Minnesota Assignment of Debt

Description

How to fill out Assignment Of Debt?

Selecting the appropriate legal document template can be challenging.

Of course, there is an array of templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website.

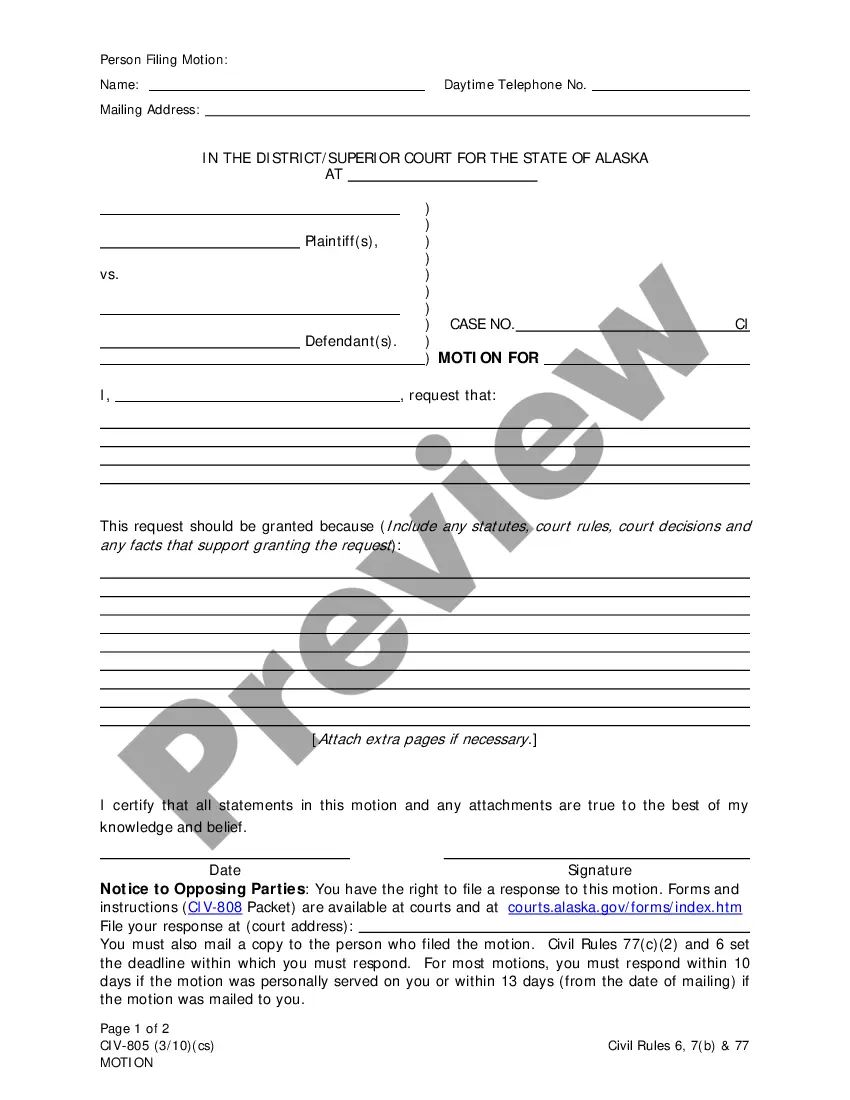

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and read the form description to make sure it is right for you.

- This service offers thousands of templates, including the Minnesota Assignment of Debt, suitable for both business and personal purposes.

- All forms are reviewed by experts and comply with federal and state requirements.

- If you are already registered, sign in to your account and click the Download button to obtain the Minnesota Assignment of Debt.

- Use your account to inquire about the legal forms you have previously acquired.

- Navigate to the My documents section of your account to download another copy of the document you need.

Form popularity

FAQ

In Minnesota, debt collectors typically have six years from the date of the last payment or written acknowledgment to initiate a lawsuit for collecting a debt. This aligns with the statute of limitations for most debts. Being aware of these timelines can help you take appropriate actions, and the Minnesota Assignment of Debt offers a potential avenue to settle debts without facing further legal action.

Unlike bankruptcy proceedings, there is no automatic stay in an assignment for the benefit of creditors in Minnesota. This means that creditors may continue to pursue collections unless a court orders otherwise. Engaging with a knowledgeable legal platform like UsLegalForms can help you navigate these complexities and ensure you're protected during the process.

Minnesota statute 577 outlines the legal procedures and requirements for assigning debts for the benefit of creditors. This statute provides a structured framework that debtors and creditors must follow, ensuring transparency and fairness in the process. Understanding this statute is essential for anyone involved in the Minnesota Assignment of Debt, as it dictates the rights and responsibilities of all parties.

In Minnesota, the statute of limitations typically allows creditors six years to collect a debt. After this period elapses, the debt may become uncollectible, meaning creditors cannot pursue legal action. Staying informed about these timelines is critical for both debtors and creditors; thus, the Minnesota Assignment of Debt can offer a pathway for resolution before this point.

Inside the legal framework, an assignment for the benefit of creditors is a process whereby a debtor transfers their non-exempt assets to a designated assignee. This assignee is tasked with liquidating those assets to repay creditors. In Minnesota Assignment of Debt, this process serves as an alternative to bankruptcy and allows for a structured resolution of debts.

In Minnesota, creditors typically have up to one year from the date of a debtor's death to collect debts from the estate. However, this timeline can depend on whether the estate has undergone probate. For effective management of these timelines and to ensure that all creditors are treated fairly, utilizing resources like UsLegalForms can be beneficial.

Assignment of debt consideration refers to the evaluation of the debtor's assets and liabilities during the assignment for the benefit of creditors. In the context of Minnesota Assignment of Debt, this consideration helps in determining how much can be allocated to creditors based on the available assets. Understanding this process can lead to more informed decisions regarding debt management and creditor expectations.

The primary disadvantages of assignment for the benefit of creditors include limited control over the process and potential impacts on credit ratings. In Minnesota, creditors may not receive full repayment as the assets are divided among all claimants. Additionally, individuals might face social stigma due to the public nature of the assignment, making it essential to weigh these factors carefully before proceeding.

A proof of claim form for assignment for the benefit of creditors is a legal document that creditors submit to establish their right to receive payment from the debtor's estate. In Minnesota, this form plays a crucial role in the Minnesota Assignment of Debt process, ensuring that all claims against the debtor are officially recognized. By filing this form, creditors can detail the amount owed and the basis of the debt, facilitating a fair distribution of the debtor’s available assets.

An assignment indeed needs to be in writing in Minnesota to be recognized legally. This written format ensures that the terms are documented and can be referenced if needed. Clarity in writing not only protects the parties involved but also facilitates the process of debt resolution. By familiarizing yourself with the Minnesota Assignment of Debt, you will navigate this requirement with ease.