Minnesota Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

Description

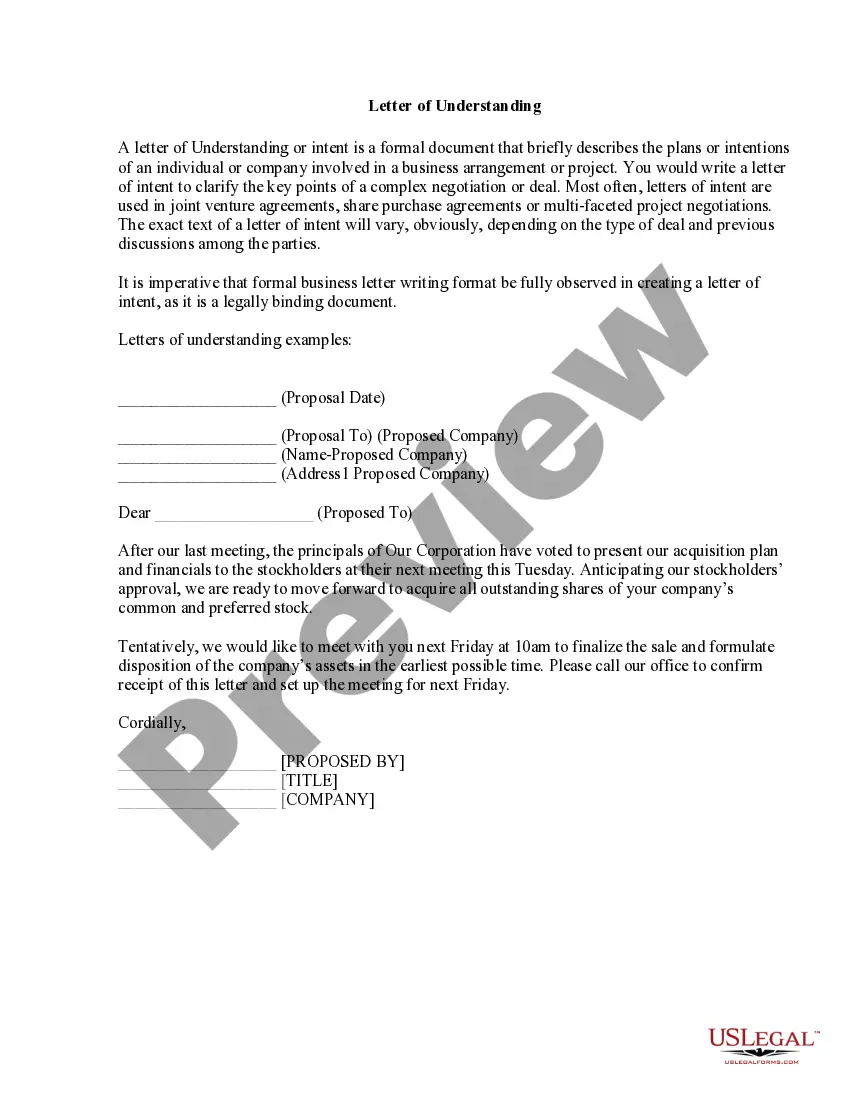

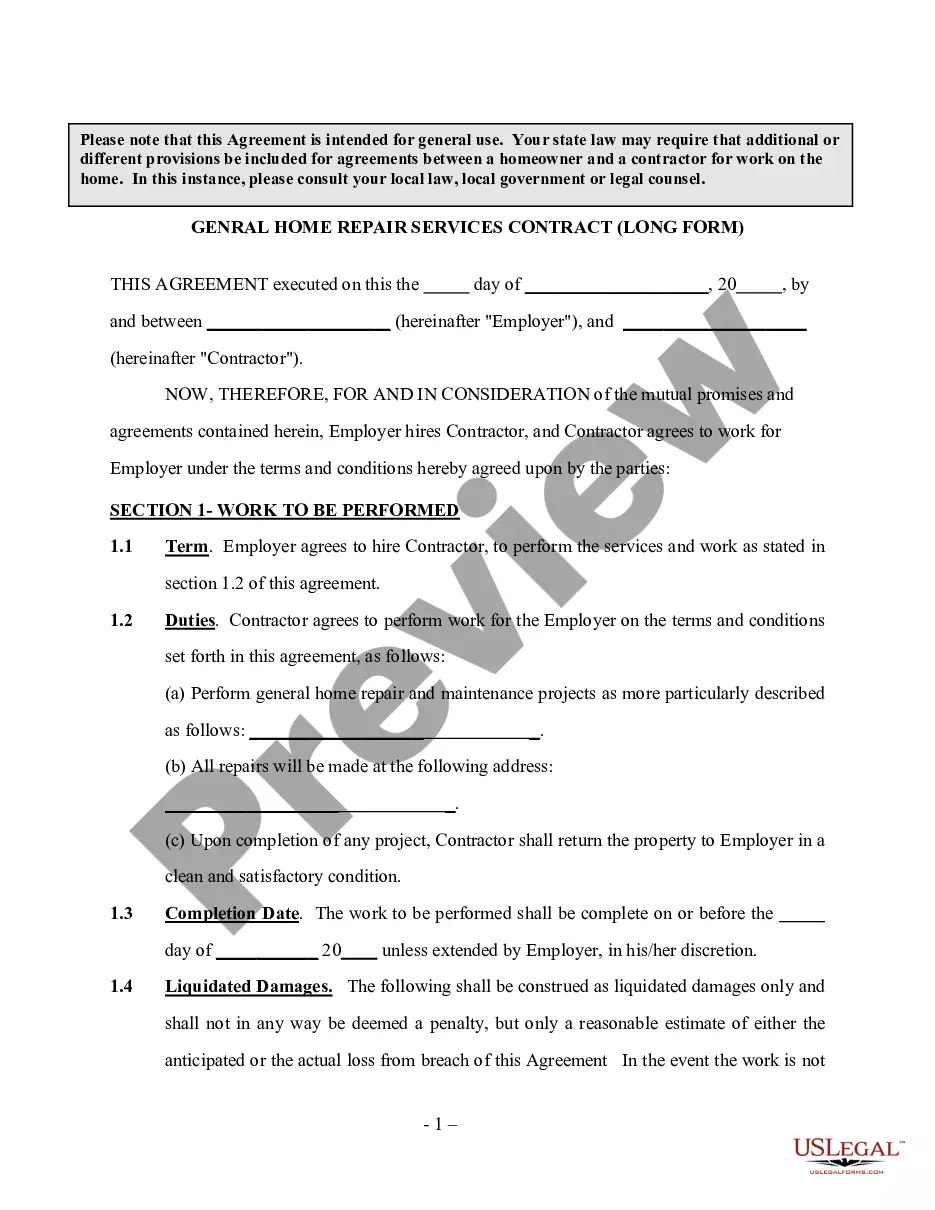

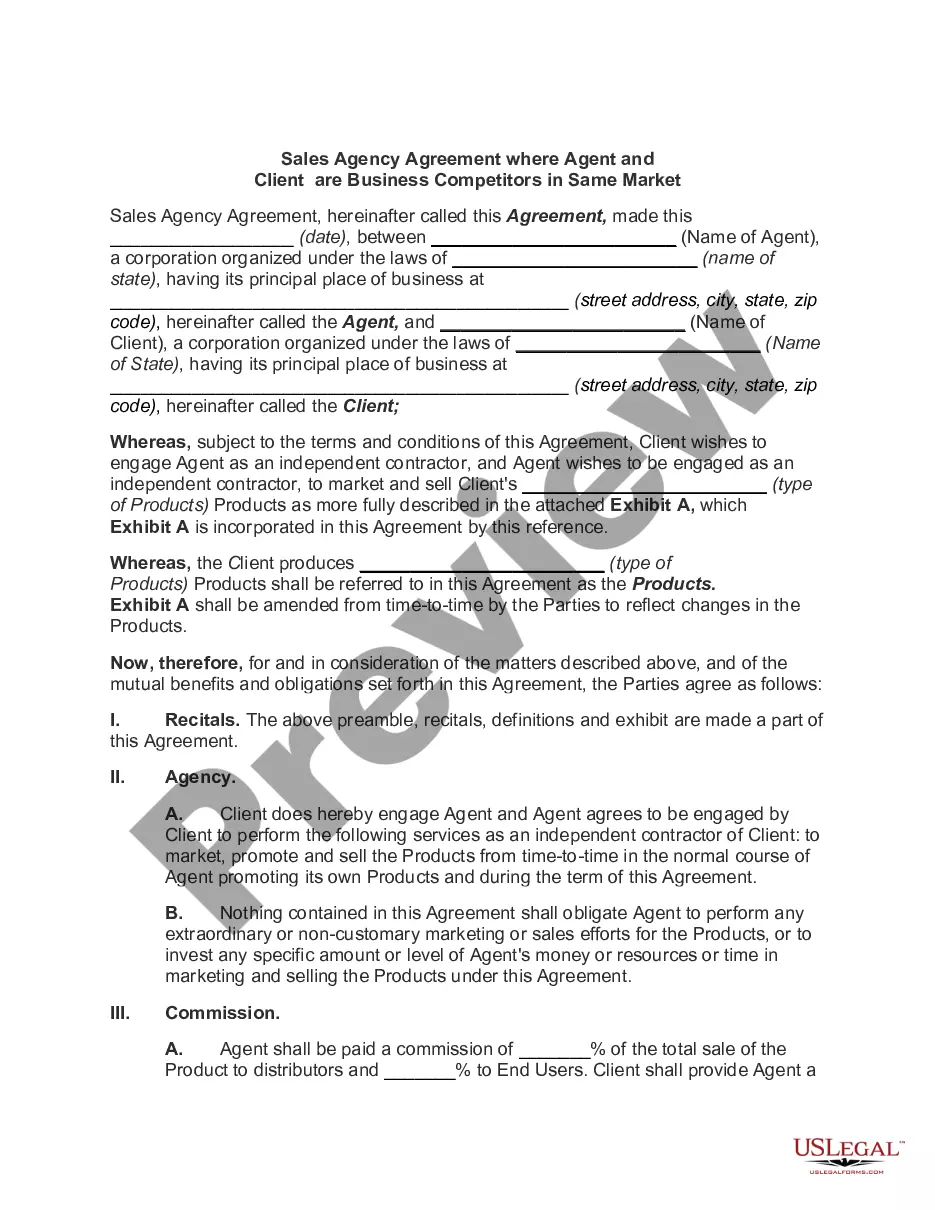

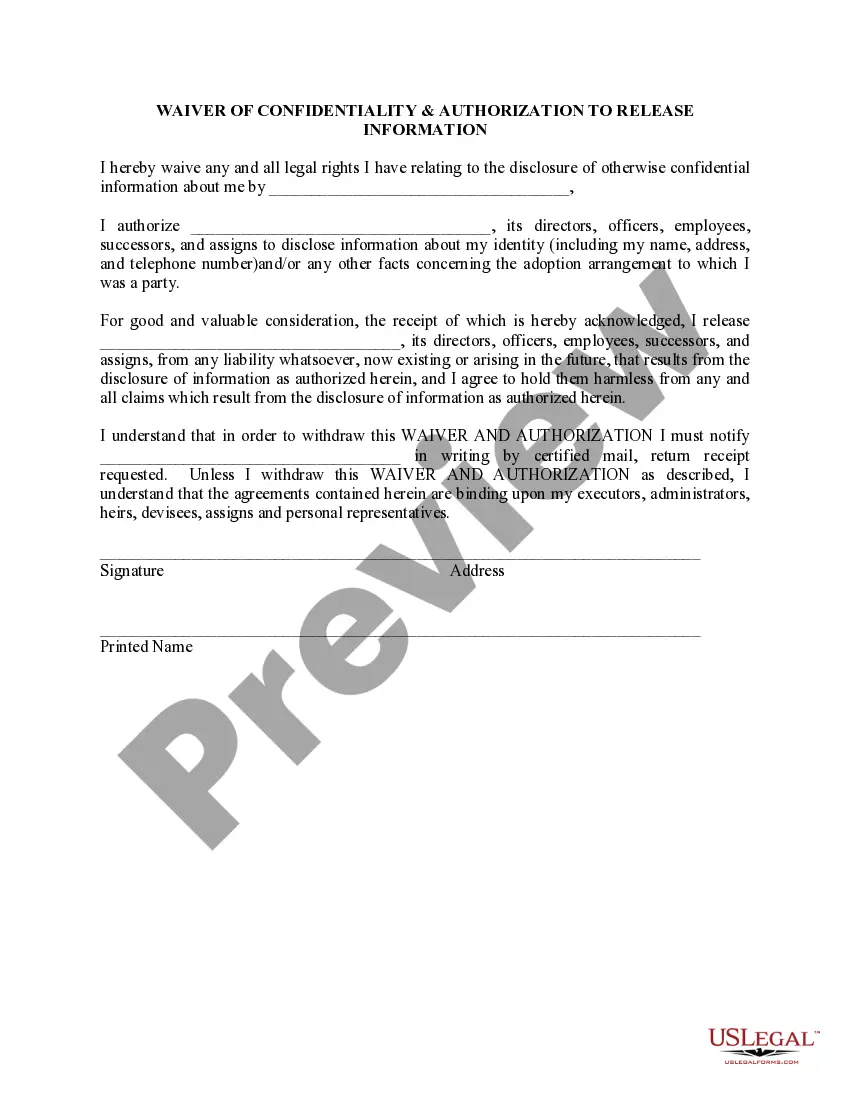

How to fill out Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

You can invest time on-line trying to find the authorized document web template that meets the state and federal specifications you need. US Legal Forms gives a large number of authorized varieties that are analyzed by professionals. It is simple to download or print the Minnesota Sample Letter to City Clerk regarding Ad Valorem Tax Exemption from the support.

If you already possess a US Legal Forms bank account, you are able to log in and click the Acquire switch. Afterward, you are able to full, revise, print, or indication the Minnesota Sample Letter to City Clerk regarding Ad Valorem Tax Exemption. Every single authorized document web template you purchase is the one you have forever. To have yet another duplicate of any bought form, visit the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms website initially, keep to the basic guidelines beneath:

- First, be sure that you have chosen the right document web template to the state/city of your choice. See the form explanation to ensure you have picked the appropriate form. If available, make use of the Preview switch to check through the document web template as well.

- If you would like find yet another edition from the form, make use of the Lookup discipline to obtain the web template that meets your needs and specifications.

- Upon having identified the web template you desire, just click Get now to move forward.

- Pick the prices prepare you desire, enter your references, and sign up for a merchant account on US Legal Forms.

- Full the deal. You can use your charge card or PayPal bank account to pay for the authorized form.

- Pick the formatting from the document and download it for your device.

- Make alterations for your document if possible. You can full, revise and indication and print Minnesota Sample Letter to City Clerk regarding Ad Valorem Tax Exemption.

Acquire and print a large number of document templates while using US Legal Forms website, that offers the greatest collection of authorized varieties. Use expert and condition-particular templates to handle your organization or specific demands.

Form popularity

FAQ

Churches are not exempt from special assessments, but only from taxes. Taxes are imposed on both real and personal property; with very few exceptions, special assessments apply only to land or to land and improvements. Church property remains subject to all district levies on land only or land and improvements only.

Property tax deferral for senior citizens This program allows people 65 or older to defer a portion of their homestead property taxes and is also administered by the State of Minnesota. Property Tax Refunds | Ramsey County ramseycounty.us ? taxes-values ? homestead ramseycounty.us ? taxes-values ? homestead

To be eligible for exemption, a property needs to meet two criteria: It needs to be owned by a qualifying person or entity, and. It needs to be used for a public, educational, religious, or charitable purpose. Property Tax Exemptions | Ramsey County ramseycounty.us ? residents ? taxes-values ramseycounty.us ? residents ? taxes-values

Today, in all 50 states and the District of Columbia, statutes and constitutions provide various types of property tax exemptions for religious organizations.

As a general rule, all property in the state of Minnesota is taxable, except tribal lands, unless the property is owned and used for a public purpose, education, or religious or charitable ministration. Exempt Status | Scott County, MN scottcountymn.gov ? Exempt-Status scottcountymn.gov ? Exempt-Status

Organizations that may qualify include: Churches. Museums and historical societies. Private schools, colleges, and universities.

All properties used exclusively for public purposes, including public hospitals, schools, burial grounds, etc. Certain kinds of personal property, including in most cases property that creates energy, enables commerce, or conserves nature. Qualifying wetlands or native prairie lands.