Minnesota Stock Option and Stock Award Plan of American Stores Company

Description

How to fill out Stock Option And Stock Award Plan Of American Stores Company?

Are you inside a place that you need documents for either enterprise or personal purposes just about every working day? There are tons of authorized document templates available on the Internet, but discovering ones you can rely is not simple. US Legal Forms offers a huge number of kind templates, like the Minnesota Stock Option and Stock Award Plan of American Stores Company, which are published to fulfill state and federal requirements.

When you are currently knowledgeable about US Legal Forms site and also have a free account, simply log in. Following that, you can down load the Minnesota Stock Option and Stock Award Plan of American Stores Company template.

Unless you have an profile and wish to start using US Legal Forms, follow these steps:

- Obtain the kind you want and ensure it is for the correct metropolis/state.

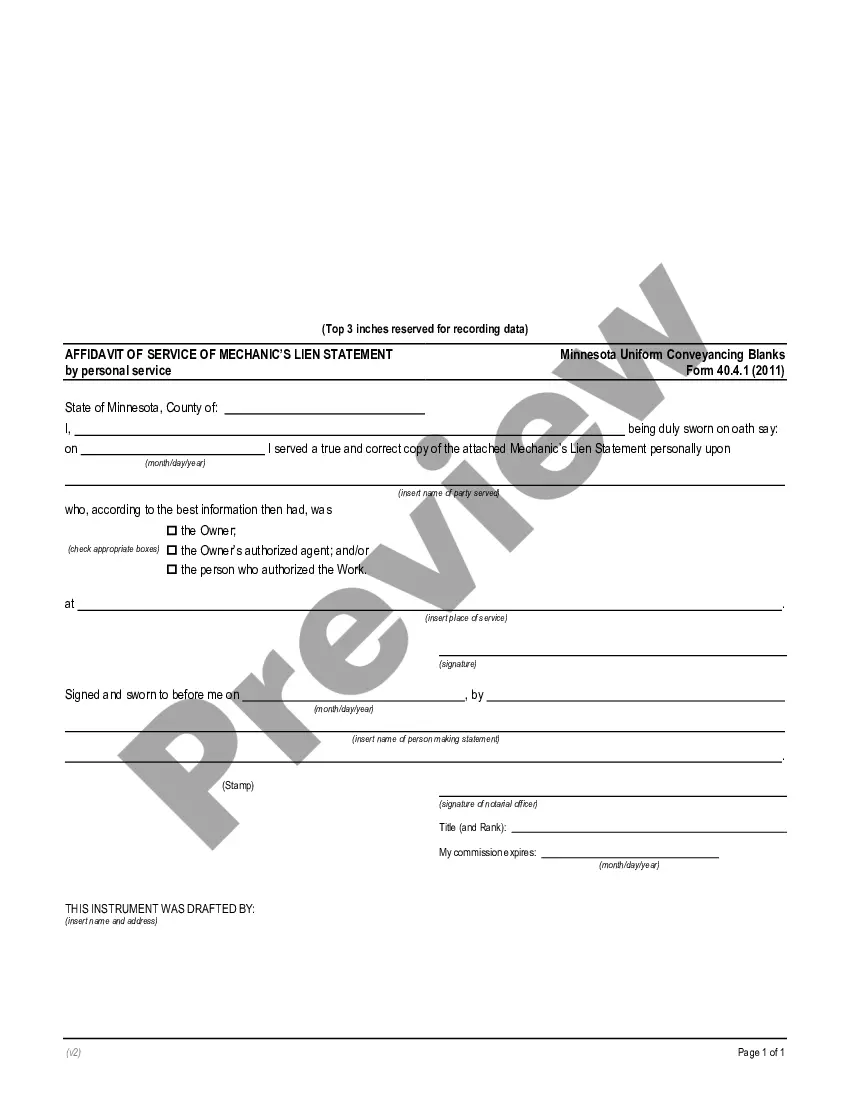

- Take advantage of the Review button to check the shape.

- Read the outline to ensure that you have chosen the right kind.

- When the kind is not what you are looking for, use the Look for discipline to obtain the kind that meets your needs and requirements.

- If you discover the correct kind, click Purchase now.

- Pick the pricing program you need, complete the desired info to make your account, and buy the order making use of your PayPal or credit card.

- Choose a convenient document format and down load your version.

Find every one of the document templates you have bought in the My Forms food list. You may get a more version of Minnesota Stock Option and Stock Award Plan of American Stores Company at any time, if required. Just go through the essential kind to down load or printing the document template.

Use US Legal Forms, the most comprehensive collection of authorized forms, in order to save time as well as steer clear of blunders. The support offers professionally produced authorized document templates that can be used for an array of purposes. Produce a free account on US Legal Forms and start producing your life easier.

Form popularity

FAQ

Stock awards provide corporations a way to pay their executives based on company performance so their compensation aligns with the expectations of the shareholders. Companies may also grant stock awards to lower-level employees to incentivize them to take ownership of the company's performance and retain their loyalty.

Stock options are a benefit often associated with startup companies, which may issue them in order to reward early employees when and if the company goes public. They are awarded by some fast-growing companies as an incentive for employees to work towards growing the value of the company's shares.

The bottom line on ESPPs If you can afford it, you should participate up to the full amount and then sell the shares as soon as you can. You might even consider prioritizing your ESPP over 401(k) contributions, depending on your specific financial situation, because your after-tax returns could be higher.

An employee stock purchase plan (ESPP) is a company-run program in which participating employees can purchase company stock directly, at a discounted price. Employees contribute to the plan through payroll deductions which build up between the offering date and the purchase date.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.