Minnesota Self-Employed Mechanic Services Contract

Description

How to fill out Self-Employed Mechanic Services Contract?

If you wish to aggregate, download, or print authorized document templates, utilize US Legal Forms, the largest assortment of legal forms, that can be located online.

Employ the site's straightforward and user-friendly search to locate the documents you require.

Various templates for commercial and personal uses are categorized by groups and jurisdictions, or keywords.

Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Step 4. After finding the form you need, click on the Acquire now button. Choose your preferred pricing plan and enter your credentials to register for an account.

- Utilize US Legal Forms to find the Minnesota Self-Employed Mechanic Services Contract with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to download the Minnesota Self-Employed Mechanic Services Contract.

- You can also access documents you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have selected the form for the correct city/state.

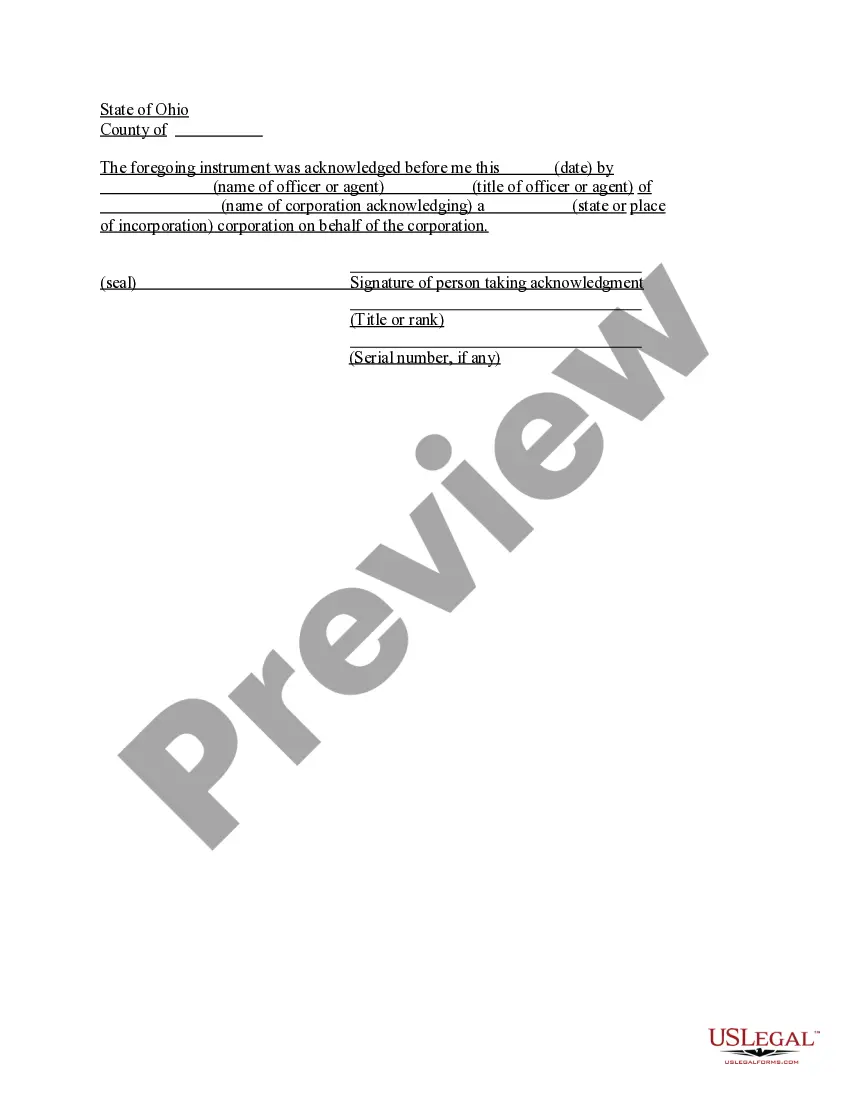

- Step 2. Use the Preview option to examine the form's contents. Don't forget to review the description.

Form popularity

FAQ

Taxable Services in MinnesotaAdmissions to places of amusement (including recreational areas and athletic events)Making available amusement devices (including video games and games of chance)Making available health clubs, spas, tanning facilities, reducing salons, steam baths, or athletic facilities.More items...?

Common examples include:Clothing for general use, see Clothing.Food (grocery items), see Food and Food Ingredients.Prescription and over-the-counter drugs for humans, see Drugs.

First up: Get your tax forms in orderStep 1: Ask your independent contractor to fill out Form W-9.Step 2: Fill out two 1099-NEC forms (Copy A and B)Ask your independent contractor for invoices.Add your freelancer to payroll.Keep records like a boss.Tools to check out:

Auto body and automotive repair labor is not taxable when it is separately stated from repair parts on the invoice. Repair labor restores an item to its original condition so it can be used for its original purpose. Parts used to repair or service a vehicle are taxable to the customer.

Fabrication labor is taxable, even if the customer provides the materials for the products that will be created or altered. Fabrication labor may be purchased exempt if the purchaser gives the seller a completed Form ST3, Certificate of Ex- emption. lumber to make tables that will be sold to retail stores.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Have a current license, certificate or registration issued by the agency; are an employee of a business performing construction services; have a current residential building contractor or remodeler certificate of exemption; or. are excluded from registration requirements under Minnesota Statutes 326B.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.