internet, but how would you obtain the legal kind you need? Use the US Legal Forms web site. The support offers thousands of web templates, such as the Minnesota Instructions for Completing Mortgage Deed of Trust Form, which you can use for organization and personal needs. Each of the kinds are checked out by experts and meet federal and state needs.

In case you are already listed, log in to your bank account and click on the Obtain option to find the Minnesota Instructions for Completing Mortgage Deed of Trust Form. Use your bank account to appear with the legal kinds you may have acquired earlier. Visit the My Forms tab of your respective bank account and get yet another backup in the document you need.

In case you are a fresh consumer of US Legal Forms, allow me to share straightforward recommendations for you to stick to:

- Very first, be sure you have selected the appropriate kind to your town/state. It is possible to examine the shape making use of the Review option and browse the shape description to guarantee it will be the best for you.

- When the kind will not meet your expectations, take advantage of the Seach industry to get the proper kind.

- When you are sure that the shape is acceptable, select the Get now option to find the kind.

- Opt for the pricing prepare you desire and enter the essential info. Make your bank account and pay money for the order making use of your PayPal bank account or charge card.

- Choose the data file format and obtain the legal document format to your system.

- Full, modify and print and signal the received Minnesota Instructions for Completing Mortgage Deed of Trust Form.

US Legal Forms may be the biggest library of legal kinds that you will find numerous document web templates. Use the company to obtain professionally-manufactured files that stick to state needs.

Form popularity

FAQ

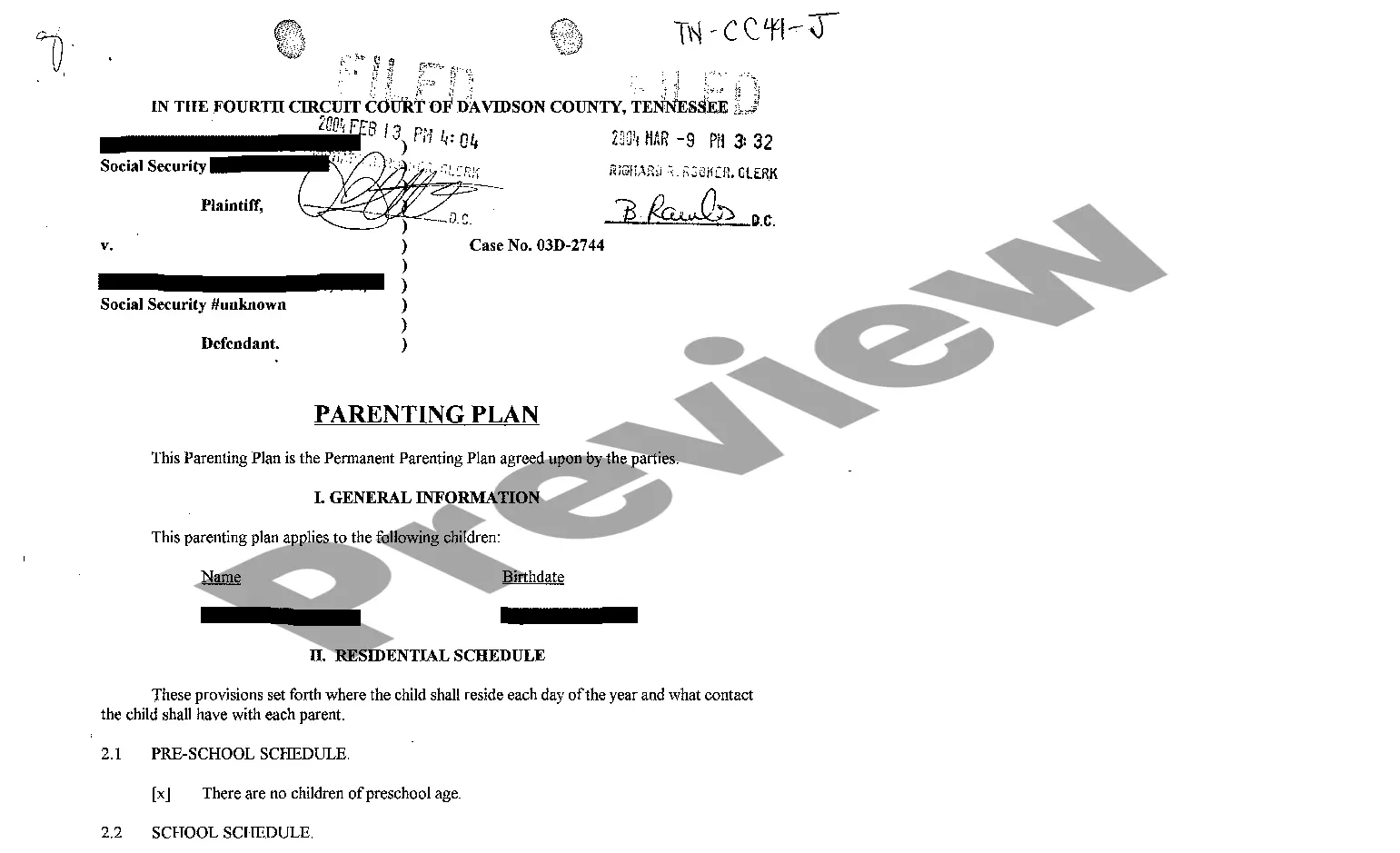

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Hawaii is a lien theory state and uses mortgages instead of deeds of trust.

Current Owner and New Owner Information. A Minnesota deed must include the names of the current owner (the grantor) signing the deed and the new owner (the grantee) receiving title to the property. Deeds customarily state each party's address and marital status.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

A Minnesota deed of trust is used to secure real estate financing by placing the borrower's property in trust until the lender has been paid back.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateMarylandYYMassachusettsYMichiganYYMinnesotaY47 more rows

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A mortgage or deed of trust is an agreement in which a borrower puts up title to real estate as security (collateral) for a loan. People often refer to a home loan as a "mortgage." But a mortgage isn't a loan agreement. The promissory note promises to repay the amount you borrowed to buy a home.