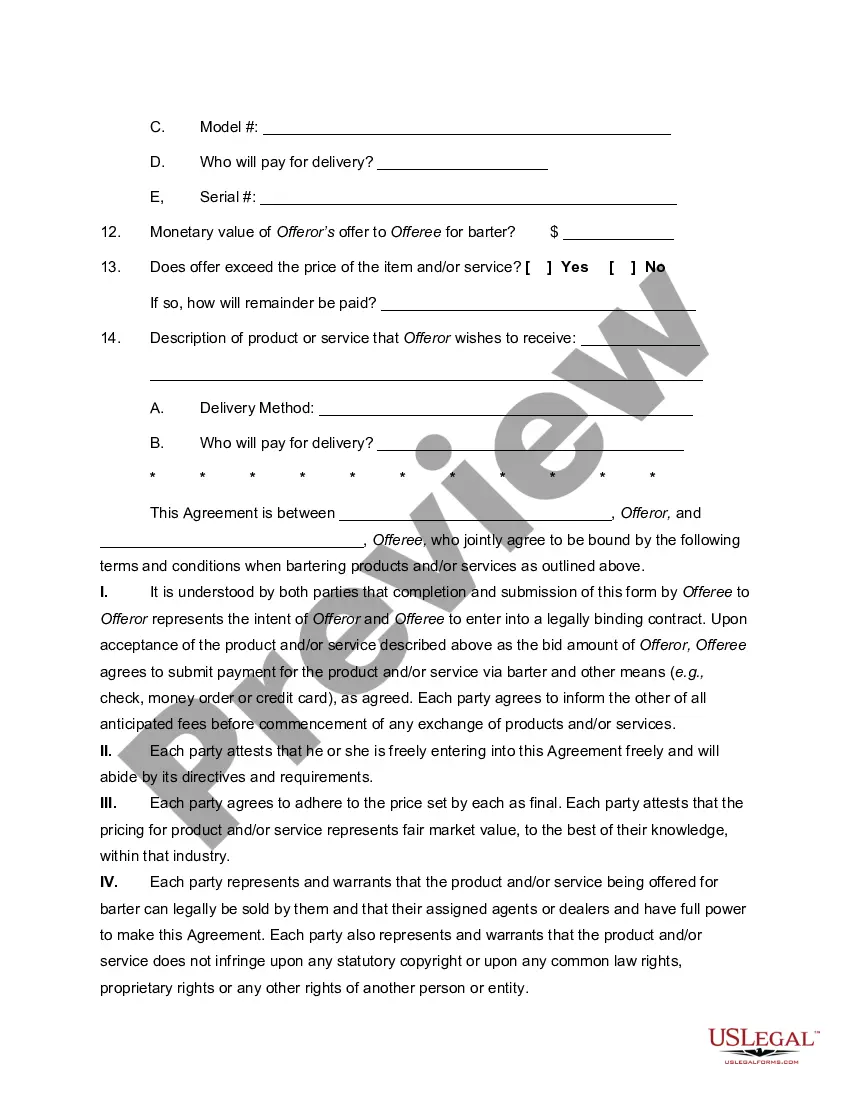

Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Minnesota Bartering Contract or Exchange Agreement

Description

How to fill out Bartering Contract Or Exchange Agreement?

Are you presently in a circumstance that necessitates documents for both organizational or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating those you can trust is not simple.

US Legal Forms offers a vast selection of form templates, including the Minnesota Bartering Contract or Exchange Agreement, which are designed to meet federal and state requirements.

Once you identify the correct form, click Buy now.

Select your preferred pricing plan, fill out the necessary information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Minnesota Bartering Contract or Exchange Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to inspect the form.

- Review the description to confirm that you have selected the correct form.

- If the form does not fit what you're seeking, use the Search field to find the form that aligns with your needs.

Form popularity

FAQ

Filing proceeds from broker and barter exchange transactions involves reporting the income received from the exchange on your tax return. Ensure you track your exchanges carefully, as accurate records will support your claims. Using a Minnesota Bartering Contract or Exchange Agreement can help you maintain organized documentation of these transactions for tax purposes.

When claiming bartering on your taxes, you must report the fair market value of the goods or services received, just like any other income. It’s essential to keep records of your barter transactions for accurate reporting. Consulting a tax professional can help you navigate the specifics of claiming a Minnesota Bartering Contract or Exchange Agreement on your taxes.

Writing an agreement deal requires clarity and precision. Start by outlining the terms of the exchange, including what goods or services will be exchanged, their value, and any deadlines involved. Using a Minnesota Bartering Contract or Exchange Agreement template can simplify this process and ensure that all necessary details are included.

Yes, barter agreements are legal in Minnesota and across the United States. These agreements are considered contracts, provided they meet the essential elements of a valid contract. It's important to properly document the terms of the exchange, as a Minnesota Bartering Contract or Exchange Agreement can help protect both parties involved in the transaction.

Barter contract law refers to the legal principles that govern agreements made in exchange for goods or services without monetary payment. In Minnesota, parties entering into a Minnesota Bartering Contract or Exchange Agreement must adhere to state contract laws to ensure validity. Understanding these laws can help you navigate the benefits of barter, and using a resource like US Legal Forms can simplify the process of creating the necessary documentation.

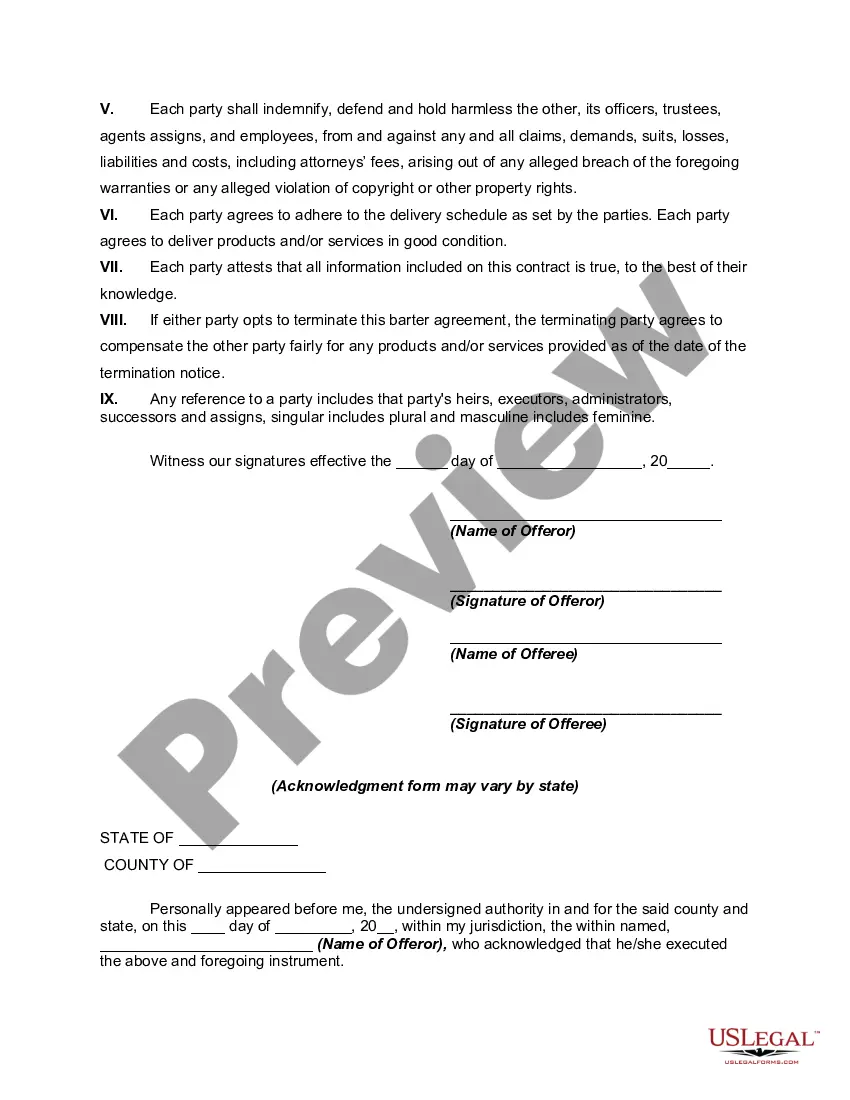

For a contract to be considered legally binding in Minnesota, it must include an offer, acceptance, and consideration, which is typically something of value exchanged between the parties. Additionally, the parties must have the legal capacity to enter the agreement, and the contract must have a lawful purpose. When creating a Minnesota Bartering Contract or Exchange Agreement, attention to these elements ensures enforceability and reduces potential disputes.

Bartering is not illegal in the US, including Minnesota. In fact, individuals can engage in barter agreements or exchanges without any legal issues. However, it’s essential to create a Minnesota Bartering Contract or Exchange Agreement to ensure both parties understand their obligations. Documenting the exchange protects against misunderstandings and provides clarity.

To write an effective barter agreement, start by clearly identifying the parties involved and the specific items or services being exchanged. The Minnesota Bartering Contract or Exchange Agreement should include details such as the items' value, the timeline for the exchange, and any relevant terms. This thoroughness ensures both parties have a mutual understanding of the agreement.

Bartering can have tax implications, as the IRS considers it taxable income. When engaging in barter, you must report the fair market value of goods or services received in your Minnesota Bartering Contract or Exchange Agreement. Keeping accurate records of these transactions will aid in proper tax reporting and compliance.

Yes, bartering can be treated as a business activity depending on the scale and frequency of transactions. If you're regularly engaging in trades for goods or services, you are likely operating as a business. In such cases, a Minnesota Bartering Contract or Exchange Agreement helps formalize your transactions.