Minnesota Franchise Feasibility Test

Description

How to fill out Franchise Feasibility Test?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can quickly find the latest versions of forms such as the Minnesota Franchise Feasibility Test.

If you are a member, Log In and retrieve the Minnesota Franchise Feasibility Test from the US Legal Forms library. The Download button will appear on every form you view. You can find all your previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Edit it as needed. Fill out, modify, and print or sign the downloaded Minnesota Franchise Feasibility Test.

Each template saved in your account does not have an expiration date and is yours permanently. So, if you want to download or print another copy, just go to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/state.

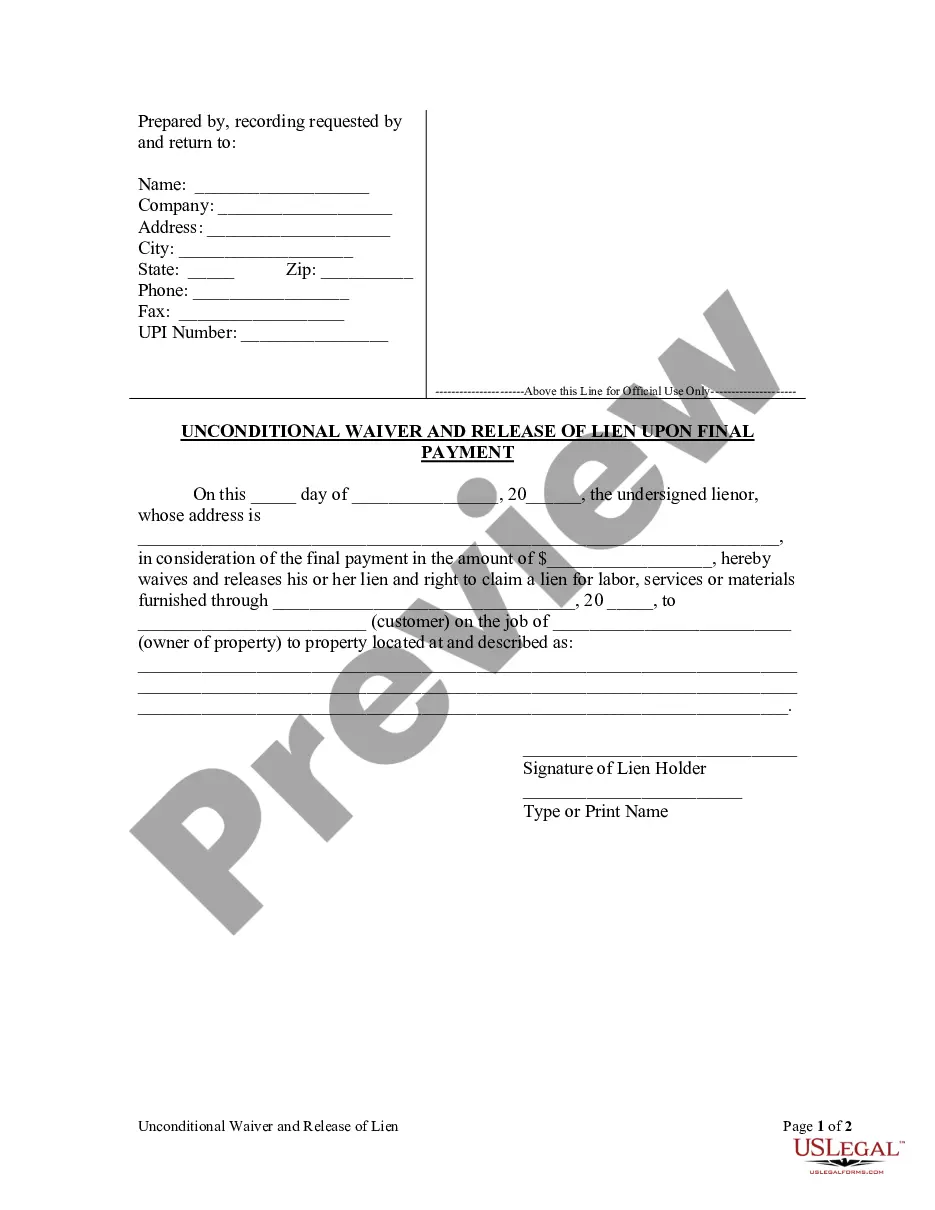

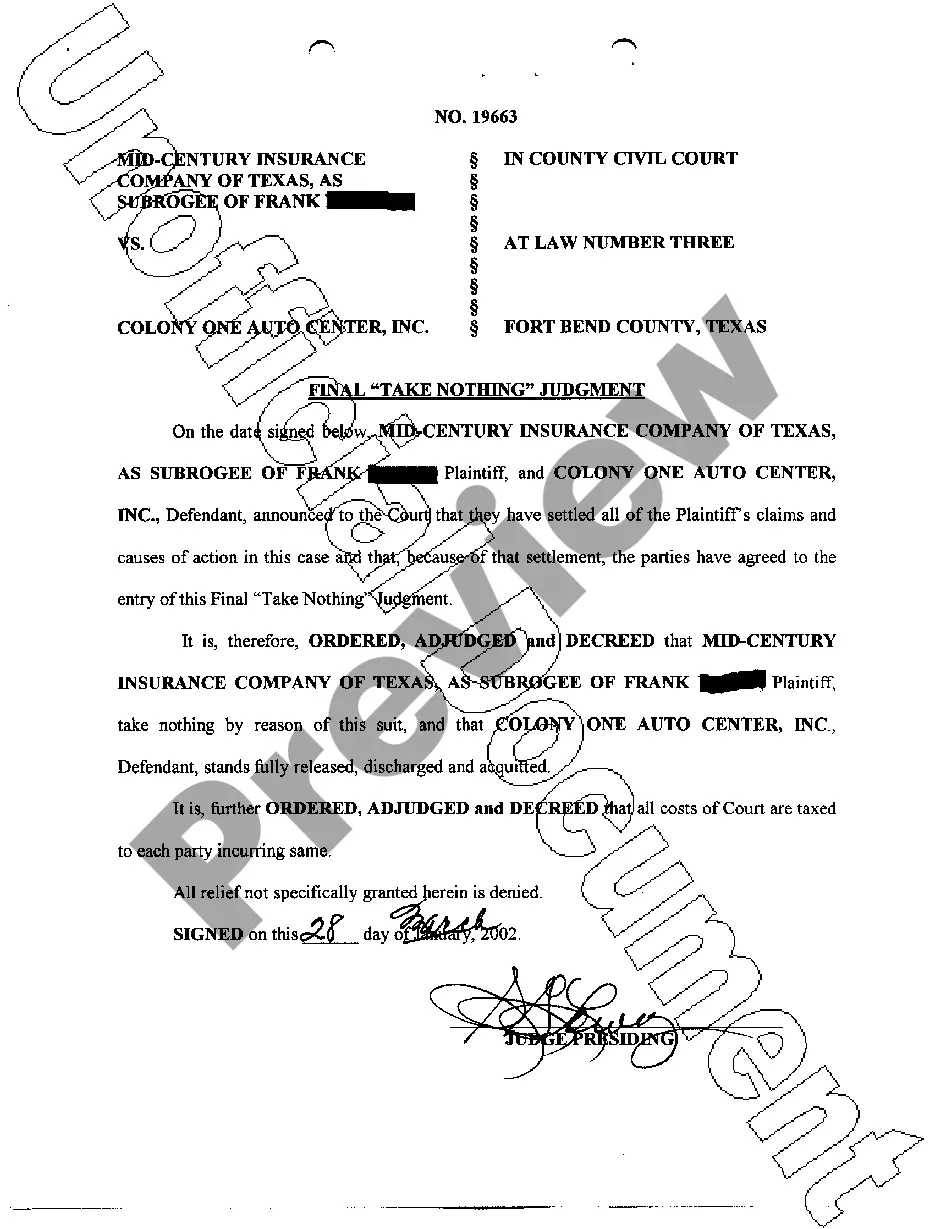

- Click the Preview option to review the form’s content.

- Check the form description to make sure you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

Yes, Minnesota is a franchise registration state, meaning that businesses must register their franchises before offering them in the state. This requirement is crucial for compliance with state laws and the success of your franchise operations. The Minnesota Franchise Feasibility Test can help assess the viability of registering your franchise in the state. Use platforms like uslegalforms to streamline the registration process and ensure adherence to legal requirements.

In Minnesota, gross income is evaluated to determine if it meets the state's minimum filing requirement for taxes. If your business generates enough income, you must file the appropriate tax forms, which is essential to fulfilling the Minnesota Franchise Feasibility Test. Ensuring your income aligns with these requirements is crucial for compliance. Resources from uslegalforms can help you navigate these filing processes with ease.

Minnesota's nexus rules specify that a business may have nexus if it has a physical presence, employees, or significant sales in the state. Additionally, these rules can change based on legislative updates and court rulings. Understanding these conditions is crucial for passing the Minnesota Franchise Feasibility Test. Tools from providers like uslegalforms can help clarify your status and obligations under these rules.

Several factors can trigger nexus in Minnesota, such as having a storefront, employees working in the state, or conducting significant sales. Each of these triggers creates a connection that obliges your business to comply with state tax laws. To successfully navigate the Minnesota Franchise Feasibility Test, you need to understand these triggers. This awareness allows you to manage your business operations while ensuring compliance.

Nexus rules in Minnesota involve several factors, including physical presence, employee presence, and sales activities. If your business engages in these activities within the state, you may meet the nexus criteria, leading to tax obligations. Evaluating these rules is necessary for a comprehensive Minnesota Franchise Feasibility Test. By staying compliant with nexus rules, you can reduce the risk of unexpected financial liabilities.

If your business is registered as a corporation in Minnesota, you might be liable for the Minnesota Corporation franchise tax. This tax applies to corporations based on their income and may depend on whether your business has established nexus in the state. Understanding your obligations under this tax is crucial for a successful Minnesota Franchise Feasibility Test. Use platforms like uslegalforms to stay informed about your tax responsibilities.

The 183 day rule in Minnesota determines tax residency based on the amount of time an individual spends in the state. If you reside in Minnesota for 183 days or more during the year, you are considered a resident for tax purposes. This rule influences how you may need to meet the Minnesota Franchise Feasibility Test when determining if your business requires specific filings. Understanding this rule helps you avoid unexpected tax obligations.

While specific credit score requirements can differ among franchises, a score of 680 or higher is generally preferred. A solid credit score demonstrates financial responsibility and can improve your chances of obtaining financing. As part of your Minnesota Franchise Feasibility Test, review your credit situation early, allowing you time to address any issues before applying.

Getting approved for a franchise can be competitive, depending on the brand and your background. Franchisors typically look for candidates with financial stability and business acumen. A comprehensive Minnesota Franchise Feasibility Test allows you to evaluate your strengths and weaknesses, enhancing your chances of securing approval.

Becoming a franchisee can be straightforward, but it often requires diligence and commitment. The process involves understanding the franchise model, securing financing, and completing legal requirements. By performing a Minnesota Franchise Feasibility Test, you can clarify the steps ahead, making the journey to franchise ownership less challenging.