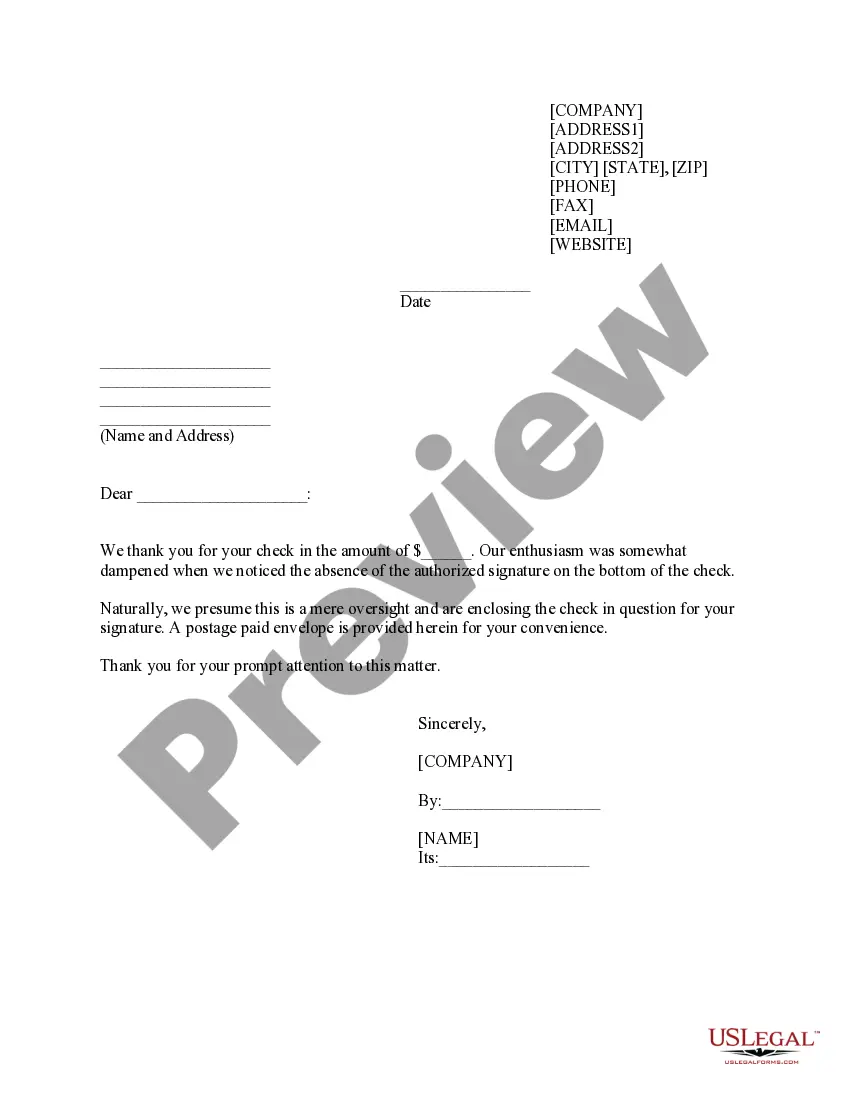

Minnesota Sample Letter for Return of Check Missing Signature

Description

How to fill out Sample Letter For Return Of Check Missing Signature?

Are you in a scenario where you require documentation for both organizations or specific purposes almost every day.

There are numerous legitimate document templates available online, but locating ones you can trust isn't straightforward.

US Legal Forms offers thousands of template documents, such as the Minnesota Sample Letter for Return of Check Missing Signature, which are designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive selection of legitimate documents, to save time and prevent mistakes.

The service offers professionally crafted legal document templates for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Minnesota Sample Letter for Return of Check Missing Signature template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Find the template you need and ensure it is for your correct region/state.

- Utilize the Preview button to examine the template.

- Review the description to confirm you have selected the correct template.

- If the template isn’t what you need, use the Search field to find the document that meets your needs and requirements.

- Once you find the appropriate template, click Purchase now.

- Select the pricing plan you prefer, fill in the required information to create your account, and pay for your order using PayPal or a credit card.

- Choose a suitable file format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Minnesota Sample Letter for Return of Check Missing Signature at any time if needed.

- Just click on the necessary template to download or print the document template.

Form popularity

FAQ

To track your Minnesota state tax return, you can visit the Minnesota Department of Revenue website. By using their online tracking system, you can enter your information to check the status of your return. In situations where you've submitted correspondence, such as a Minnesota Sample Letter for Return of Check Missing Signature, keep an eye on updates for any feedback or requests for additional information.

You should mail your completed Minnesota state tax return to the address specified in the instructions for your tax forms. If you are expecting a refund, send your return to the St. Paul processing center. Remember, if your return involves a missing signature or related issues, including a Minnesota Sample Letter for Return of Check Missing Signature can help clarify the situation and expedite processing.

Typically, Minnesota state returns take about 4 to 6 weeks to process if you file by mail. However, if you e-file, processing can be quicker, often taking just 1 to 2 weeks. To avoid delays, ensure all forms are complete and accurate, and include any relevant correspondence, such as a Minnesota Sample Letter for Return of Check Missing Signature, if applicable.

When you mail your tax return, you should include all necessary forms and documentation. This typically includes your completed tax return, W-2 or 1099 forms, and any supporting documentation related to deductions or credits. Additionally, if you are responding to a missing signature issue, consider adding a Minnesota Sample Letter for Return of Check Missing Signature. This letter can clarify any discrepancies and ensure a smooth processing of your return.

Yes, a signature is typically required on a tax return to validate it. An unsigned return may lead to processing delays or rejections from tax authorities. If you encounter complications, utilizing a Minnesota Sample Letter for Return of Check Missing Signature can assist in addressing any issues effectively.

You should mail your Minnesota state tax return to the appropriate address listed by the Minnesota Department of Revenue. This mailing address often depends on whether you are expecting a refund or you owe additional taxes. To clarify your submission needs, the Minnesota Sample Letter for Return of Check Missing Signature can serve as a useful resource.

Filing taxes without a signature is generally not allowed, as it may raise red flags for the tax authorities. To avoid complications, ensure your return is signed before submission. If you've faced issues, consider a Minnesota Sample Letter for Return of Check Missing Signature for assistance.

When a tax return is not signed, it usually results in immediate issues with processing. Tax authorities may return it, requesting a signature, or not process it at all. Using a Minnesota Sample Letter for Return of Check Missing Signature can help you address this issue promptly.

If your tax return is missing a signature, it may be considered incomplete by the IRS. This can result in delays or rejections. A Minnesota Sample Letter for Return of Check Missing Signature can help you effectively communicate with tax authorities to clarify your situation.

The IRS typically does not accept unsigned tax returns. An unsigned return can lead to unnecessary complications and potential penalties. To ensure your filing is accepted, be sure to include a signature or use the Minnesota Sample Letter for Return of Check Missing Signature if needed.