Michigan Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage

Description

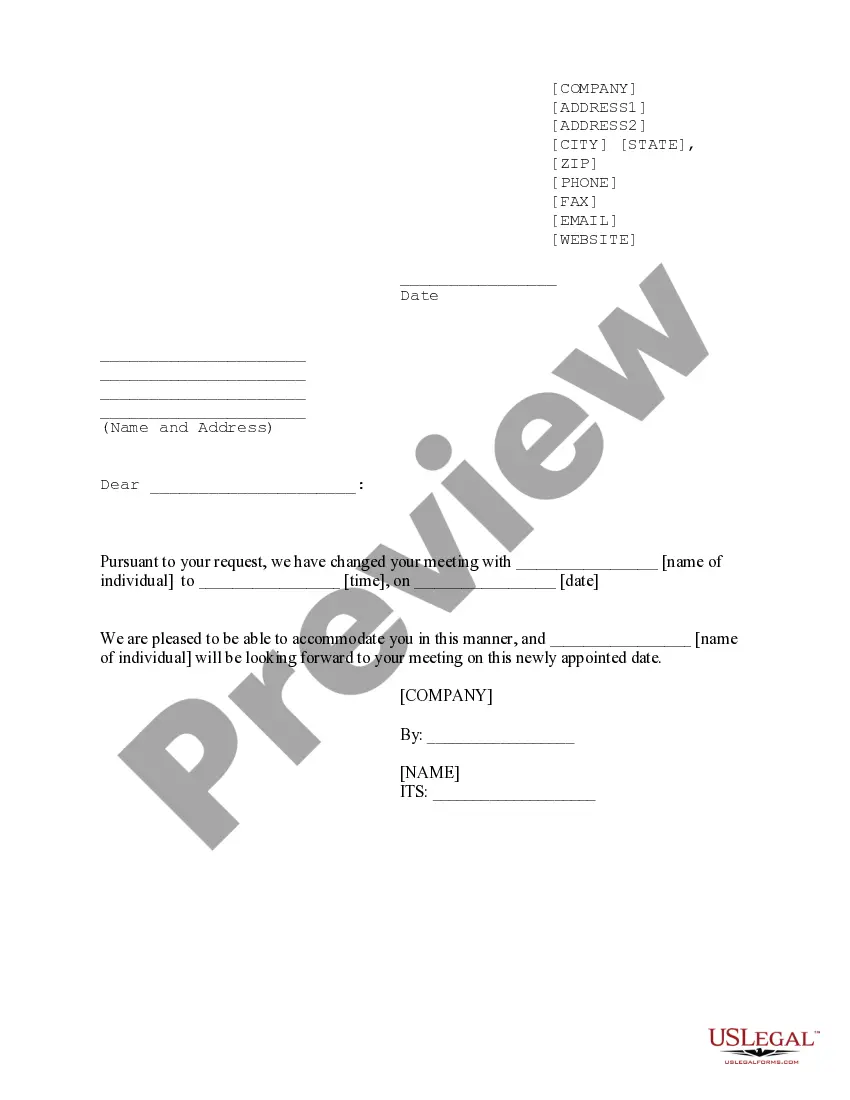

How to fill out Assignment Of Overriding Royalty Interest By Working Interest Owner, Single Lease, Stated Percentage?

You may invest several hours on the web trying to find the legal papers web template that meets the federal and state specifications you want. US Legal Forms supplies a huge number of legal varieties that are reviewed by experts. It is simple to acquire or print out the Michigan Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage from our services.

If you already possess a US Legal Forms bank account, you can log in and then click the Acquire option. Following that, you can complete, edit, print out, or indicator the Michigan Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage. Each and every legal papers web template you buy is your own eternally. To have one more duplicate associated with a purchased kind, check out the My Forms tab and then click the related option.

If you work with the US Legal Forms internet site the very first time, adhere to the simple recommendations listed below:

- First, ensure that you have chosen the proper papers web template to the area/metropolis of your liking. Look at the kind information to ensure you have picked out the correct kind. If available, utilize the Review option to appear through the papers web template also.

- If you want to discover one more version of the kind, utilize the Research field to get the web template that meets your needs and specifications.

- After you have located the web template you would like, click Get now to carry on.

- Select the prices prepare you would like, type your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You may use your charge card or PayPal bank account to fund the legal kind.

- Select the formatting of the papers and acquire it in your device.

- Make changes in your papers if required. You may complete, edit and indicator and print out Michigan Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage.

Acquire and print out a huge number of papers templates utilizing the US Legal Forms site, that provides the greatest selection of legal varieties. Use professional and state-certain templates to take on your company or personal demands.

Form popularity

FAQ

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres. Net Royalty Acres Defined - Oil and Gas Lawyer Blog oilandgaslawyerblog.com ? net-royalty-acre... oilandgaslawyerblog.com ? net-royalty-acre...

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) Endeavor Energy Resources, LP ? 2019/07 Endeavor Energy Resources, LP ? 2019/07 PDF

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) - Endeavor Energy Resources endeavorenergylp.com ? InterestDefinitions endeavorenergylp.com ? InterestDefinitions

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750. What is Overriding Royalty Interest and How to Value it? pheasantenergy.com ? overriding-royalty-in... pheasantenergy.com ? overriding-royalty-in...

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production. Transferring Oil and Gas Lease Interests Bureau of Land Management (.gov) ? Assignments Handout_6 Bureau of Land Management (.gov) ? Assignments Handout_6 PDF

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12. Information and Procedures for Transferring Overriding Royalty ... blm.gov ? article ? Information-and-Procedu... blm.gov ? article ? Information-and-Procedu...

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...