Minnesota Business Trust

Description

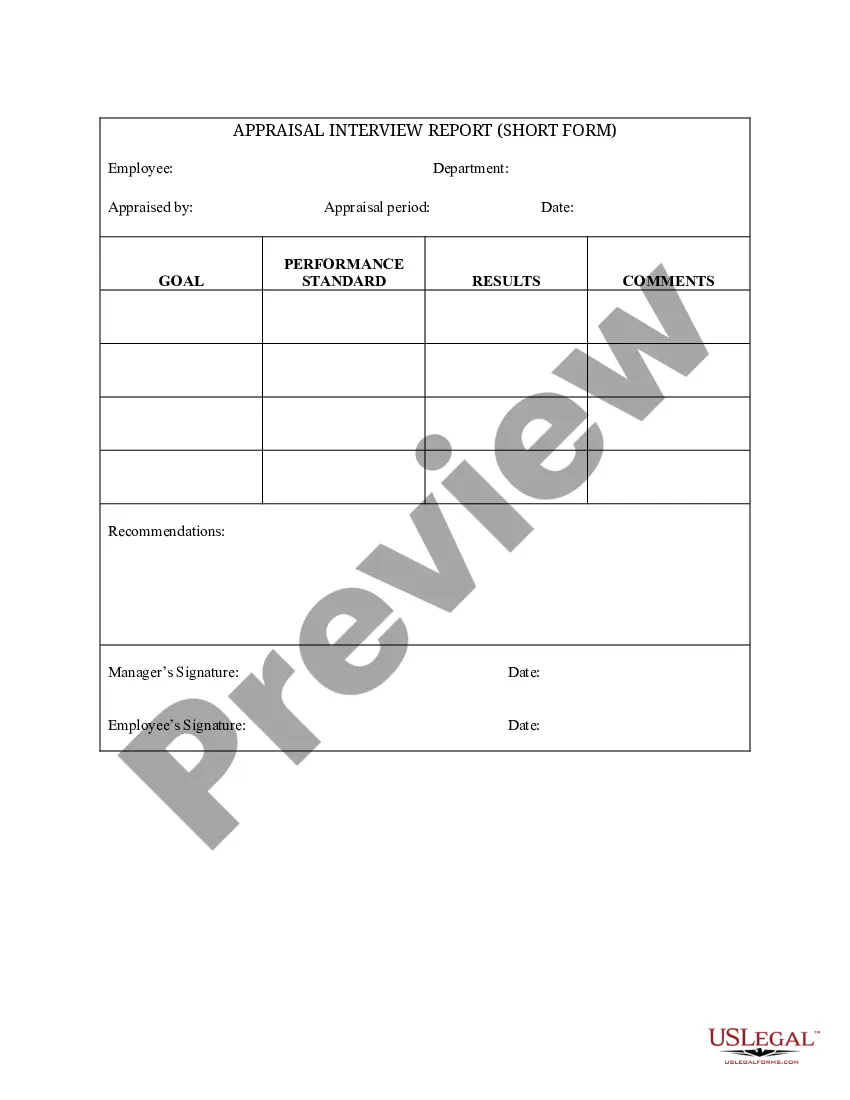

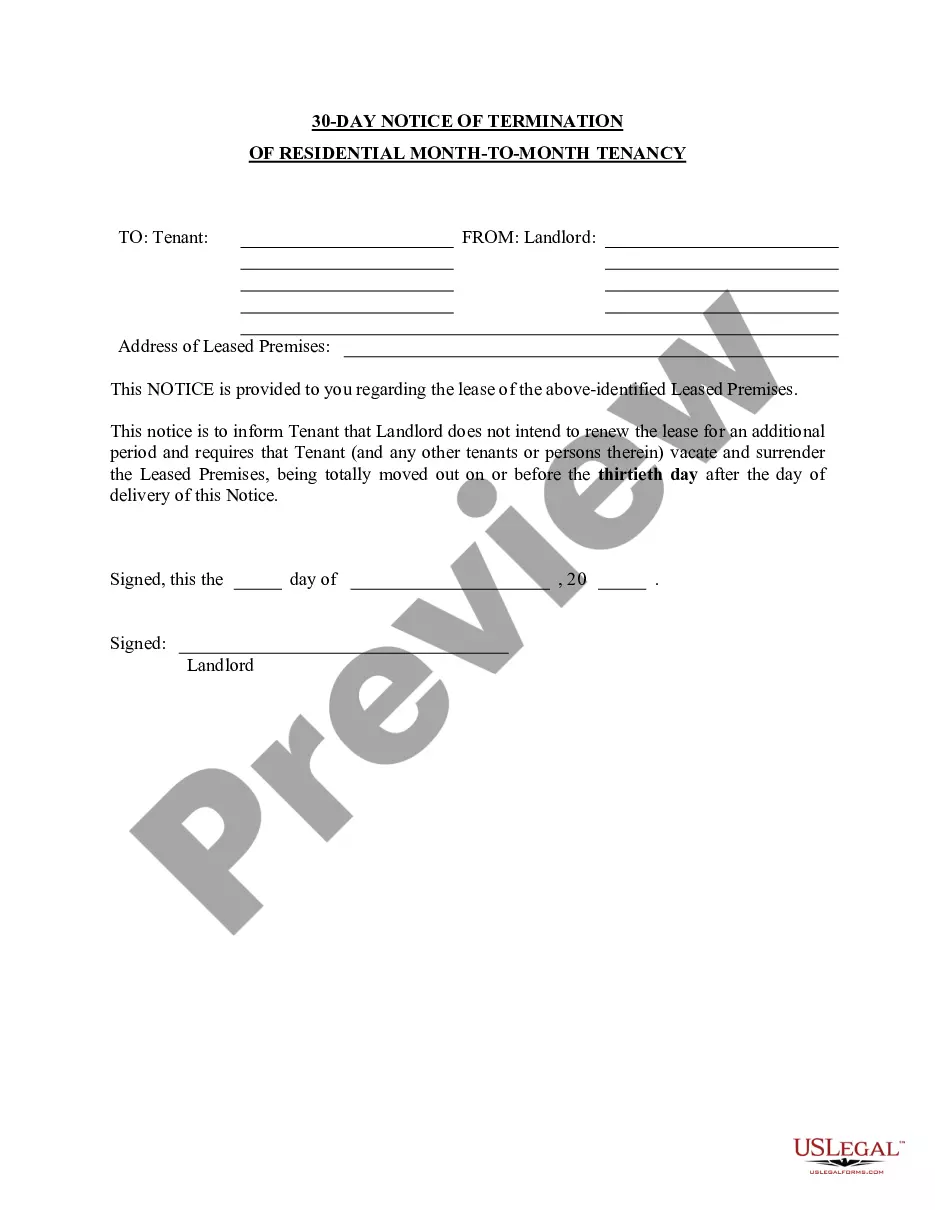

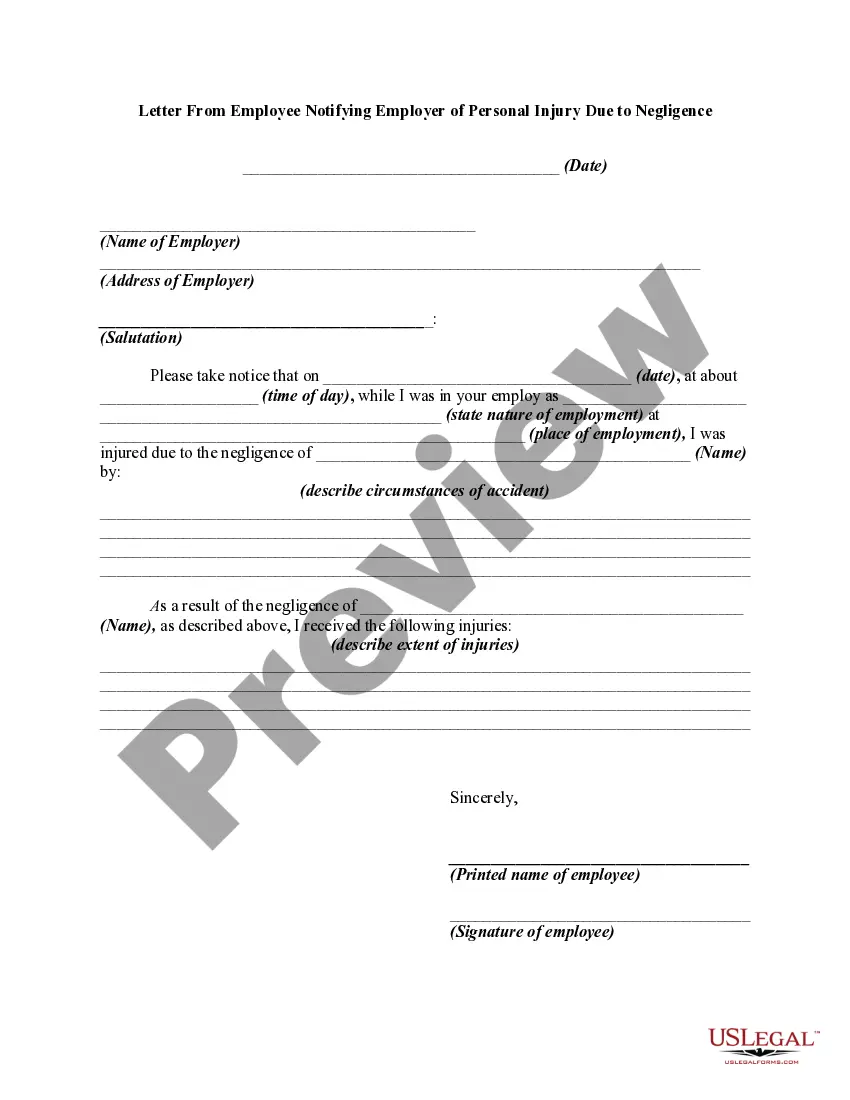

How to fill out Business Trust?

US Legal Forms - one of the most prominent repositories of legal documents in the USA - provides a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find updated versions of forms like the Minnesota Business Trust in just a few minutes.

If you have a monthly subscription, Log In to retrieve the Minnesota Business Trust from the US Legal Forms collection. The Download option will appear on every form you view. You can access all previously acquired forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to process the transaction.

Select the format and download the form to your device.

- Ensure you have selected the correct form for your locality/region.

- Click on the Preview option to review the content of the form.

- Check the form description to confirm you have selected the correct one.

- If the form does not suit your needs, use the Search section at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking on the Purchase now option.

- Next, choose the payment plan you prefer and provide your information to register for the account.

Form popularity

FAQ

Once you submit your application for your Minnesota Business Trust as an LLC, the processing time typically ranges from a few days to several weeks. Online submissions tend to be quicker, so it is advisable to register online if possible. This efficient process makes starting your business less stressful and helps you get to work sooner.

The irrevocable trust will automatically dissolve if its intent has been fulfilled. You might also contend that: The purpose of the trust has become illegal, impossible, wasteful or impractical to fulfill; Compliance with trust terms preclude accomplishing a material purpose of the trust; and.

Where modification or termination is by consent, the settlor (creator of the trust) may also initiate the petition. A proceeding under any of these provisions begins with a petition filed in probate court, asking the court to grant the modification or termination. The request is a formal court proceeding.

Description: Minnesota law requires charitable trusts and foundations, with gross assets of $25,000 or more at any time during a taxable year, to register with the Minnesota Attorney General's Office within three months of receiving the trust property.

The Uniform Trust Code (UTC) is a comprehensive codification of the common law on trusts.

As discussed above, irrevocable trusts are not completely irrevocable; they can be modified or dissolved, but the settlor may not do so unilaterally. The most common mechanisms for modifying or dissolving an irrevocable trust are modification by consent and judicial modification.

Minnesota's updates, initially drafted by the MSBA Probate and Trust Section and based on the Uniform Law published by the Uniform Law Commission, was signed by Governor Dayton in March 2015, and goes into effect for all trusts (whether established before or after) on January 1, 2016.

The states that have enacted a version of the Uniform Trust Code are Alabama, Arizona, Arkansas, Florida, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Hampshire, New Mexico, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania,

0605 of the Minnesota Statutes contains the new provisions relating to the time limit for contesting a revocable trust. The law sets the time limit for contesting the validity of a revocable trust at three years after the settlor's death.

Applications for use by a trust company or bank conducting trust services in Minnesota can be found below. Questions regarding the below applications can be directed to bank.applications.comm@state.mn.us.