Minnesota Multistate Promissory Note - Secured

Description

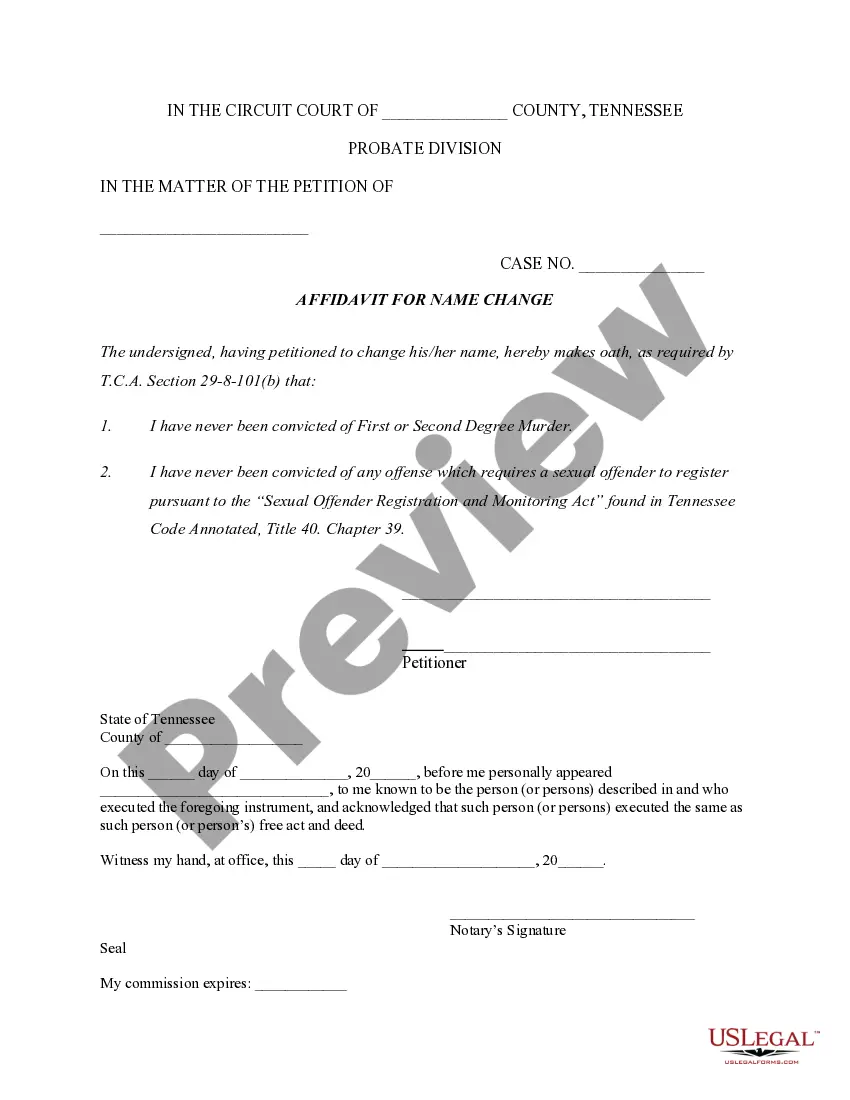

How to fill out Multistate Promissory Note - Secured?

If you need to finalize, acquire, or print legal document templates, utilize US Legal Forms, the premier compilation of legal forms available online.

Employ the website's straightforward and user-friendly search tool to locate the documents you require.

A variety of templates for business and individual applications are organized by categories and states, or keywords.

Step 4. Once you've located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 6. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to retrieve the Minnesota Multistate Promissory Note - Secured in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to find the Minnesota Multistate Promissory Note - Secured.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the guidelines provided below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Review option to examine the form's content. Don't forget to view the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The format of a Minnesota Multistate Promissory Note - Secured generally consists of an introduction that identifies the note, followed by detailed sections on terms and conditions. It includes the names of the lender and borrower, the amount borrowed, the interest rate applied, payment schedules, and what happens in case of default. Following a clear structure helps ensure that the note is comprehensive and legally enforceable.

An example of a Minnesota Multistate Promissory Note - Secured would be a borrower agreeing to repay $10,000 to a lender over five years, with a fixed interest rate of 5%. The note would specify monthly payments and default consequences, as well as collateral such as a vehicle. This concrete scenario illustrates how the terms work in real-life situations.

The structure of a Minnesota Multistate Promissory Note - Secured includes key components such as the names of the parties involved, the principal amount, interest rate, payment schedule, and terms for default. Additionally, it identifies collateral that secures the debt, ensuring the lender can claim it if the borrower fails to repay. Understanding this structure helps in drafting a valid and enforceable note.

Yes, a promissory note can be categorized as a type of security, particularly when it is structured with clear terms and obligations. A Minnesota Multistate Promissory Note - Secured provides legal assurance to both parties involved, ensuring the lender's investment is protected. Thus, understanding the legal context surrounding these notes is vital for informed transactions.

An unsecured promissory note may not meet the legal definition of a security under certain jurisdictions. However, a Minnesota Multistate Promissory Note - Secured clearly identifies the creditor's rights and obligations, establishing it as a recognized security. Proper structure and documentation are essential for compliance and protection.

While an unsecured promissory note can be classified differently based on its structure, it is generally not considered a security. A Minnesota Multistate Promissory Note - Secured, on the other hand, includes an asset that secures the debt, enhancing its status as a legitimate security. Therefore, understanding the distinctions between secured and unsecured notes is crucial for investors.

In certain instances, promissory notes may be considered exempt securities, particularly if they meet specific legal criteria. A Minnesota Multistate Promissory Note - Secured might fall under exemptions outlined in state and federal regulations. It is important for individuals or businesses to consult legal experts to ensure compliance.

Promissory notes can qualify as debt securities, depending on their terms. A Minnesota Multistate Promissory Note - Secured is a debt instrument where the borrower agrees to repay the borrowed amount along with interest. This arrangement makes the note a legally binding tool for both parties in a financial agreement.

Yes, promissory notes can be secured by collateral, which enhances their reliability. Specifically, a Minnesota Multistate Promissory Note - Secured often involves an asset that the lender can claim if the borrower defaults. This security gives lenders greater confidence in the transaction and can lead to lower interest rates for borrowers.

For a Minnesota Multistate Promissory Note - Secured to be valid, it must contain specific elements such as clear terms, date, and proper signatures from both parties. Importantly, the note should state a definitive amount and include the repayment method. Furthermore, adherence to state regulations is crucial to uphold its integrity. By ensuring these components are meticulously addressed, you can establish a legally binding agreement.