Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor

Description

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

Are you currently in a situation where you require documents for either business or personal purposes almost daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of template options, such as the Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor, designed to meet state and federal requirements.

Once you find the right document, click Acquire now.

Choose the subscription plan you prefer, fill in the necessary details to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor template.

- If you don’t have an account and want to start using US Legal Forms, follow these instructions.

- Retrieve the document you need and ensure it is for the correct city/region.

- Utilize the Preview button to examine the form.

- Peruse the description to confirm that you have selected the correct document.

- If the document isn’t what you’re seeking, use the Search box to locate the form that suits your requirements.

Form popularity

FAQ

Yes, having a contract as an independent contractor is highly recommended. A written agreement helps clarify the terms of your engagement and protects your rights. A Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor minimizes potential misunderstandings between you and your client. For ease, consider using resources like USLegalForms to create a comprehensive contract tailored to your specific needs.

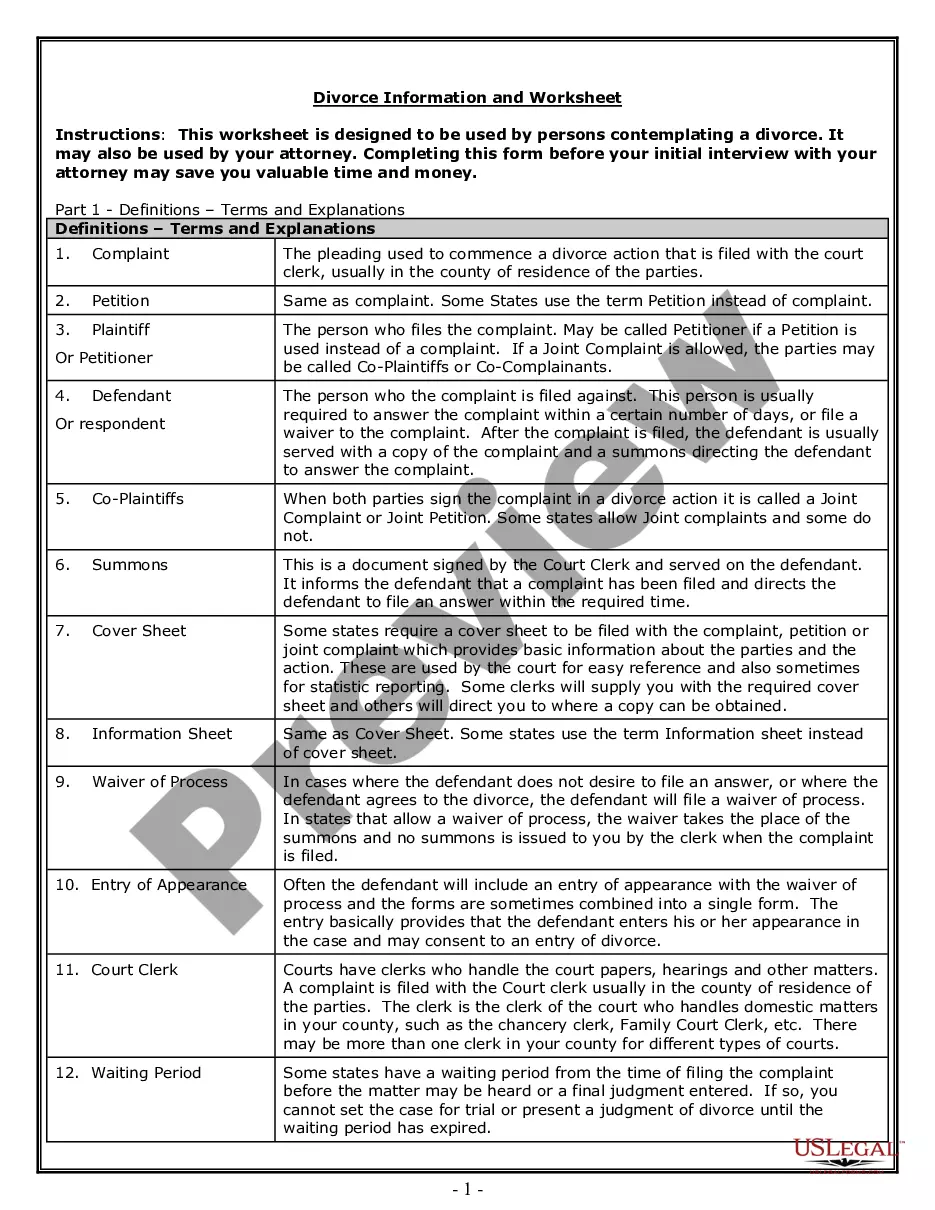

The independent contractor agreement in Minnesota serves as a crucial document that defines the relationship between the contractor and their client. This agreement should include specific terms relevant to the work being performed, such as duration, compensation, and obligations. A Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor adheres to state regulations and helps establish a secure working environment. USLegalForms provides templates to simplify this process.

A basic independent contractor agreement outlines essential details between a contractor and a client. This document typically includes scope of work, payment terms, deadlines, and confidentiality clauses. For those in Minnesota, crafting a Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor ensures comprehensive coverage of these elements. Utilizing platforms like USLegalForms can facilitate creating a tailored agreement that meets your needs.

The new federal rule on independent contractors focuses on the criteria used to determine whether a worker qualifies as an independent contractor or an employee. This classification impacts tax responsibilities and business liabilities. It is important for independent contractors, particularly in Minnesota, to ensure their Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor aligns with these evolving federal guidelines. Staying informed helps you avoid legal pitfalls.

Independent contractors must adhere to specific legal requirements, including tax obligations and compliance with workplace regulations. In Minnesota, a Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor should outline these responsibilities clearly. It is crucial to understand your rights and obligations to ensure a successful independent business. Consulting resources like USLegalForms can help you navigate these legal aspects.

Yes, you can be self-employed and have a contract. In fact, having a written agreement is essential for a self-employed independent contractor. A Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor provides clarity on the terms of your work, including payment, responsibilities, and deadlines. This contract protects both you and your client by setting clear expectations.

The terms self-employed and independent contractor can often be used interchangeably, but there are subtle differences. Self-employed generally refers to individuals who work for themselves, while independent contractors are specifically hired to complete tasks for other businesses. For a Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor, you can confidently choose the term that best fits your business model, keeping your audience and legal requirements in mind.

To fill out an independent contractor form, start by providing your personal information along with the details of your business or services. Clearly state the compensation structure and any relevant deadlines. Using platforms like USLegalForms makes it easy to navigate the specifics of a Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor, ensuring you include all necessary components correctly.

Filling out an independent contractor agreement involves entering relevant details about the project, such as the contractor's name, services provided, and payment terms. Be specific about deadlines and deliverables, making sure they align with your expectations. With tools like USLegalForms, you can easily create a Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor that guides you in providing all necessary information accurately.

Yes, you can and should have a contract if you are self-employed. A contract protects both you and your clients by clearly defining the terms of your working relationship. This is especially crucial for a Minnesota Data Entry Employment Contract - Self-Employed Independent Contractor, as it sets expectations and promotes trust. Using a well-drafted agreement can also reduce misunderstandings and provide legal support if needed.