Minnesota Release and Indemnification of Personal Representative by Heirs and Devisees

Description

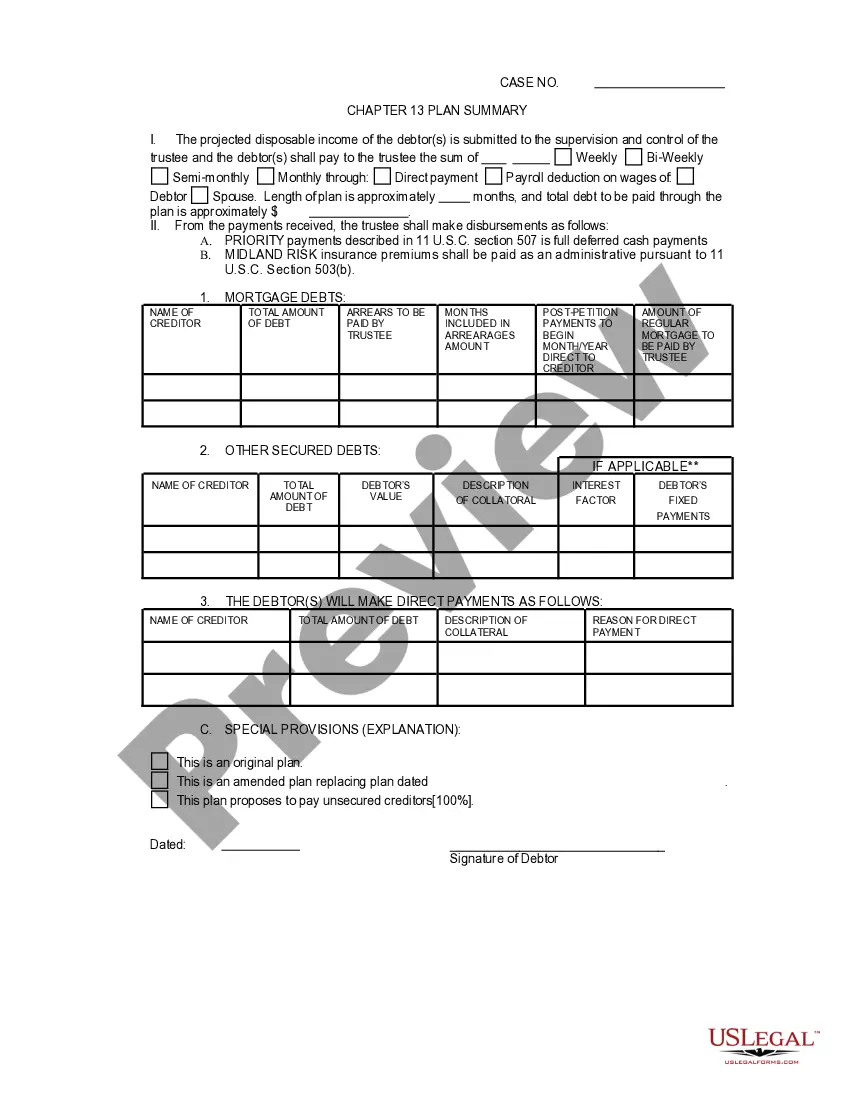

How to fill out Release And Indemnification Of Personal Representative By Heirs And Devisees?

You can spend countless hours online trying to locate the legal document template that meets the state and federal criteria you need.

US Legal Forms provides thousands of legal documents that are reviewed by experts.

It is easy to obtain or print the Minnesota Release and Indemnification of Personal Representative by Heirs and Devisees from the platform.

If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Minnesota Release and Indemnification of Personal Representative by Heirs and Devisees.

- Every legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, go to the My documents tab and click the respective button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the county/town of your choice.

- Review the form details to ensure you have selected the right document.

Form popularity

FAQ

The personal representative is personally responsible for probating the estate completely and correctly according to Minnesota law. Most estates are expected to be completed within an 18 month period. If more time is needed, the personal representative must petition the court for an extension.

Minnesota has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

Requirements of small estate exemption in Minnesota First, the total value of the estate must be less than $75,000. That number is calculated by taking all the money, assets and real estate the decedent owned, minus debts, such as medical bills and mortgages on a house.

If your personal property exceeds $75,000 or you own real estate in your name alone, your estate must be probated.

How Long Do You Have to File Probate After a Death in Minnesota? Minnesota Probate Code requires that probate be opened on an estate within three years of the person's death.

How to File (3 Steps)Step 1 Wait Thirty (30) Days.Step 2 Complete Documents.Step 3 File With the Holder of Property.

The answer is yes, it's perfectly normal (and perfectly legal) to name the same person as an executor and a beneficiary in your will.

The personal representative is personally responsible for probating the estate completely and correctly according to Minnesota law. Most estates are expected to be completed within an 18 month period. If more time is needed, the personal representative must petition the court for an extension.

How to Write(1) Name Of Minnesota Deceased.(2) County Of Minnesota Deceased.(3) Name of Minnesota Petitioner.(4) Address Of Minnesota Petition.(5) Date Of Minnesota Decedent Death.(6) Basis For Minnesota Petitioner Claim.(7) Minnesota Decedent Estate Assets.(8) Signature Date Of Minnesota Petitioner.More items...?