Minnesota Assignment of Note and Deed of Trust as Security for Debt of Third Party

Description

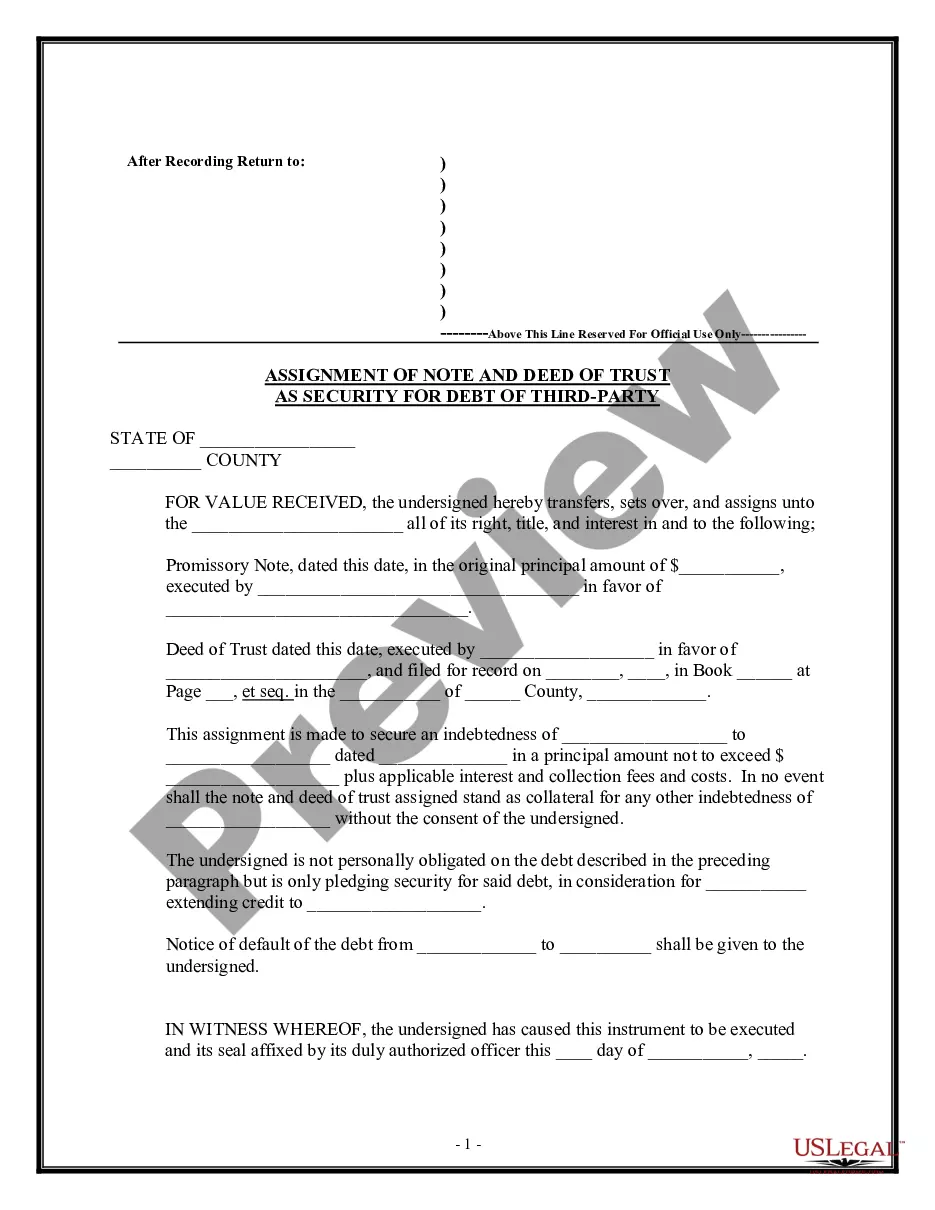

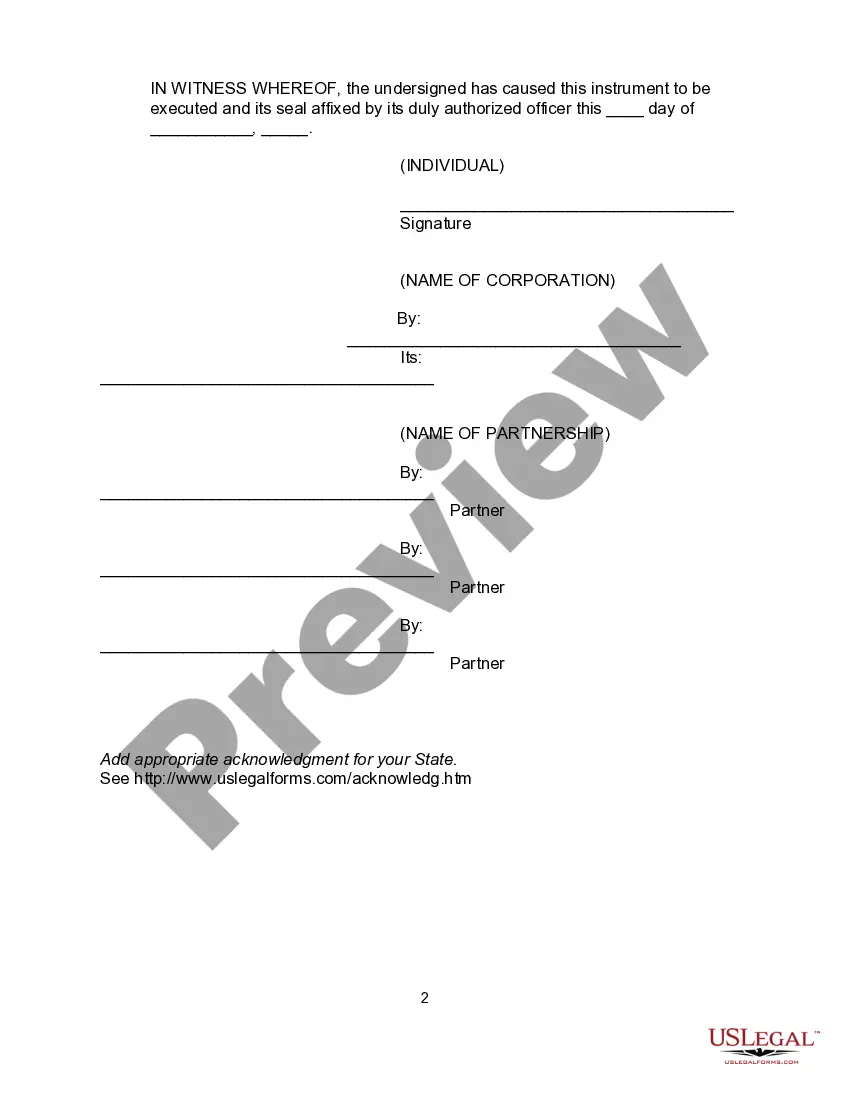

How to fill out Assignment Of Note And Deed Of Trust As Security For Debt Of Third Party?

If you want to comprehensive, down load, or print out authorized document themes, use US Legal Forms, the largest collection of authorized kinds, which can be found on-line. Make use of the site`s simple and easy practical look for to find the paperwork you require. A variety of themes for organization and individual purposes are categorized by groups and claims, or keywords. Use US Legal Forms to find the Minnesota Assignment of Note and Deed of Trust as Security for Debt of Third Party within a handful of click throughs.

Should you be currently a US Legal Forms buyer, log in for your bank account and click the Obtain option to have the Minnesota Assignment of Note and Deed of Trust as Security for Debt of Third Party. You can also gain access to kinds you formerly delivered electronically from the My Forms tab of your own bank account.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for that correct city/land.

- Step 2. Use the Preview solution to examine the form`s content material. Don`t forget to read the outline.

- Step 3. Should you be unhappy using the develop, take advantage of the Search area at the top of the screen to find other types from the authorized develop design.

- Step 4. Once you have discovered the shape you require, click on the Buy now option. Choose the prices plan you choose and add your accreditations to sign up on an bank account.

- Step 5. Procedure the purchase. You can use your Мisa or Ьastercard or PayPal bank account to complete the purchase.

- Step 6. Find the file format from the authorized develop and down load it on your own gadget.

- Step 7. Total, revise and print out or indicator the Minnesota Assignment of Note and Deed of Trust as Security for Debt of Third Party.

Every single authorized document design you acquire is the one you have forever. You possess acces to every develop you delivered electronically inside your acccount. Go through the My Forms area and pick a develop to print out or down load again.

Remain competitive and down load, and print out the Minnesota Assignment of Note and Deed of Trust as Security for Debt of Third Party with US Legal Forms. There are millions of professional and status-specific kinds you may use for your personal organization or individual needs.

Form popularity

FAQ

A deed of trust is satisfied when the debt it secures is paid or when the obligation it secures is fulfilled. A deed of trust is no longer a lien on the property if the debt or obligation it secures has been satisfied but it will remain a cloud on title until removed from the chain of title.

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower. In most cases, the trustee is an escrow If you don't repay your loan, the escrow company's attorney must begin the foreclosure process.

This is a standard form security trust deed. It creates a single security trust specifically for use in syndicated finance or other finance transactions where security is held on trust by a security trustee for the benefit of a group of secured finance parties (the beneficiaries).

Essentially, a deed of trust provides a lender with security for the repayment of the loan and effectively functions similarly to a mortgage. A deed of trust is a deed that transfers a legal interest in a piece of real property owned by the lendee to the lender, or trustee, in order to secure the debt owed on the loan.

What is a trust deed. A trust deed is a voluntary agreement between you and the people you owe money to (also called your creditors). You agree to pay a regular amount of money towards your debts and at the end of a fixed time the rest of your debts will be written off.