Minnesota Visiting Professor Agreement - Self-Employed Independent Contractor

Description

How to fill out Visiting Professor Agreement - Self-Employed Independent Contractor?

If you require thorough, obtain, or reproduce legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site’s straightforward and convenient search to locate the documents you need.

Various templates for business and personal purposes are categorized by types and regions, or keywords. Use US Legal Forms to find the Minnesota Visiting Professor Agreement - Self-Employed Independent Contractor with just a few clicks.

Each legal document template you buy is yours permanently. You have access to every form you saved within your account.

Click on the My documents section and select a form to print or download again. Compete and acquire, and print the Minnesota Visiting Professor Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire option to obtain the Minnesota Visiting Professor Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the guidelines below.

- Step 1. Ensure you have selected the form for your appropriate area/region.

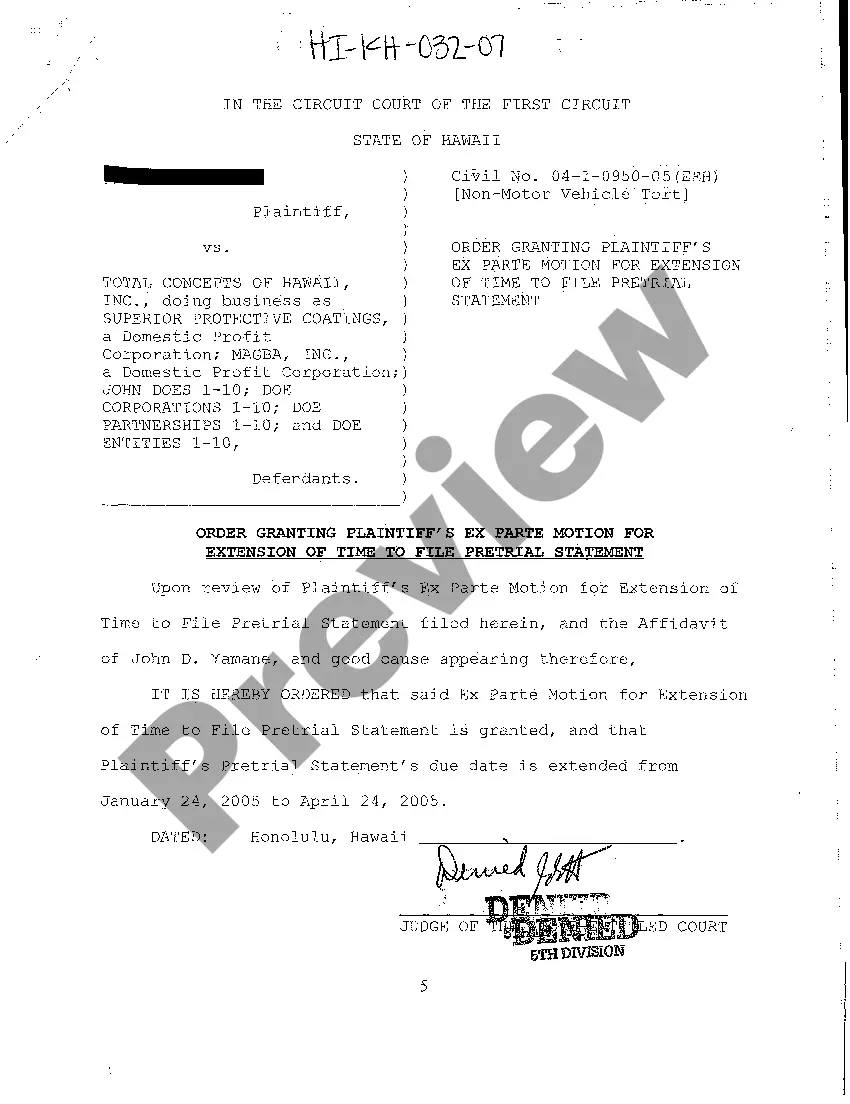

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to check the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other types of your legal form template.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose your preferred payment plan and enter your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the purchase.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Minnesota Visiting Professor Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Filling out an independent contractor form, such as the Minnesota Visiting Professor Agreement - Self-Employed Independent Contractor, requires accurate and complete information. Start with your name, tax identification details, and project specifics. Be sure to review the terms of the contract thoroughly, as this documentation is vital for both legal clarity and financial arrangements. If you need guidance, uslegalforms offers valuable resources to assist you.

Writing a Minnesota Visiting Professor Agreement - Self-Employed Independent Contractor involves detailing the terms of your engagement. Begin with the names and addresses of both parties, then describe the services to be provided, payment structure, and the duration of the agreement. Utilizing a template from uslegalforms can simplify this process and ensure that you include all necessary legal protections.

To fill out the Minnesota Visiting Professor Agreement - Self-Employed Independent Contractor, start by entering your personal details and the specifics of the project. Clearly outline the scope of work, payment terms, and deadlines. Ensure that all parties involved review and sign the document. This agreement helps clarify expectations and protects your rights as an independent contractor.

While 'self-employed' and 'independent contractor' can be used interchangeably in some contexts, 'independent contractor' specifically indicates a formal business arrangement. This can be beneficial when discussing agreements, like the Minnesota Visiting Professor Agreement - Self-Employed Independent Contractor. Clear terminology helps avoid confusion when establishing work relationships with educational institutions.

An adjunct professor is often classified as an independent contractor, but this can vary by institution. They are usually hired to teach specific courses without the full benefits of a permanent faculty role. Therefore, having a Minnesota Visiting Professor Agreement - Self-Employed Independent Contractor is an excellent tool for adjunct professors to define their working terms.

Professors can be either employees or independent contractors, depending on their role and the institution's structure. Full-time faculty are typically employees, while adjunct or visiting professors may work as independent contractors. Understanding this distinction is crucial, especially for those needing a Minnesota Visiting Professor Agreement - Self-Employed Independent Contractor to formalize their status.

The independent contractor agreement in Minnesota outlines the terms and conditions of the working relationship between a business and a self-employed individual. This document specifies expectations, payment details, and responsibilities for both parties. For those involved in academia, such as visiting professors, having a Minnesota Visiting Professor Agreement - Self-Employed Independent Contractor ensures clarity and professionalism.