Minnesota Amendment to the articles of incorporation to eliminate par value

Description

How to fill out Amendment To The Articles Of Incorporation To Eliminate Par Value?

You are able to commit hrs on-line trying to find the legal document web template which fits the federal and state needs you need. US Legal Forms gives 1000s of legal types that happen to be examined by specialists. You can easily obtain or print out the Minnesota Amendment to the articles of incorporation to eliminate par value from the services.

If you already possess a US Legal Forms account, it is possible to log in and click the Acquire key. Afterward, it is possible to total, change, print out, or indicator the Minnesota Amendment to the articles of incorporation to eliminate par value. Each and every legal document web template you purchase is the one you have for a long time. To obtain yet another version for any obtained kind, visit the My Forms tab and click the corresponding key.

If you work with the US Legal Forms site the very first time, keep to the straightforward instructions under:

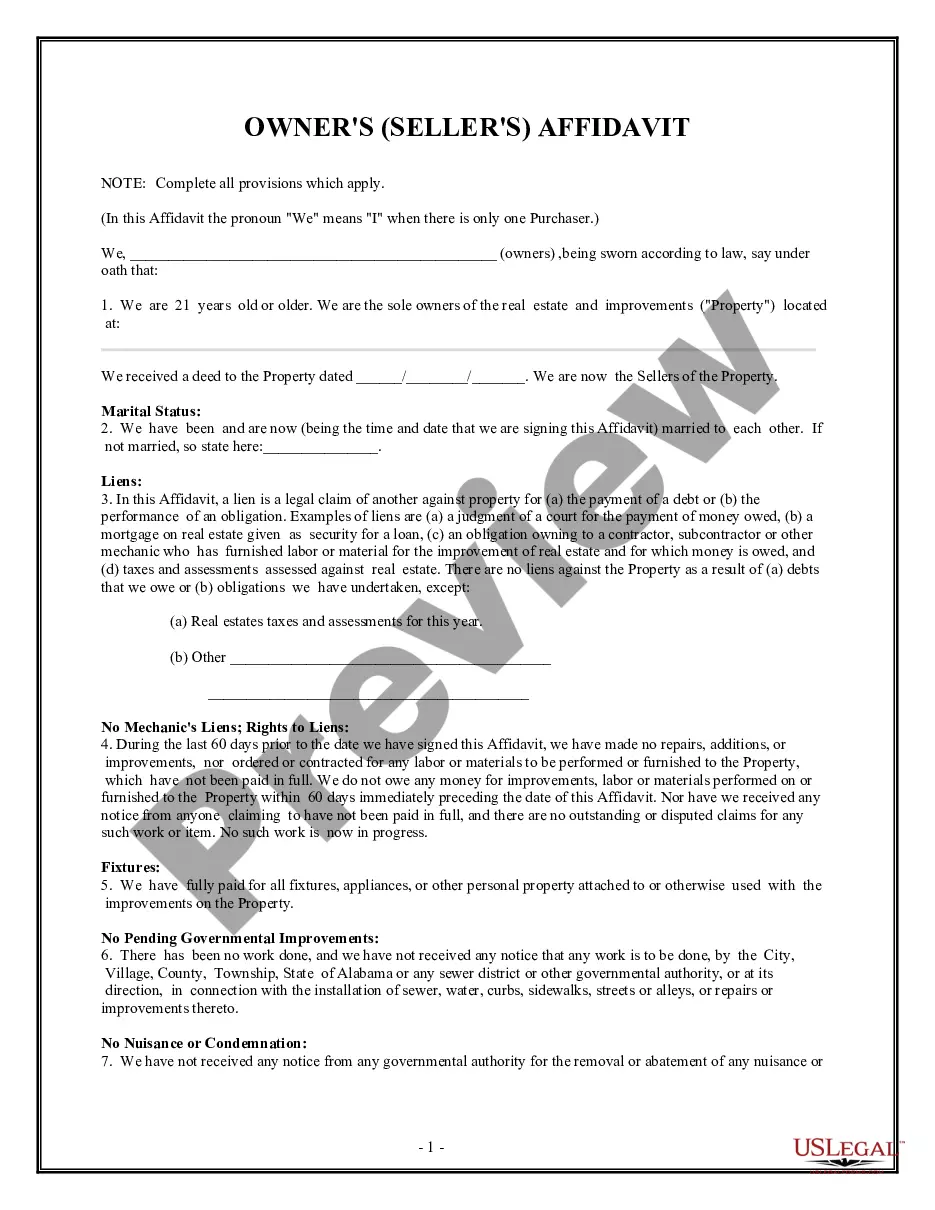

- Very first, make sure that you have chosen the right document web template for that county/metropolis of your liking. Browse the kind outline to ensure you have chosen the correct kind. If readily available, make use of the Review key to look through the document web template too.

- If you would like get yet another model of the kind, make use of the Research field to obtain the web template that meets your needs and needs.

- Once you have discovered the web template you want, click on Purchase now to move forward.

- Find the pricing strategy you want, key in your qualifications, and sign up for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal account to purchase the legal kind.

- Find the structure of the document and obtain it for your product.

- Make adjustments for your document if needed. You are able to total, change and indicator and print out Minnesota Amendment to the articles of incorporation to eliminate par value.

Acquire and print out 1000s of document web templates utilizing the US Legal Forms website, which provides the most important assortment of legal types. Use specialist and express-specific web templates to take on your small business or person requires.

Form popularity

FAQ

Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split). A stock split is exactly what it sounds like: a division of shares.

The Articles of Amendment, also sometimes called a Certificate of Amendment, is a document filed with your state of incorporation (or any states in which your company has foreign qualified to transact business), to enact a specific change to the information included in your company's incorporation or qualification ...

The process of amending a corporation's articles is typically done through a special resolution. This can be achieved by a resolution approved by no less than two-thirds of the votes cast at a meeting of shareholders, or by a written resolution signed by all eligible shareholders.

Typically, an amendment to the Articles of Incorporation must be confirmed by a greater majority (2/3 or 3/4 depending on the jurisdiction) of the votes cast by the shareholders at a special general meeting.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

Articles of Incorporation must be amended to alert the state to major changes. Changes that qualify for state notification include changes to: address. company name.

To file in person or by mail, submit the Amendment of Articles of Incorporation to the Minnesota SOS. The form you need to amend your articles of incorporation is in your online account when you sign up for registered agent service with Northwest. Keep the original copy and submit a legible photocopy to the SOS.

Generic Procedure Plan to Amend a Company's Articles Firstly, the directors must convene a board meeting and provide appropriate notice. The director must obtain a quorum to approve the proposal and submit a resolution to the shareholders to amend the company's articles.