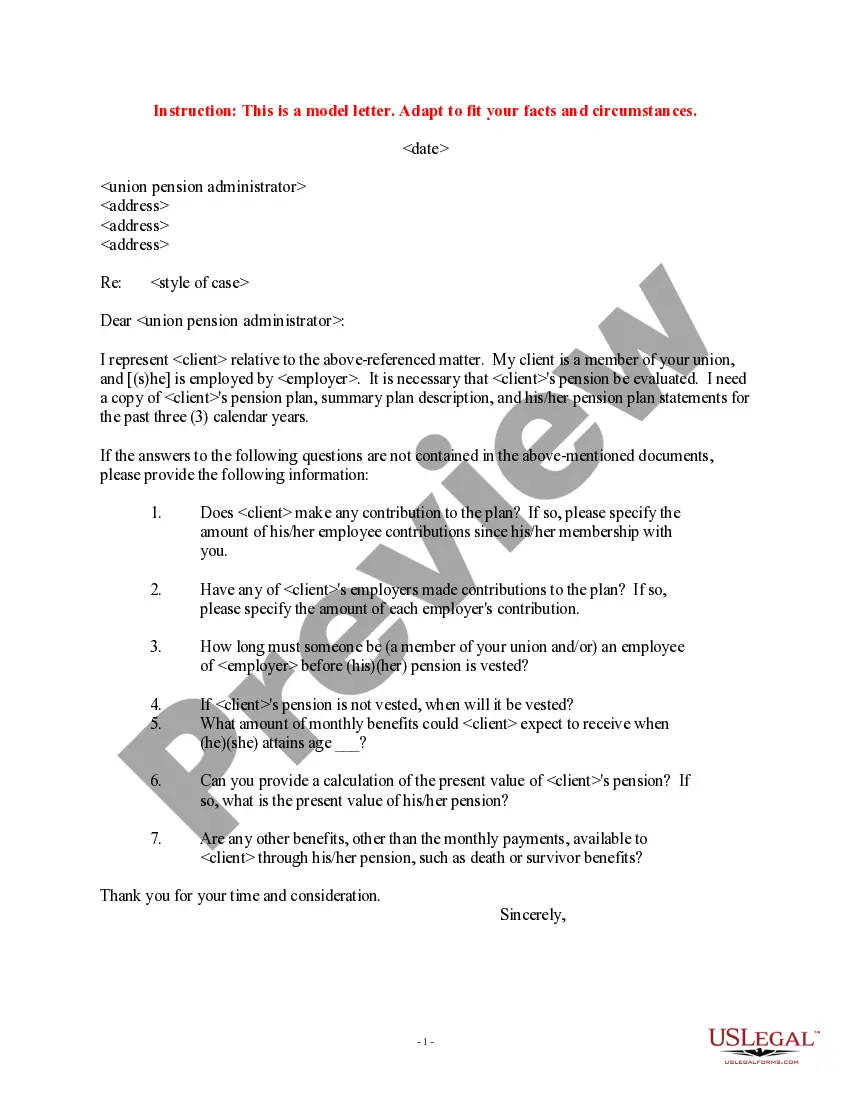

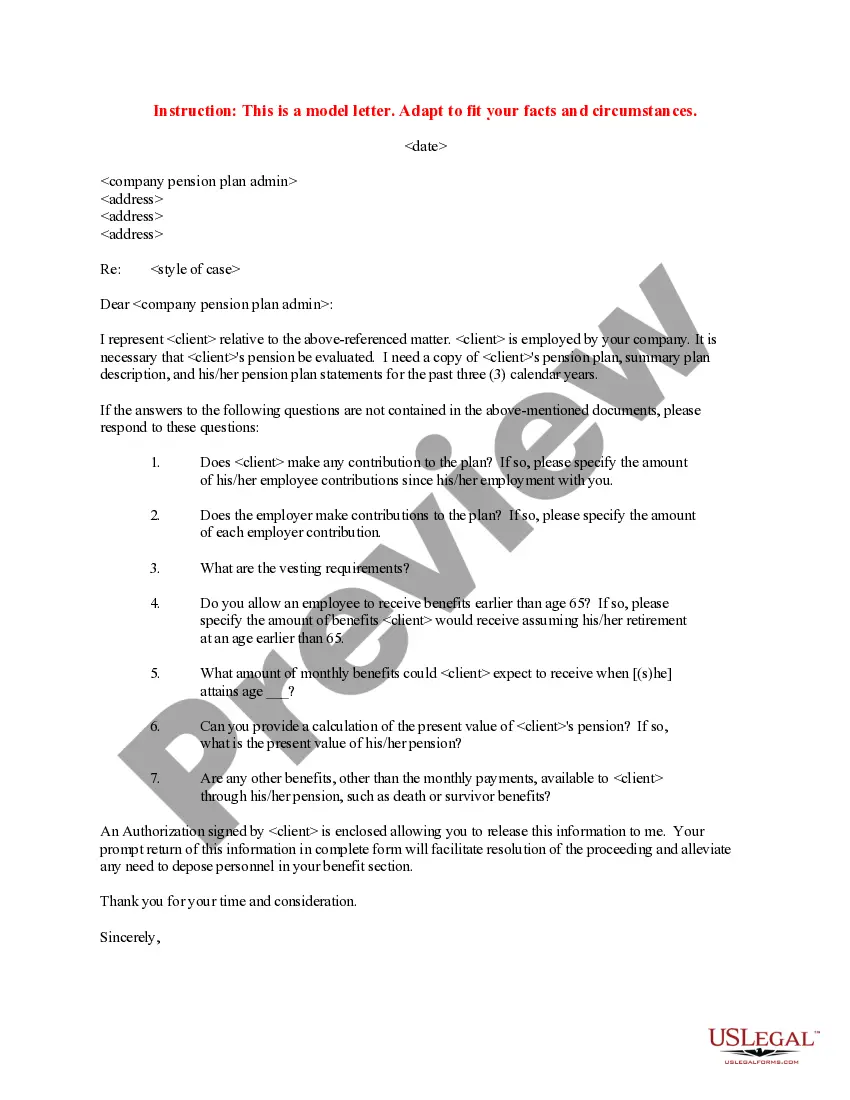

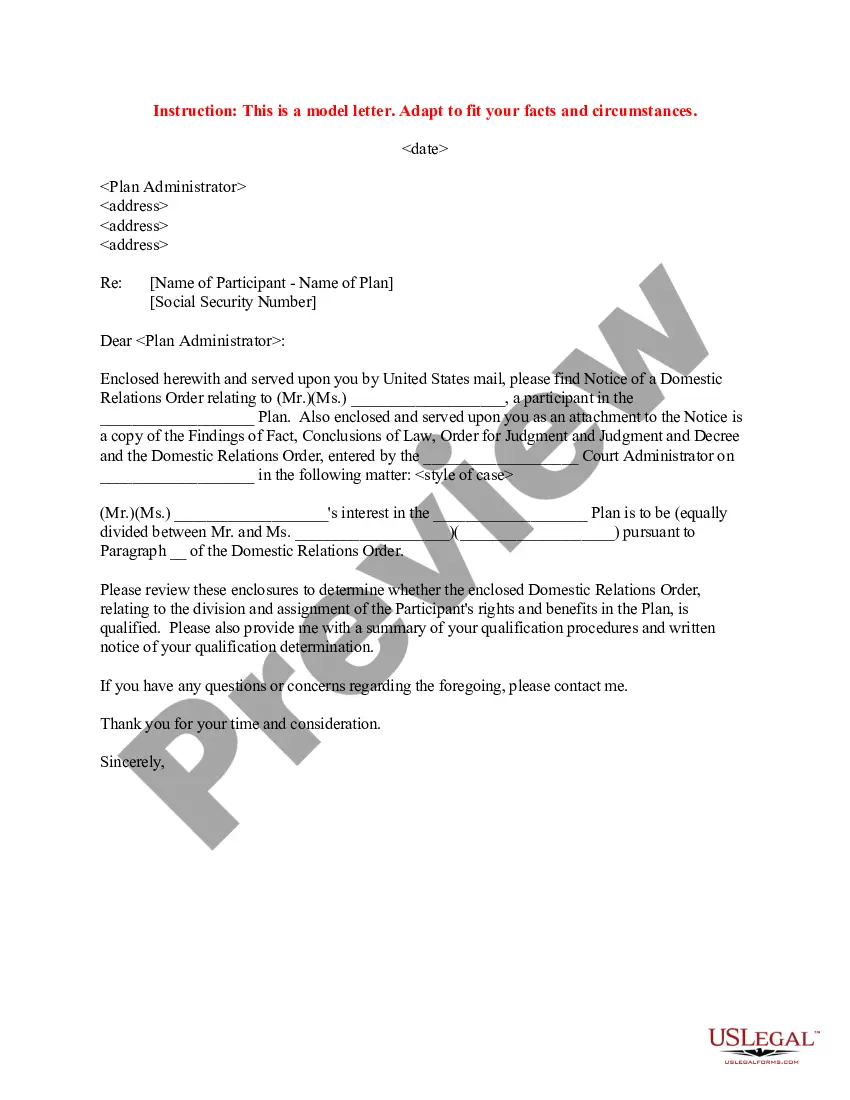

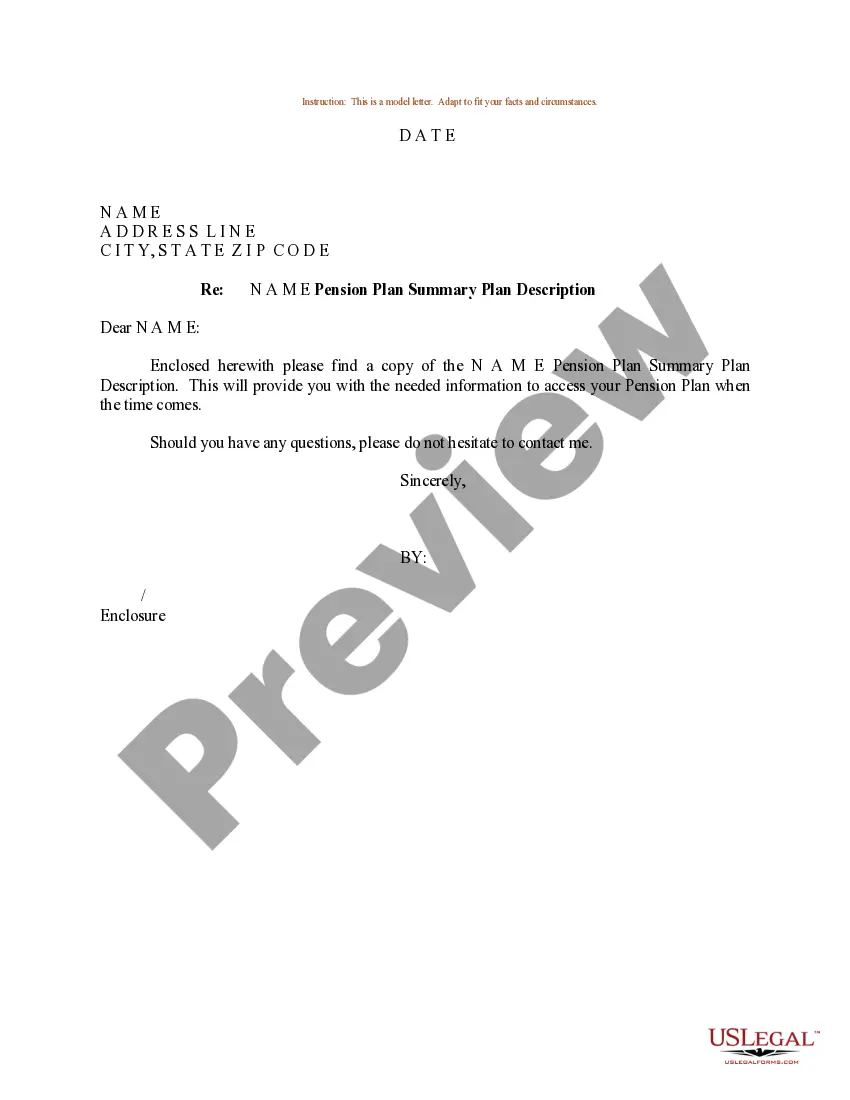

Minnesota Sample Letter for Pension Plan Summary Plan Description

Description

How to fill out Sample Letter For Pension Plan Summary Plan Description?

Discovering the right authorized document design could be a battle. Naturally, there are a variety of themes available on the Internet, but how would you find the authorized kind you will need? Utilize the US Legal Forms site. The service offers a huge number of themes, for example the Minnesota Sample Letter for Pension Plan Summary Plan Description, which can be used for organization and private needs. All of the varieties are examined by professionals and meet state and federal needs.

In case you are previously signed up, log in to your profile and click on the Download option to get the Minnesota Sample Letter for Pension Plan Summary Plan Description. Utilize your profile to check throughout the authorized varieties you possess purchased previously. Go to the My Forms tab of your profile and obtain an additional backup in the document you will need.

In case you are a whole new user of US Legal Forms, allow me to share straightforward recommendations that you should follow:

- Initial, make sure you have selected the right kind to your metropolis/region. It is possible to look over the shape making use of the Review option and browse the shape information to make sure it will be the best for you.

- In the event the kind does not meet your expectations, make use of the Seach industry to obtain the proper kind.

- Once you are certain that the shape would work, click the Buy now option to get the kind.

- Opt for the rates plan you would like and enter in the necessary info. Build your profile and pay money for the order utilizing your PayPal profile or charge card.

- Pick the file formatting and acquire the authorized document design to your gadget.

- Full, change and print out and indicator the acquired Minnesota Sample Letter for Pension Plan Summary Plan Description.

US Legal Forms is the most significant collection of authorized varieties where you can find a variety of document themes. Utilize the company to acquire skillfully-made files that follow state needs.

Form popularity

FAQ

The Summary Plan Description (SPD) is one of the important 401(k) plan documents that provides plan participants (and their beneficiaries) with the most important details of their benefit plan, like eligibility requirements or participation dates, benefit calculations, plan management instructions, and general member ...

A complete description of the Plan's investment options and their performance, as well as planning tools to help you choose an appropriate investment mix, are available online through Fidelity NetBenefits® at .netbenefits.com/novanthealth.

The summary plan description is an important document that tells participants what the plan provides and how it operates. It provides information on when an employee can begin to participate in the plan and how to file a claim for benefits.

The summary plan description (SPD) is simply a summary of the plan document required to be written in such a way that the participants of the benefits plan can easily understand it. Unlike the plan document, the SPD is required to be distributed to plan participants.

Eligible (vested) after three years of service. Full retirement benefit: Typically at age 66. Reduced retirement benefit: age 55 or later, assuming you have 3 years of service.

Summary Plan Description: A written document required to be distributed to plan participants regarding information about the benefits plan. This document covers items such as plan features and benefits, rules, and claims procedures (see above).

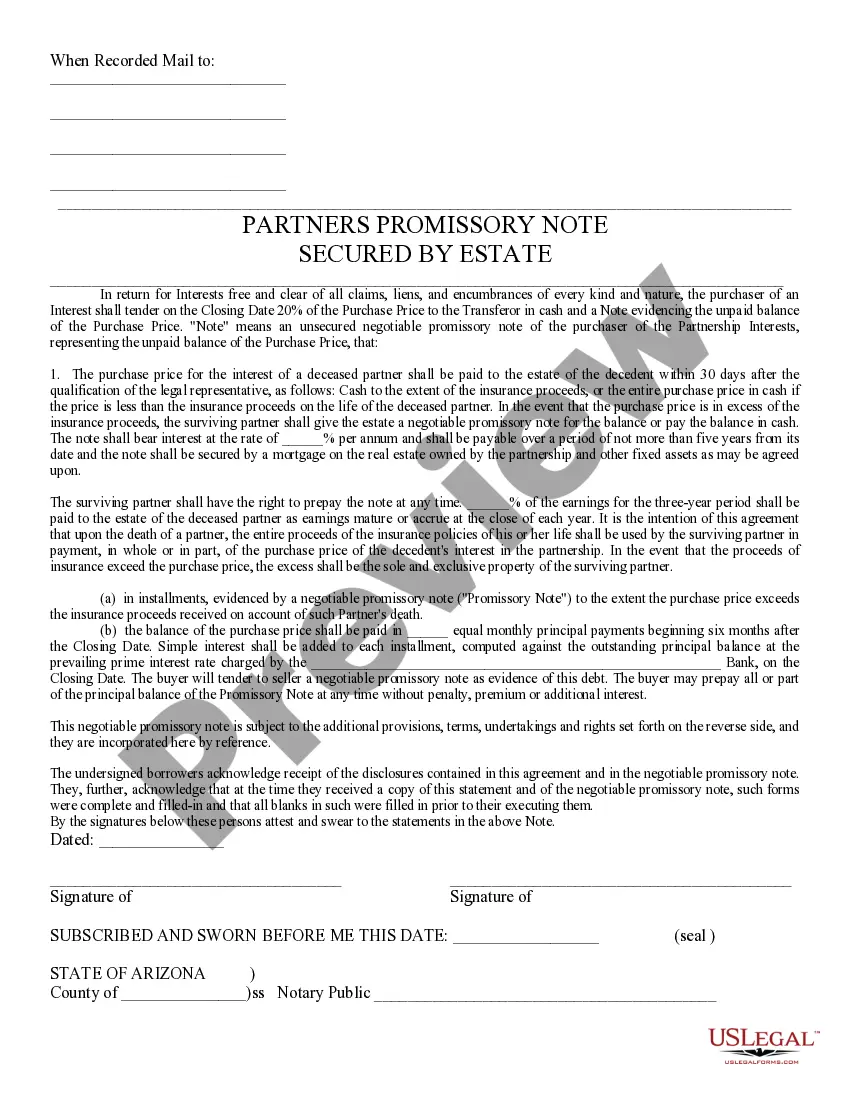

The Unclassified Retirement Plan is a defined contribution retirement plan. The plan is "tax-deferred," which means you don't pay taxes until the money is withdrawn. Retirement benefits are based on the value of your account when you retire and the age at which you start to collect your benefit.

A pension plan or fund is a defined benefit plan. This type of plan guarantees a set monthly payment or lump sum after retirement. It may also use a specific formula that includes how long you've worked at the job and your salary to determine your monthly payout. A defined benefit plan may be funded or unfunded.