Minnesota Actor - Actress Employment Agreement - Self-Employed Independent Contractor

Description

How to fill out Actor - Actress Employment Agreement - Self-Employed Independent Contractor?

If you wish to total, down load, or printing legitimate record web templates, use US Legal Forms, the largest collection of legitimate forms, which can be found online. Utilize the site`s simple and practical lookup to find the files you need. Various web templates for organization and person uses are sorted by groups and states, or keywords and phrases. Use US Legal Forms to find the Minnesota Actor - Actress Employment Agreement - Self-Employed Independent Contractor in a handful of mouse clicks.

Should you be already a US Legal Forms consumer, log in in your accounts and then click the Acquire switch to get the Minnesota Actor - Actress Employment Agreement - Self-Employed Independent Contractor. You can even entry forms you formerly saved within the My Forms tab of the accounts.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have selected the form for the proper metropolis/nation.

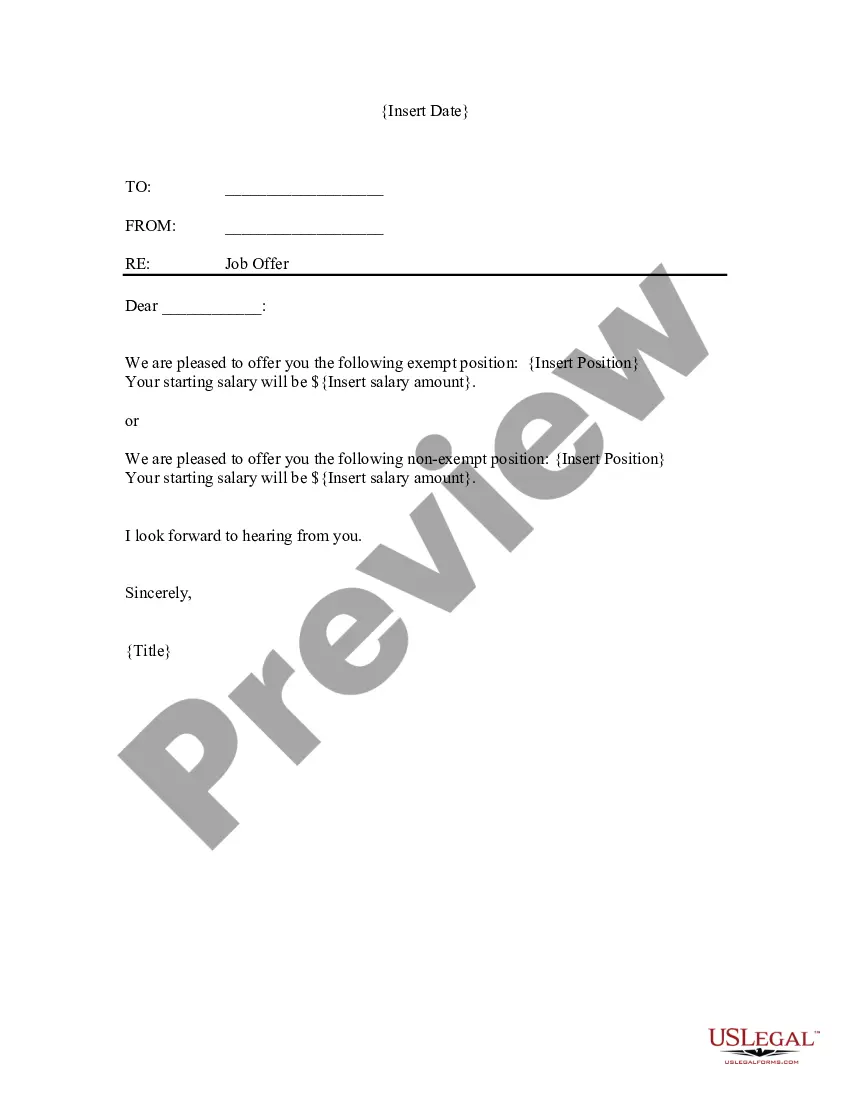

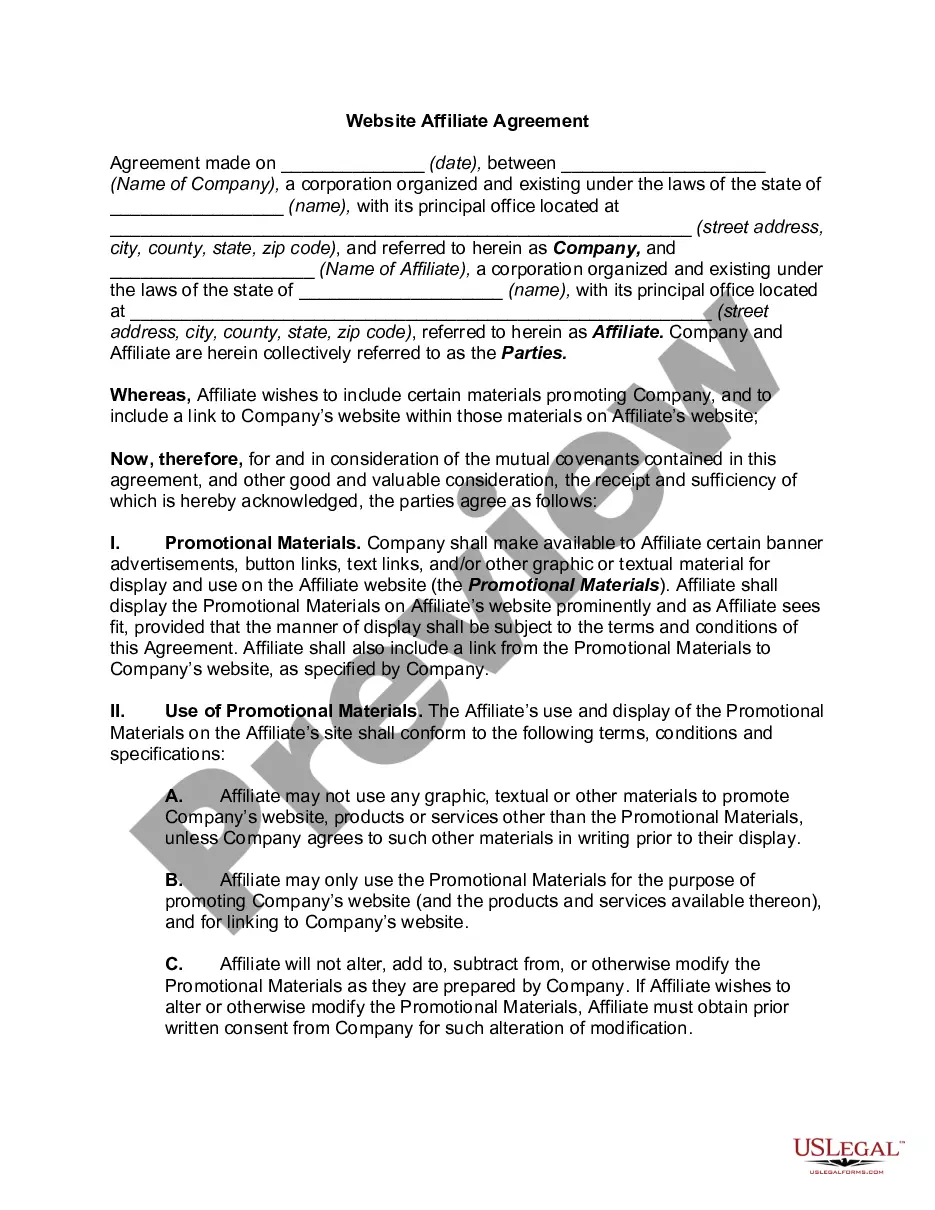

- Step 2. Use the Review option to check out the form`s content. Never neglect to see the outline.

- Step 3. Should you be not satisfied together with the type, take advantage of the Research area near the top of the display to find other types of your legitimate type web template.

- Step 4. When you have discovered the form you need, click the Buy now switch. Pick the prices prepare you prefer and put your accreditations to register for an accounts.

- Step 5. Process the transaction. You may use your bank card or PayPal accounts to perform the transaction.

- Step 6. Find the formatting of your legitimate type and down load it on your gadget.

- Step 7. Total, change and printing or sign the Minnesota Actor - Actress Employment Agreement - Self-Employed Independent Contractor.

Each and every legitimate record web template you buy is your own forever. You may have acces to each and every type you saved within your acccount. Select the My Forms area and decide on a type to printing or down load once again.

Remain competitive and down load, and printing the Minnesota Actor - Actress Employment Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of expert and condition-particular forms you may use for your organization or person demands.

Form popularity

FAQ

What Is a Standard Actor Contract? A standard actor contract is a written agreement of employment between an actor and the client or employer. This is a legally binding document, so it protects the interests of both parties involved and outlines all their terms and conditions to complete an acting job.

However, for the most part, under the Federal regulations (and most states including California), a crew member on a film or other similar type production should never be categorized as an independent contractor they are really employees and are subject to federal and state withholding (from their paychecks) as

Musicians are considered employees by the National Labor Relations Board (NLRB), not independent contractors.

An actor is considered self-employed if they work for themselves as a sole proprietor, an LLC, or an S corporation or C corporation. Some actors are employees and some actors are self-employed. Self-employed people work for themselves and aren't considered employees of anyone else.

Are actors considered self-employed? An actor is considered self-employed if they work for themselves as a sole proprietor, an LLC, or an S corporation or C corporation. Some actors are employees and some actors are self-employed. Self-employed people work for themselves and aren't considered employees of anyone else.

Freelance actors are ideal for small projects such as television commercials or non-commercial documentaries. Freelance actors are usually represented by themselves and hence their charges are much lower than those that are represented by an agency.

It's often difficult to determine which classification to use. The IRS view is that most crew members, actors, and others working on a film production should be classified as employees, not independent contractors, and that taxes should thus be withheld.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Actors and extras have a tax status of self-employment, but an employment status as workers, which conferrs a number of important rights. Even if the contract states the performer is self employed, they retain their employment rights as a worker.

A writer or artist, who is not employed continuously but hired to do specific assignments. b (as modifier)