Minnesota Assignment and Transfer of Stock

Description

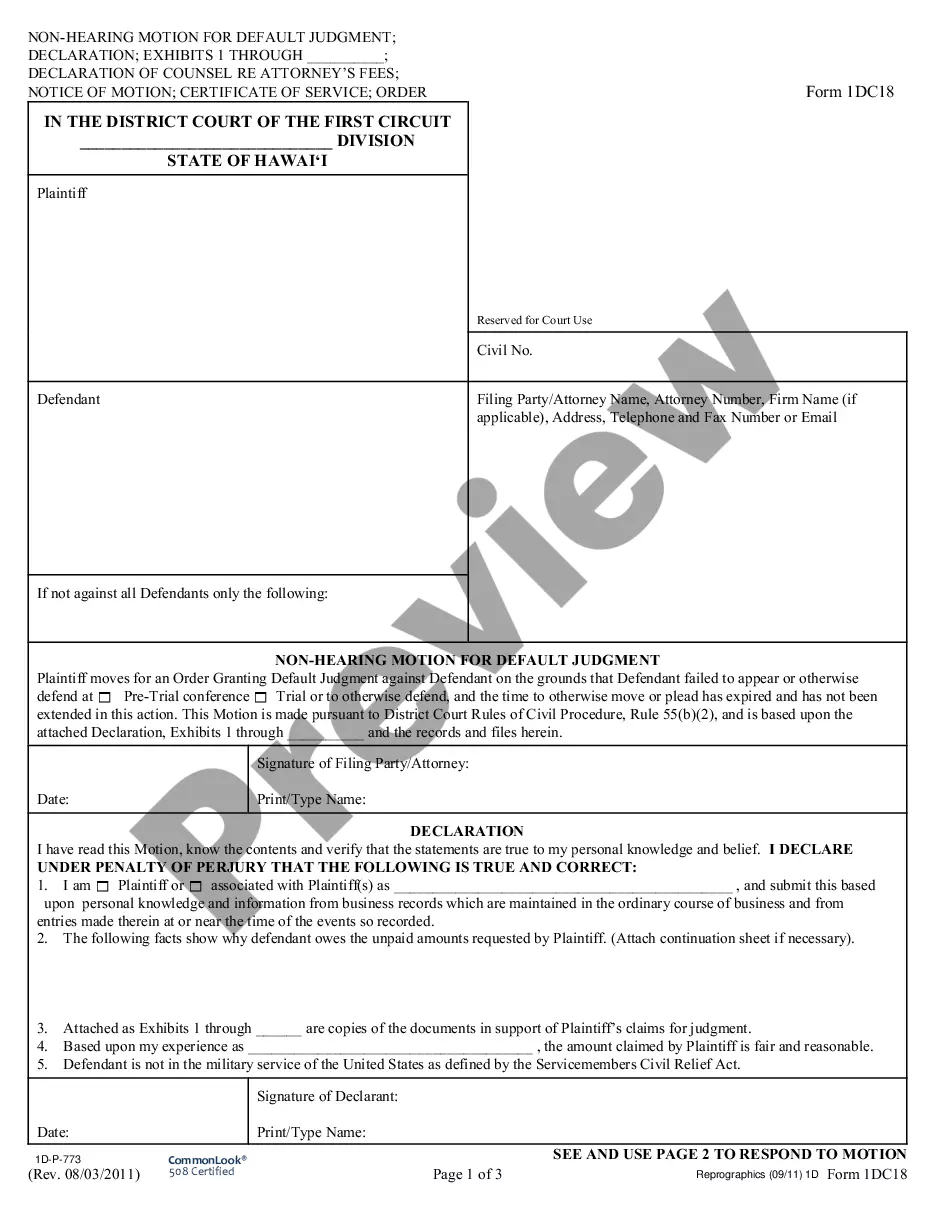

How to fill out Assignment And Transfer Of Stock?

Are you currently in a situation where you require documents for either business or personal matters every day.

There are many legal document templates available online, but finding reliable ones is not easy.

US Legal Forms provides a vast array of form templates, such as the Minnesota Assignment and Transfer of Stock, designed to meet federal and state requirements.

Once you have the correct form, click Purchase now.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Minnesota Assignment and Transfer of Stock template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific region/area.

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the one that meets your requirements.

Form popularity

FAQ

Yes, an assignment is indeed a transfer of ownership, particularly in the context of shares. It legally grants the rights of the stock from one owner to another. When you consider the Minnesota Assignment and Transfer of Stock, understanding this relationship is crucial for accurate documentation. Using a platform like USLegalForms can provide clarity and assistance in formatting these essential legal documents.

To fill out a stock transfer form, you will need to provide information about both the current owner and the new owner of the shares. Specify the number of shares being transferred and any necessary details about the company issuing the stock. Utilizing resources like USLegalForms can simplify this process and ensure your Minnesota Assignment and Transfer of Stock is compliant with regulations.

While both terms involve changing ownership, assignment typically refers to the transfer of rights or interests in shares, while transfer specifically denotes the shift of ownership. In the context of the Minnesota Assignment and Transfer of Stock, you may use these terms interchangeably, but it's important to grasp their nuances when completing legal documents.

A transfer involves moving ownership from one person to another, establishing a new owner for specific shares. On the other hand, reassignment generally refers to switching rights or ownership back to a previous owner or to a different party, with conditions that may vary. Understanding these distinctions is vital when dealing with the Minnesota Assignment and Transfer of Stock to ensure compliance.

The assignment of shares refers to the act of transferring ownership rights from one party to another. In the context of the Minnesota Assignment and Transfer of Stock, this means the original shareholder assigns their shares to a new shareholder. It is an essential process that ensures proper documentation and legal acknowledgment of share ownership changes.

Filling out a stock power form involves providing essential details about the shares being transferred. Start by entering the name of the current owner and the number of shares being transferred. Then, include the name of the new owner and their address to complete the Minnesota Assignment and Transfer of Stock. Platforms like USLegalForms provide user-friendly templates to assist you with this process.

To transfer stock in Minnesota, you typically use a stock transfer form or a stock power. These documents facilitate the legal transfer of ownership from one shareholder to another. You can create these forms easily using platforms like USLegalForms, which offer templates designed for the Minnesota Assignment and Transfer of Stock. Ensuring you have the correct paperwork is crucial for a smooth transition.

An assignment for the benefit of creditors under Minnesota statute 577 outlines the legal procedures and protections available when a debtor assigns their property to a trustee. This statute ensures that the process is transparent and fair for all parties involved. Utilizing this legal framework can be beneficial for those navigating Minnesota Assignment and Transfer of Stock.

The key difference between assignment and transfer of shares lies in the nature of ownership change. Assignment typically refers to the legal rights associated with ownership, while transfer involves the physical change in ownership of the shares themselves. Understanding these distinctions is important in the realm of Minnesota Assignment and Transfer of Stock.

To transfer a company's stock, one must typically complete a stock transfer form which includes details about the seller, buyer, and shares involved. It's crucial to follow the procedures outlined in the company's bylaws and state laws to ensure compliance. In Minnesota, understanding the nuances of stock transfer is essential for a smooth transition.