Michigan Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust

Description

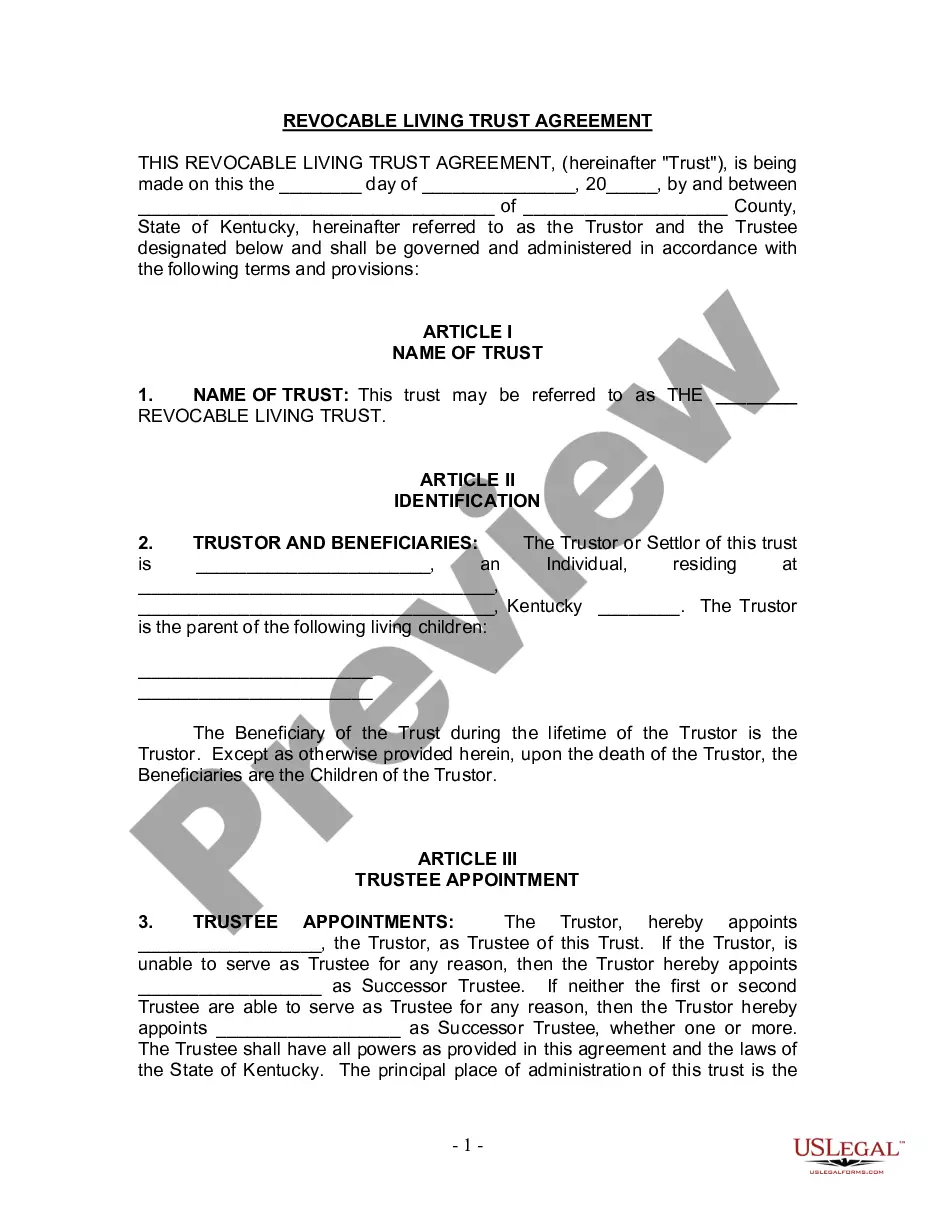

How to fill out Polaris 401(k) Retirement Savings Plan Trust Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Co. Regarding Establishment Of Trust?

Are you presently within a position the place you need files for either enterprise or person functions virtually every time? There are a variety of lawful record templates available on the net, but finding kinds you can depend on is not straightforward. US Legal Forms gives a large number of form templates, just like the Michigan Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust, that are written to meet federal and state demands.

Should you be already acquainted with US Legal Forms web site and get an account, just log in. After that, you may down load the Michigan Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust format.

Unless you offer an account and want to start using US Legal Forms, adopt these measures:

- Obtain the form you want and ensure it is to the appropriate city/county.

- Use the Preview key to check the shape.

- Read the information to ensure that you have chosen the right form.

- If the form is not what you are seeking, make use of the Research area to get the form that meets your needs and demands.

- Whenever you obtain the appropriate form, simply click Buy now.

- Opt for the costs prepare you need, fill out the necessary information and facts to make your money, and pay money for the transaction with your PayPal or bank card.

- Select a hassle-free paper format and down load your copy.

Find each of the record templates you have bought in the My Forms food list. You may get a additional copy of Michigan Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust anytime, if necessary. Just go through the essential form to down load or printing the record format.

Use US Legal Forms, the most extensive assortment of lawful forms, to conserve time and stay away from faults. The services gives professionally created lawful record templates that can be used for an array of functions. Generate an account on US Legal Forms and commence producing your lifestyle easier.

Form popularity

FAQ

The first screen you'll see is the Account Summary page. From the top menu of options on Account Summary, click on 'Manage Investments'. 4. Then choose 'Move or withdraw cash' under the 'Cash' heading.

Go to Fidelity.com or call 800-343-3548. Use this form to request a one-time withdrawal from a Fidelity Self-Employed 401(k), Profit Sharing, or Money Purchase Plan account. Possible requests include a one-time, immediate distribution; a qualified or direct conversion to a Roth IRA; or a direct rollover.

If you get a new job and your new employer offers a 401(k) plan, you may be able to cash out or roll funds over from your old plan to your new plan. No matter what you choose, you'll have to contact your plan provider to cash out or roll over your funds.

The basic plan document contains all the non-elective provisions and can't include any options or blanks for the employer to complete. The adoption agreement contains the options (and blanks) for the employer to complete and is also where the employer signs the plan.

Yes, you can withdraw money early for unexpected needs. But you need to know what to expect from the IRS.

Trust Agreement The trustee essentially has legal title to the plan assets. The plan's assets are protected from the creditors of the Plan Sponsor. As such, if the employer was to become financially insolvent, the assets would be available to the plan participants and their beneficiaries.

If you are under age 59½, your earnings may be subject to the 10% early withdrawal penalty. If you are over age 59½, you may withdraw before-tax funds (excluding your TVA matching funds) from the 401(k) Plan. You will not pay an early withdrawal penalty; however, your distribution will be taxed as ordinary income.

Go to Fidelity.com/rmd or call 800-343-3548. Use this form to request automatic withdrawals on a regular basis or to request Fidelity to calculate and establish a required minimum distribution (RMD) plan for a Fidelity Self-Employed 401(k), Profit Sharing, or Money Purchase Plan account.