Minnesota Consulting Agreement - with Former Shareholder

Description

How to fill out Consulting Agreement - With Former Shareholder?

Have you ever found yourself in a situation where you need paperwork for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, yet finding trustworthy ones can be challenging.

US Legal Forms offers thousands of form templates, including the Minnesota Consulting Agreement - with Former Shareholder, designed to comply with state and federal regulations.

Choose the pricing plan you prefer, fill out the required information to create your account, and complete the purchase using PayPal or a credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Minnesota Consulting Agreement - with Former Shareholder template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and verify that it is for your correct city/state.

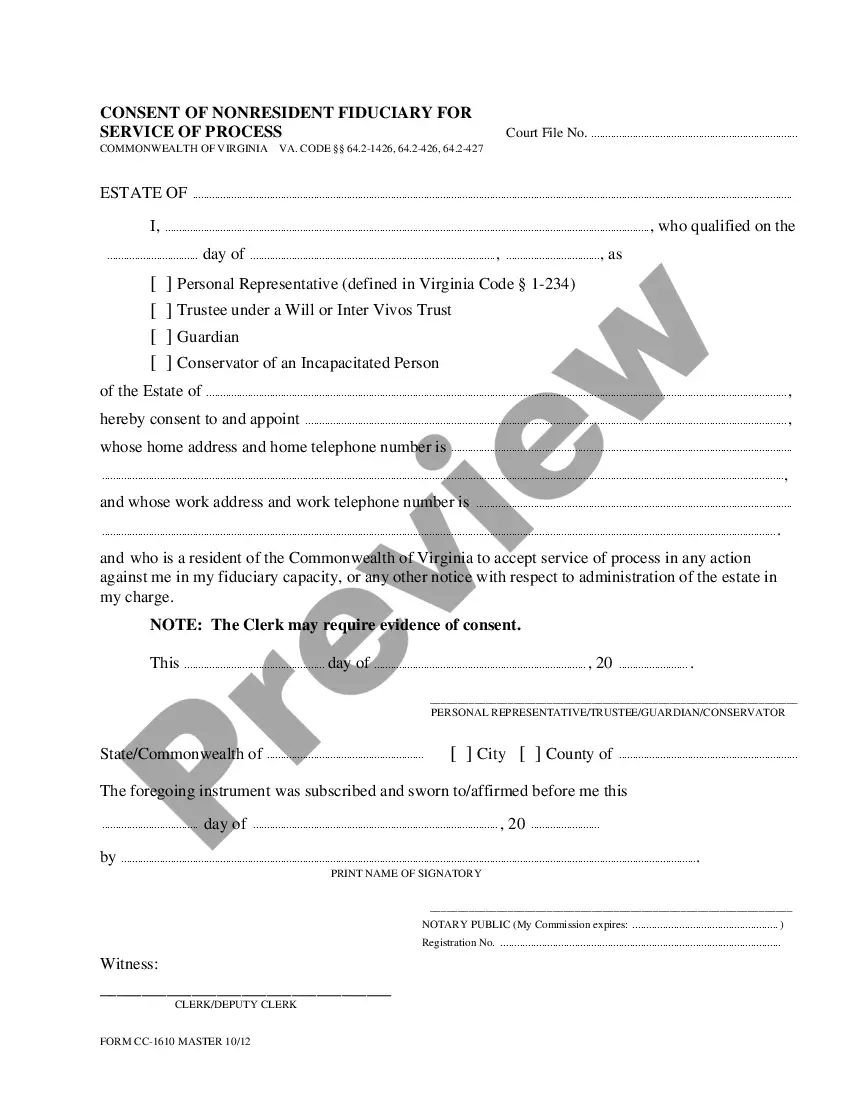

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the right form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that matches your needs and requirements.

- Once you find the correct form, click on Acquire now.

Form popularity

FAQ

A consulting contract generally includes a title, introductory section outlining the parties, and the main body detailing the services, compensation, and terms. It should also feature sections on confidentiality, intellectual property, and dispute resolution. You can find user-friendly templates on platforms like uslegalforms to ensure that your Minnesota Consulting Agreement - with Former Shareholder meets all necessary legal standards.

A consulting agreement and a Master Service Agreement (MSA) serve distinct purposes. While a consulting agreement focuses on a specific project or consultancy services, an MSA is a broader contract that outlines the terms for multiple future services or projects. Understanding this difference can help you choose the right framework for your needs in the context of a Minnesota Consulting Agreement - with Former Shareholder.

To write a consultancy agreement, begin by clearly identifying the parties and describing the services to be performed. Next, outline payment terms and conditions, along with any specific requirements like confidentiality or exclusivity. Craft the agreement in a straightforward manner, ensuring both parties can easily understand their roles and responsibilities within the framework of a Minnesota Consulting Agreement - with Former Shareholder.

When drafting a consultant contract, you should include key elements such as the parties involved, services to be provided, payment structure, and duration. Additionally, it often includes intellectual property rights, confidentiality obligations, and terms of termination. This comprehensive approach ensures that both the consultant and the client are aligned and protected under the Minnesota Consulting Agreement - with Former Shareholder.

A consulting agreement establishes a formal relationship between a consultant and a client, detailing the expectations of both parties. It clarifies the consultant's responsibilities, compensation, and timeframes, providing a clear roadmap to achieve goals. Essentially, it protects the interests of both parties and fosters trust in the relationship.

A Minnesota Consulting Agreement - with Former Shareholder typically includes essential details such as the scope of services, payment terms, and duration of the agreement. Additionally, it may outline confidentiality clauses, termination conditions, and dispute resolution processes. These components ensure both parties understand their rights and obligations, paving the way for successful collaboration.

A consulting agreement sets the overarching terms for the consultant-client relationship, while a Statement of Work (SOW) provides detailed specifics about the work to be performed. The Minnesota Consulting Agreement - with Former Shareholder can encompass multiple SOWs, giving a comprehensive view of the arrangement between both parties, including expectations, deliverables, and legal obligations.

Filling out a limited liability company operating agreement involves detailing the company's structure, management, and member roles. Begin by outlining the purpose of the LLC, then specify each member’s contributions and rights. For those considering a Minnesota Consulting Agreement - with Former Shareholder, it's essential to also ensure that the operating agreement aligns with any consultant agreements to maintain consistency and compliance.

A consulting agreement specifically relates to the services offered by a consultant, while a contract can refer to any legal agreement between parties. In the context of a Minnesota Consulting Agreement - with Former Shareholder, the focus is on terms specific to consulting services, establishing not only the relationship but also expectations regarding deliverables, fees, and duration.

To write a consulting contract agreement, start by defining the roles and responsibilities of each party. Be sure to include project scope, payment terms, and timelines. When crafting a Minnesota Consulting Agreement - with Former Shareholder, consider incorporating confidentiality clauses and ensuring compliance with state laws to protect both parties involved.