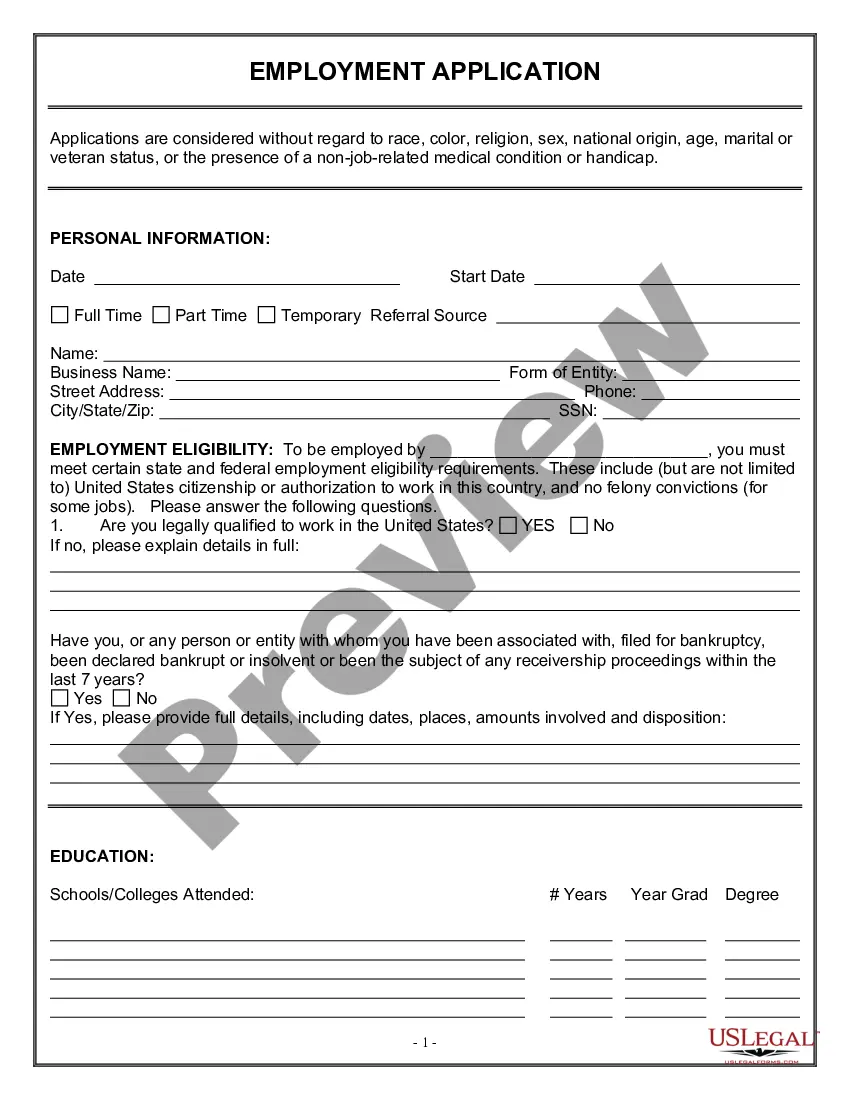

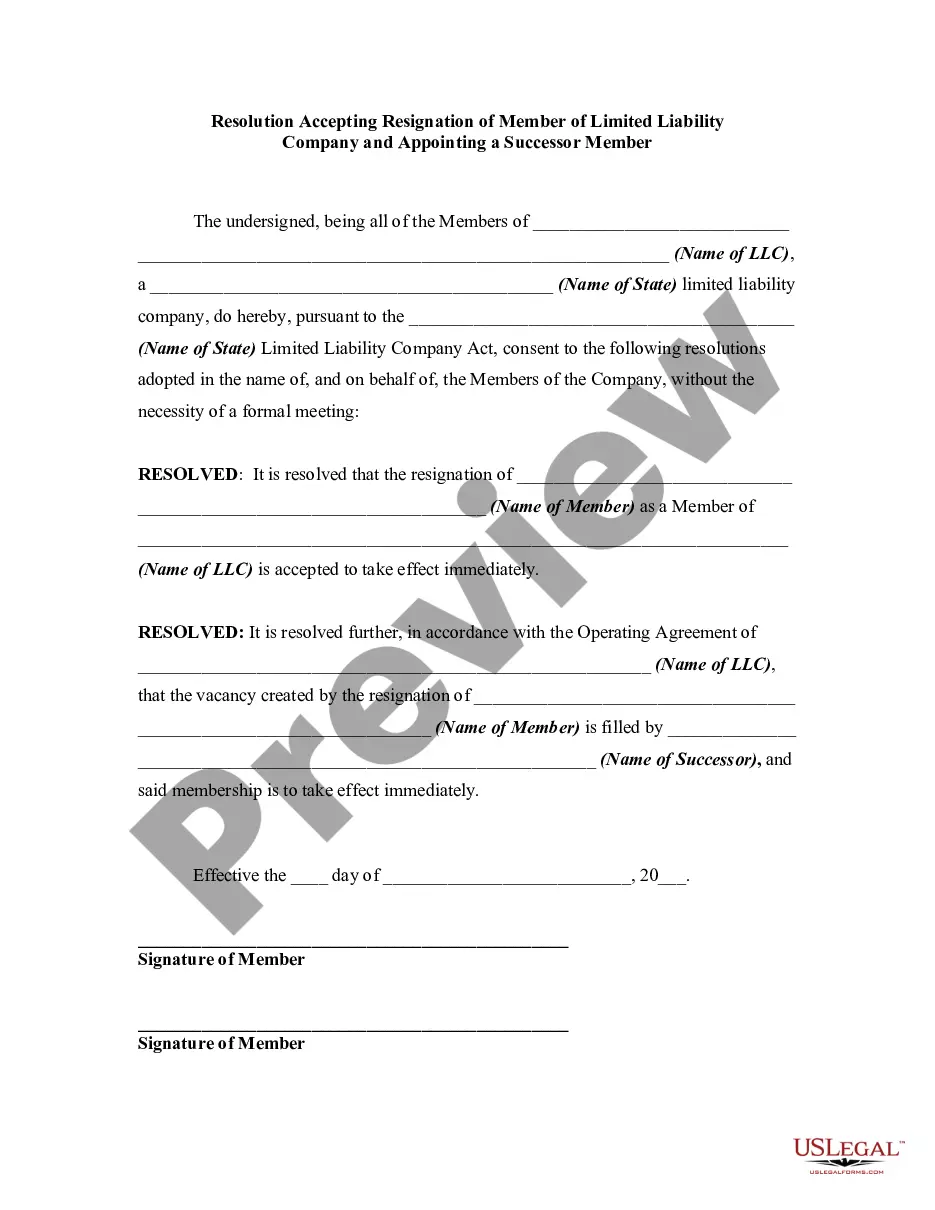

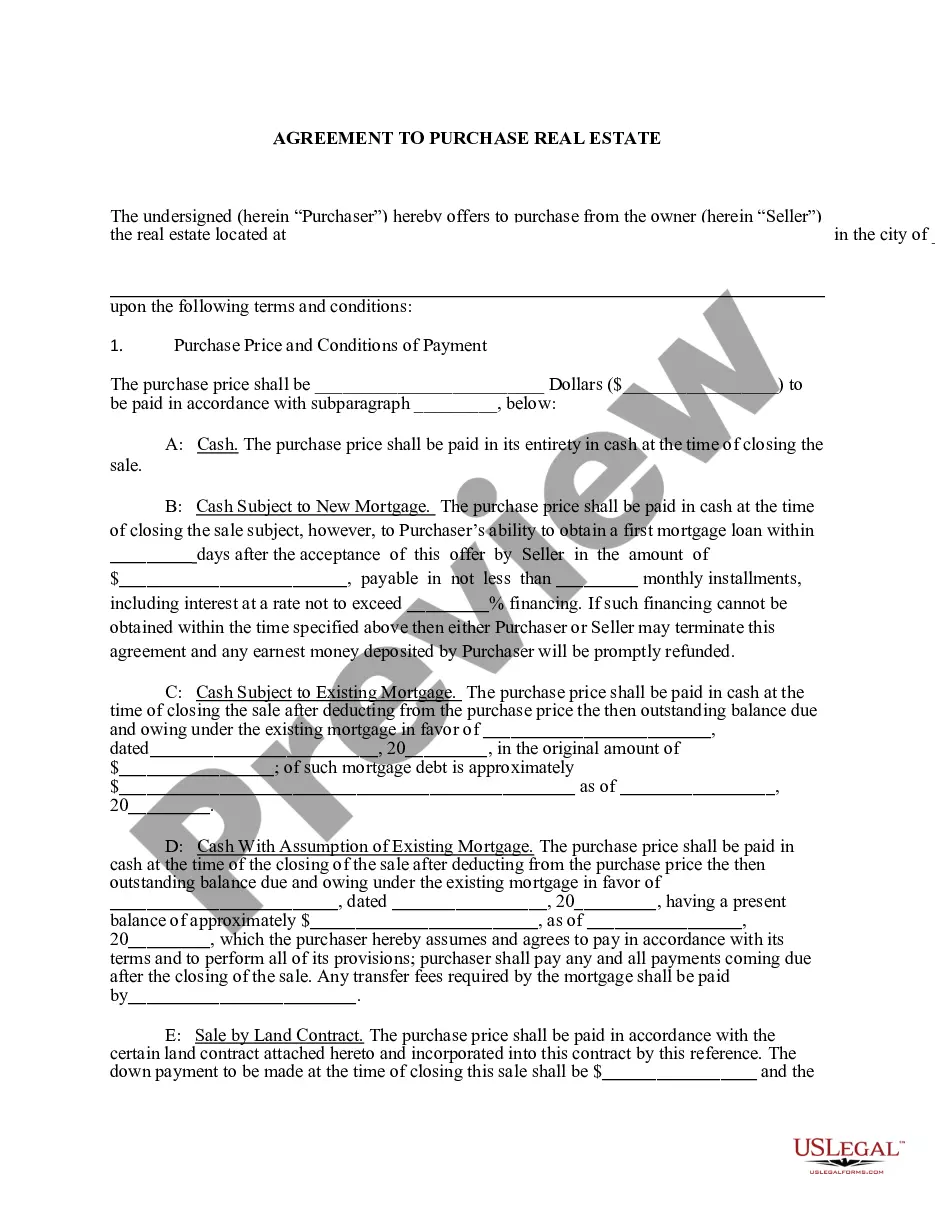

This form is a due diligence checklist that outlines information pertinent to non-employee directors in a business transaction.

Michigan Nonemployee Director Checklist

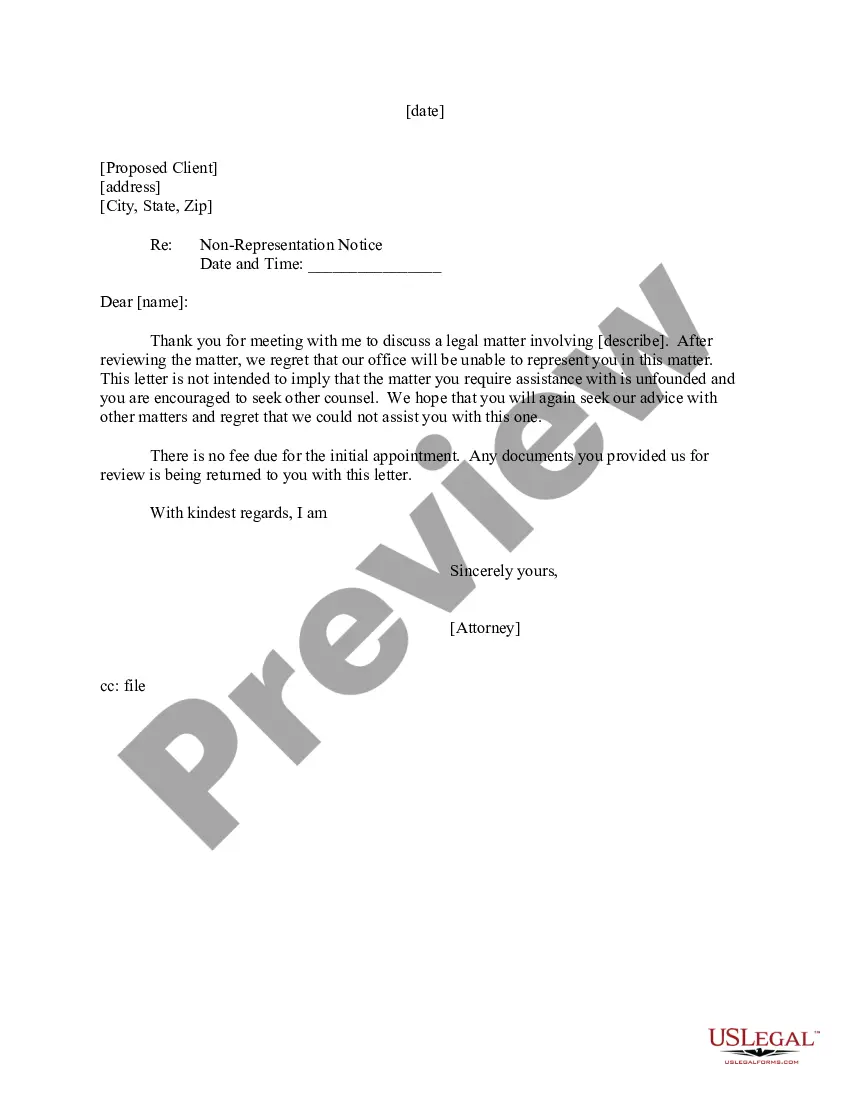

Description

How to fill out Nonemployee Director Checklist?

If you wish to acquire, receive, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's user-friendly and efficient search to obtain the documents you need.

Various templates for business and personal purposes are organized by categories and states, or by keywords.

Every legal document template you purchase is yours forever. You have access to every form you downloaded from your account. Click on the My documents section to choose a form to print or download again.

Be proactive and obtain and print the Michigan Nonemployee Director Checklist with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to obtain the Michigan Nonemployee Director Checklist with just a few clicks.

- If you are already a US Legal Forms member, Log Into your account and click on the Acquire button to get the Michigan Nonemployee Director Checklist.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review feature to examine the form’s content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other variations of the legal form template.

- Step 4. Once you’ve found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, print, or sign the Michigan Nonemployee Director Checklist.

Form popularity

FAQ

Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. The handwriting must be completely legible using black ink block letters to avoid processing errors. The IRS says, Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors.

NEC The NEC is part of the Combined Federal and State program for tax year 2021. If your state participates in this program, you likely have no additional requirements to submit files to your state; however, it is your responsibility to be fully cognizant of your state's rules.

How to Fill Out a 1099-MISC FormEnter your information in the 'payer' section.Fill in your tax ID number.As a business owner, enter the contractor's tax ID number which is found on their form W-9.Fill out the account number you have assigned to the independent contractor.More items...

You should have the following on hand to fill out the 1099-MISC form:Payer's (that's you!) name, address, and phone number.Your TIN (Taxpayer Identification Number)Recipient's TIN.Recipient's name and address.Your account number, if applicable.Amount you paid the recipient in the tax year.

Form 1099-NEC. Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees.Form 1099-MISC.Payer's name, address, and phone number.Payer's TIN.Recipient's TIN.Recipient's name.Street address.City, state, and ZIP.More items...?

Form 1099-NEC. Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees.Form 1099-MISC.Payer's name, address, and phone number.Payer's TIN.Recipient's TIN.Recipient's name.Street address.City, state, and ZIP.More items...?

Treasury requires state copy filing of Form 1099-NEC per Internal Revenue Code (IRC Chapter 61; Section 331). While Form 1099-NEC is included in the Combined Federal/State Filing Program beginning tax year 2021, Michigan requires the state copy be filed directly with Treasury.

NEC The NEC is part of the Combined Federal and State program for tax year 2021. If your state participates in this program, you likely have no additional requirements to submit files to your state; however, it is your responsibility to be fully cognizant of your state's rules.

When filing state copies of forms 1099 with Michigan department of revenue, the agency contact information is: Michigan Department of Treasury, Return Processing Division, Lansing, MI 48930.

Self-employment taxes As a self-employed individual, you must pay Social Security and Medicare taxes. However, since your 1099-NEC income is not subject to employment-tax withholding, you're required to pay these taxes yourself.