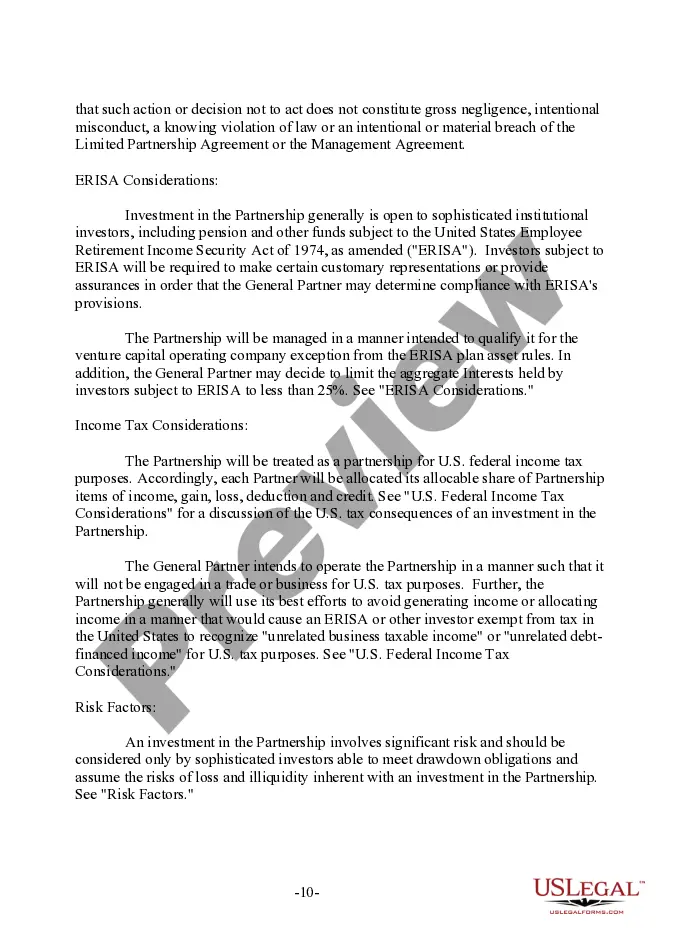

Michigan Summary of Principal Terms

Description

How to fill out Summary Of Principal Terms?

US Legal Forms - one of several most significant libraries of lawful varieties in the USA - delivers a wide array of lawful document templates it is possible to obtain or print out. While using website, you may get a huge number of varieties for organization and specific uses, sorted by categories, suggests, or key phrases.You will discover the latest variations of varieties like the Michigan Summary of Principal Terms in seconds.

If you already have a membership, log in and obtain Michigan Summary of Principal Terms in the US Legal Forms local library. The Download button can look on every kind you view. You get access to all earlier saved varieties inside the My Forms tab of your profile.

If you wish to use US Legal Forms the very first time, listed below are straightforward recommendations to get you started:

- Be sure to have picked out the proper kind to your area/region. Click the Review button to review the form`s content material. Browse the kind explanation to actually have selected the proper kind.

- When the kind does not suit your specifications, take advantage of the Search discipline towards the top of the screen to obtain the one which does.

- If you are content with the shape, validate your option by clicking on the Buy now button. Then, opt for the rates plan you prefer and provide your qualifications to sign up to have an profile.

- Method the deal. Make use of credit card or PayPal profile to finish the deal.

- Find the formatting and obtain the shape in your system.

- Make adjustments. Complete, modify and print out and indicator the saved Michigan Summary of Principal Terms.

Every template you included in your bank account does not have an expiration date and is also your own property permanently. So, if you wish to obtain or print out yet another version, just check out the My Forms section and click on in the kind you will need.

Get access to the Michigan Summary of Principal Terms with US Legal Forms, one of the most substantial local library of lawful document templates. Use a huge number of expert and express-particular templates that meet up with your business or specific needs and specifications.

Form popularity

FAQ

State Equalized Value - One half (1/2) of your property's true cash value. State Equalized Value in Contention - The difference between what Petitioner and Respondent believe to be the property's state equalized value for each tax year at issue.

True Cash Value - The fair market value or the usual selling price of property. For a more detailed definition see MCL 211.27. True Cash Value Contention - The value that the party believes is the property's fair market value or usual selling price as of December 31 of each tax year at issue.

Ing to Michigan's General Property Tax Act, two factors determine your tax bill: the taxable value of your home (assessed annually), and the applicable tax rate (that is, the percentage of the taxable value that the local tax authorities use to compute your property tax).

State equalized value: One half (1/2) of your property's true cash value. Assessed value: Generally the same as state equalized value. The assessed value can be challenged before it becomes the state equalized value. Taxable value: The value used to calculate your property taxes.

In Michigan, the assessed value is equal to 50% of the market value. Local assessors determine how much a given property could sell for on the market, usually by looking at factors such as size, features and the prices of recently sold comparable properties.

State Equalized Value (SEV) - SEV is the assessed value that has been adjusted following county and state equalization. The County Board of Commissioners and the Michigan State Tax Commission must review local assessments and adjust (equalize) them if they are above or below the constitutional 50% level of assessment.

Many factors played a role in the development of Public Act 173, which is the legislation that governs educator evaluations in Michigan. Notably, it expands and clarifies the legislative work initiated in Public Act 102 of 2011, which first laid the groundwork for educator evaluation requirements in Michigan.

Principals counsel students. Elementary, middle, and high school principals oversee all school operations, including daily school activities. They coordinate curriculums, manage staff, and provide a safe and productive learning environment for students.