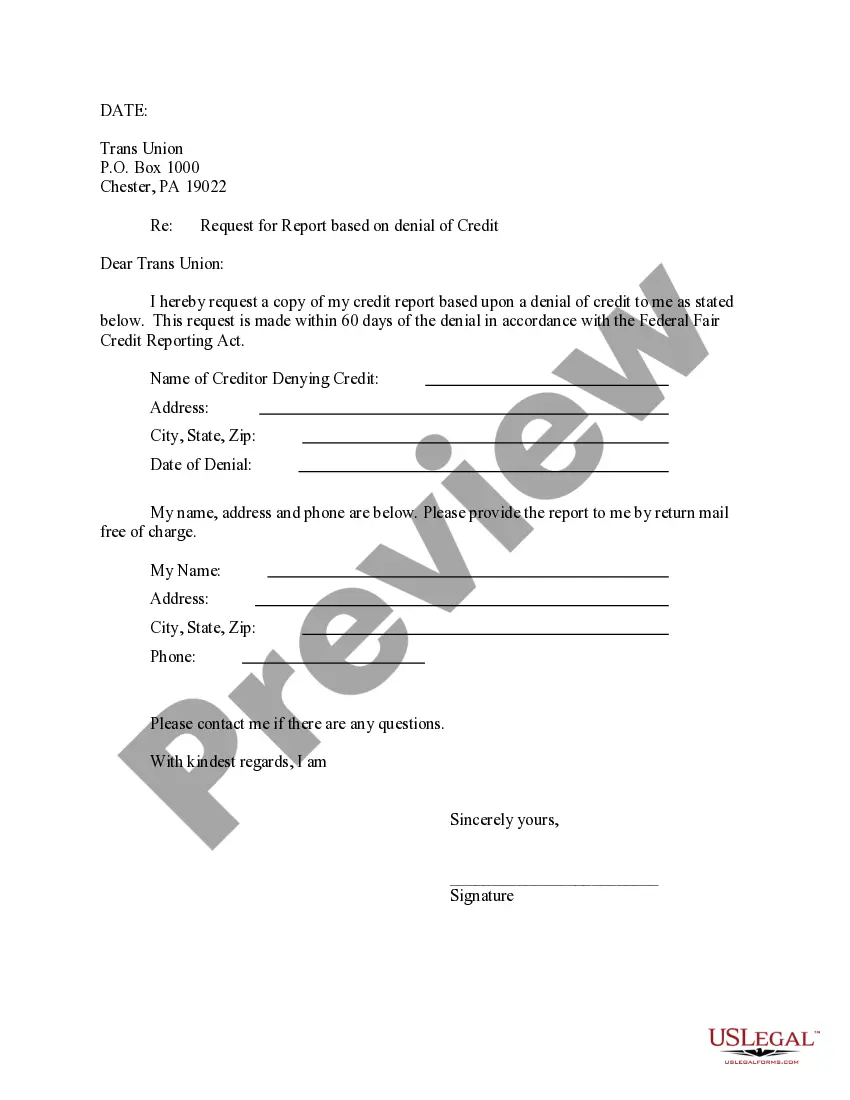

Minnesota Sample Letter for Request for Free Credit Report Allowed by Federal Law

Description

How to fill out Sample Letter For Request For Free Credit Report Allowed By Federal Law?

If you want to completely download or generate licensed document templates, utilize US Legal Forms, the largest assortment of legal forms, which are available online.

Take advantage of the website's easy and user-friendly search to find the documents you need.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you want, click the Buy now button. Select the pricing plan you prefer and provide your information to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to get the Minnesota Sample Letter for Request for Free Credit Report Permitted by Federal Law in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Minnesota Sample Letter for Request for Free Credit Report Permitted by Federal Law.

- You can also access forms you previously downloaded from the My documents section in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

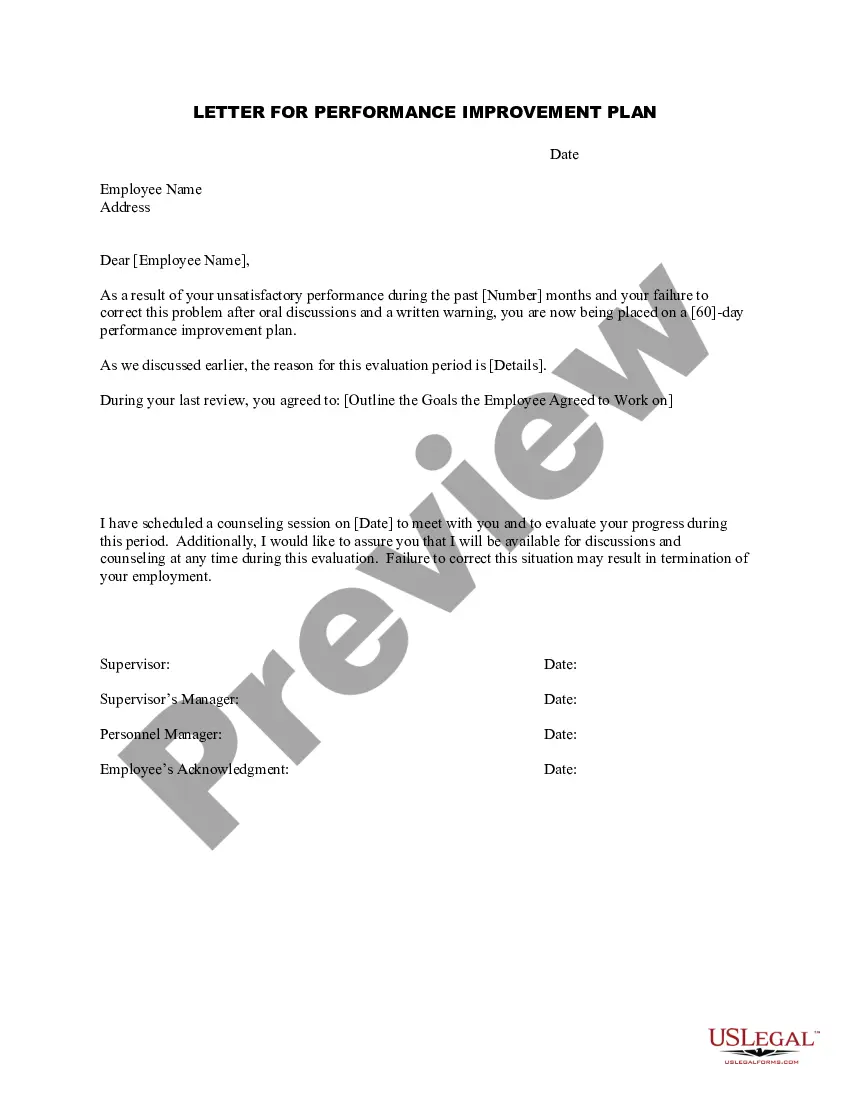

- Step 2. Utilize the Preview option to review the form’s details. Be sure to check the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit reportit's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

Steps to write a formal letter while requesting information:Identify letter Formal.Write salutation (Dear Sir/Mam,)Write purpose of letter.Describe the first bullet point (it may be same as step 3)Describe the second bullet point.Describe the third bullet point.More items...?

How to Write a 609 LetterStep 1: Get your free credit report. Before writing a 609 letter, request a free copy of your credit report online to check it for any erroneous negative items.Step 2: Write your 609 letter.Step 3: Mail your 609 letter via certified mail with a return receipt.17-Dec-2021

The Fair Credit Reporting Act (FCRA), a federal law, requires this.

AnnualCreditReport.com is a safe website that you can use to request your credit reports from the three major consumer credit bureaus: Experian, TransUnion and Equifax.

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices. Written by Natasha Wiebusch, J.D..

The following are important details to include in the goodwill letter:The date.Your name.Your address.Your creditor's name.Your creditor's address.Your account number.The negative mark you'd like removed.Which credit bureaus the mark needs to be removed from.

Request Your Free Credit Report:Online: Visit AnnualCreditReport.com. By Phone: Call 1-877-322-8228. For TTY service, call 711 and ask the relay operator for 1-800-821-7232.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.