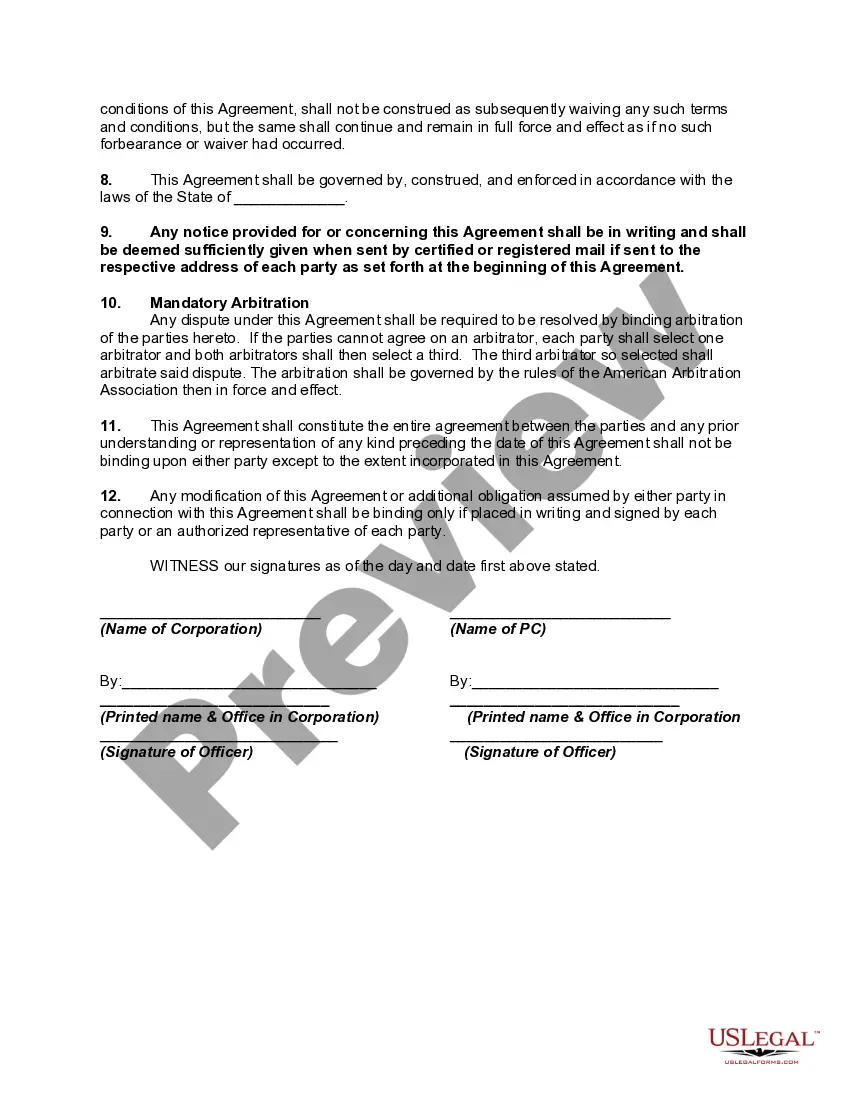

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare

Description

How to fill out Agreement Between Professional Corporation And Non-Profit Corporation To Treat People Who Cannot Afford Healthcare?

It is feasible to spend time online looking for the legal document template that aligns with the state and federal criteria you require.

US Legal Forms provides an extensive collection of legal forms that can be examined by professionals.

You can download or print the Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals who are unable to Afford Healthcare from the service.

If available, utilize the Review button to look through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals who are unable to Afford Healthcare.

- Every legal document template you obtain is yours indefinitely.

- To acquire an additional copy of a purchased form, go to the My documents tab and click on the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, make sure that you have selected the correct document template for your area/city of choice.

- Review the form description to ensure you have chosen the appropriate form.

Form popularity

FAQ

Non-profit organizations are held accountable by a combination of regulatory agencies, stakeholders, and the public. These entities ensure that non-profits operate transparently and effectively fulfill their missions. In particular, the Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare emphasizes the importance of accountability in healthcare services. By adhering to these regulations and maintaining open communication with the community, non-profits can build trust and sustain support.

The 33% rule for nonprofits refers to a guideline stating that a non-profit should ideally use at least 33% of its resources toward program services. This rule aims to ensure that a significant portion of donations supports the mission instead of administrative costs. Non-profits, especially those involved in healthcare like those engaged in the Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, must manage their funds wisely to meet this standard. By adhering to this guideline, organizations can enhance their credibility and funding opportunities.

Non-profit organizations are regulated by state and federal laws to ensure compliance with tax-exempt statuses and governance standards. Each state has its own requirements, including the Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, which governs certain operations specific to healthcare non-profits. Regulatory agencies monitor these organizations to maintain transparency and accountability. Understanding the regulatory framework helps non-profits operate effectively and serve their communities.

The complaint form for a non-profit organization is a document individuals can use to report issues within a non-profit. This form is essential for resolving disputes and ensuring accountability. You can often find specific complaint forms on the non-profit's website or through state regulatory agencies. If you are dealing with a non-profit related to the Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, it's crucial to follow the prescribed process for your complaint.

Yes, you can start a 501(c)(3) organization by yourself, but it's essential to understand the legal requirements thoroughly. This includes drafting bylaws, filing Articles of Incorporation, and applying for IRS tax-exempt status, which relates to the Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare. Many solo founders benefit from utilizing platforms like uslegalforms to streamline the filing process and ensure compliance with state and federal regulations.

In Minnesota, nonprofits must file Articles of Incorporation with the Secretary of State. This document outlines the organization’s purpose, including activities related to the Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare. Additionally, nonprofits may need to apply for tax-exempt status with the IRS and comply with state-specific reporting requirements to maintain their nonprofit status.

Many hospitals in Minnesota operate as non-profit organizations, focusing on providing care rather than generating profit. These non-profit hospitals often play a crucial role in implementing the Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare. By doing so, they ensure that essential healthcare services remain accessible to individuals facing financial barriers.

The Minnesota Attorney General plays a vital role in protecting consumer interests and ensuring that healthcare providers comply with relevant laws and regulations. This office oversees the enforcement of the Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, promoting fair practices in the healthcare sector. Their commitment helps maintain access to necessary services for those who need them most.

The new debt law in Minnesota addresses various financial obligations and provides protections for individuals facing financial hardships. This law may impact how non-profit health facilities manage debts, particularly in relation to the treatment of patients who cannot afford healthcare. Understanding the implications of the Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare in light of this law is essential for both healthcare entities and patients alike.

The Minnesota Attorney General Hospital agreement is a crucial framework designed to ensure that professional corporations and non-profit corporations collaborate effectively to provide healthcare services. This agreement establishes clear guidelines for the treatment of individuals who cannot afford healthcare. By fostering partnerships in the medical field, the Minnesota Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare aims to enhance access to necessary health services for vulnerable populations.