Minnesota Suggestion for Writ of Garnishment

Description

How to fill out Suggestion For Writ Of Garnishment?

Are you presently in the situation the place you require paperwork for both business or specific uses nearly every day time? There are a lot of authorized record templates available online, but finding versions you can trust isn`t simple. US Legal Forms gives thousands of develop templates, such as the Minnesota Suggestion for Writ of Garnishment, that are written in order to meet federal and state demands.

In case you are currently informed about US Legal Forms internet site and have an account, merely log in. Next, it is possible to acquire the Minnesota Suggestion for Writ of Garnishment design.

Should you not provide an accounts and wish to begin using US Legal Forms, adopt these measures:

- Discover the develop you require and make sure it is for your proper town/county.

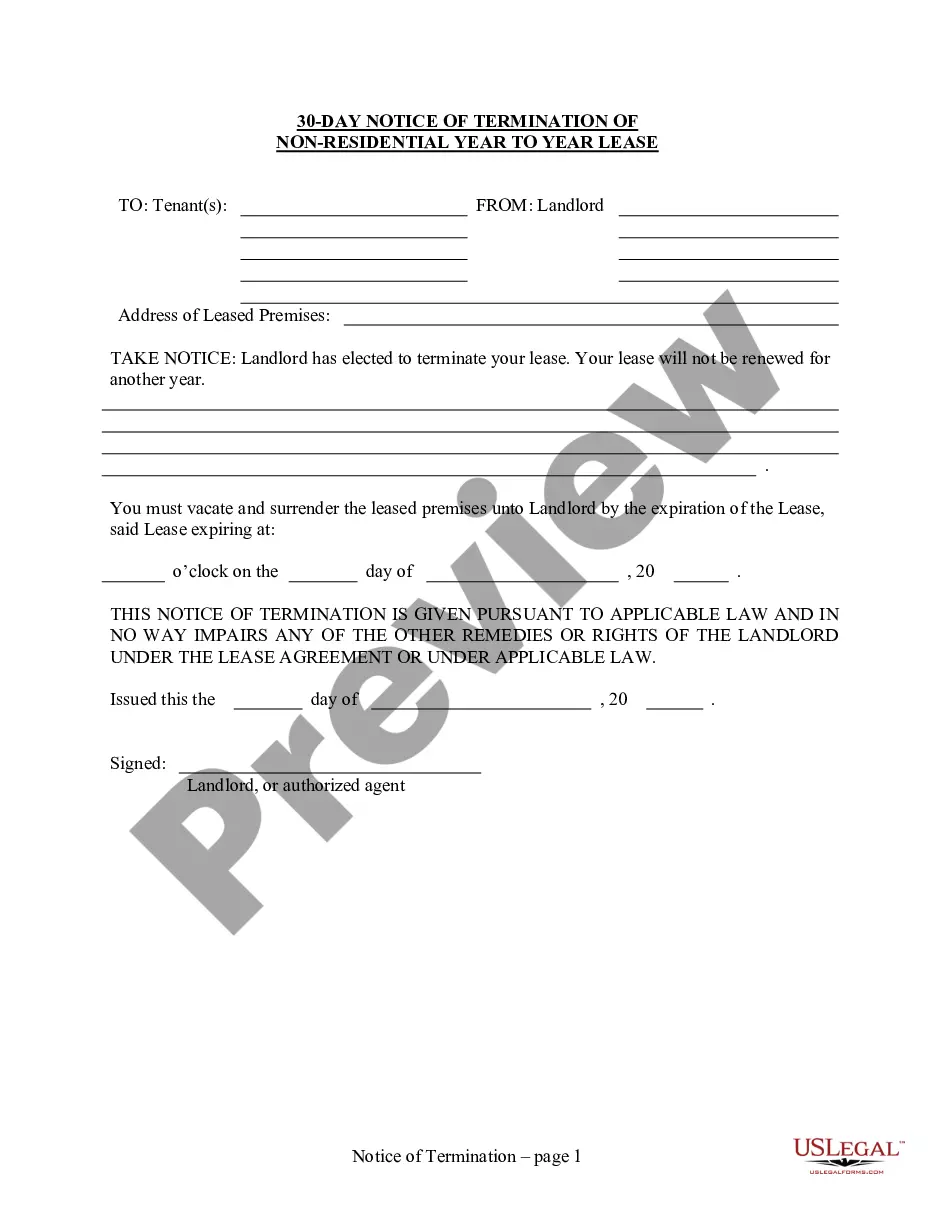

- Make use of the Review option to analyze the form.

- Read the information to ensure that you have selected the proper develop.

- In the event the develop isn`t what you are seeking, utilize the Lookup field to obtain the develop that meets your requirements and demands.

- When you get the proper develop, just click Get now.

- Choose the rates plan you would like, complete the desired information to make your account, and pay money for the transaction utilizing your PayPal or charge card.

- Pick a practical file structure and acquire your version.

Discover every one of the record templates you might have bought in the My Forms menus. You can obtain a further version of Minnesota Suggestion for Writ of Garnishment any time, if required. Just go through the essential develop to acquire or produce the record design.

Use US Legal Forms, by far the most considerable variety of authorized kinds, to save some time and prevent faults. The services gives expertly created authorized record templates which can be used for an array of uses. Create an account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

For instance, if you're behind on credit card payments or owe a doctor's bill, those creditors can't garnish your wages unless they sue you and get a judgment. Some creditors, though, like those you owe taxes, federal student loans, child support, or alimony, don't have to file a suit to get a wage garnishment.

Here are four ways to avoid paying a judgment: 1) Use asset protection tools such as an asset protection trust, 2) use legal exemptions, 3) negotiate with the creditor, 4) file for bankruptcy.

You can stop a garnishment in Minnesota by paying off the debt in full, renegotiating the debt with the creditor, orfiling bankruptcy. Filing bankruptcy stops wage garnishment through anautomatic stay. This is a court order requiring creditors or debt collectors to stop collection activity.

Your earnings are completely exempt from garnishment if you are now a recipient of assistance based on need, if you have been a recipient of assistance based on need within the last six months, or if you have been an inmate of a correctional institution in the last six months.

How much of your wages can be garnished? Creditors generally cannot garnish more than 25 percent of your ?disposable wages." ?Disposable? wages are the earnings that remain after deducting all withholdings required by law, or any of your disposable wages if you make less than $380 per week.

If you do not return the exemption notice and bank statements to the creditor's attorney within 10 days of receiving notice of the intent to garnish your wages, the creditor can begin to garnish money from your wages, and can continue to do so for up to 70 days.

Federal Wage Garnishment Limits for Judgment Creditors If a judgment creditor is garnishing your wages, federal law provides that it can take no more than: 25% of your disposable income, or. the amount that your income exceeds 30 times the federal minimum wage, whichever is less.