Michigan Retirement Benefits Plan

Description

How to fill out Retirement Benefits Plan?

Choosing the best legitimate record design could be a battle. Naturally, there are tons of templates available on the Internet, but how can you obtain the legitimate form you will need? Take advantage of the US Legal Forms site. The assistance provides thousands of templates, for example the Michigan Retirement Benefits Plan, which can be used for enterprise and private requires. All the kinds are examined by pros and satisfy federal and state demands.

When you are previously listed, log in in your account and click on the Obtain key to obtain the Michigan Retirement Benefits Plan. Use your account to search from the legitimate kinds you possess purchased previously. Visit the My Forms tab of your account and obtain an additional version of the record you will need.

When you are a new consumer of US Legal Forms, allow me to share simple instructions for you to comply with:

- Initially, make certain you have chosen the appropriate form for the town/state. It is possible to examine the shape using the Review key and read the shape explanation to make sure it is the right one for you.

- If the form is not going to satisfy your requirements, take advantage of the Seach area to obtain the appropriate form.

- When you are sure that the shape is acceptable, click on the Acquire now key to obtain the form.

- Choose the rates program you need and type in the needed details. Build your account and pay for the transaction utilizing your PayPal account or bank card.

- Opt for the data file file format and down load the legitimate record design in your system.

- Total, change and print out and sign the obtained Michigan Retirement Benefits Plan.

US Legal Forms may be the largest catalogue of legitimate kinds where you can see various record templates. Take advantage of the company to down load appropriately-made files that comply with state demands.

Form popularity

FAQ

Most taxpayers born after 1952 have no pension subtraction in 2022. After reaching age 67 (on or before December 31, 2022), individuals are entitled to subtract the Michigan Standard Deduction against all income. This deduction is reduced by: the personal exemption amount.

Michigan is tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 4.25%.

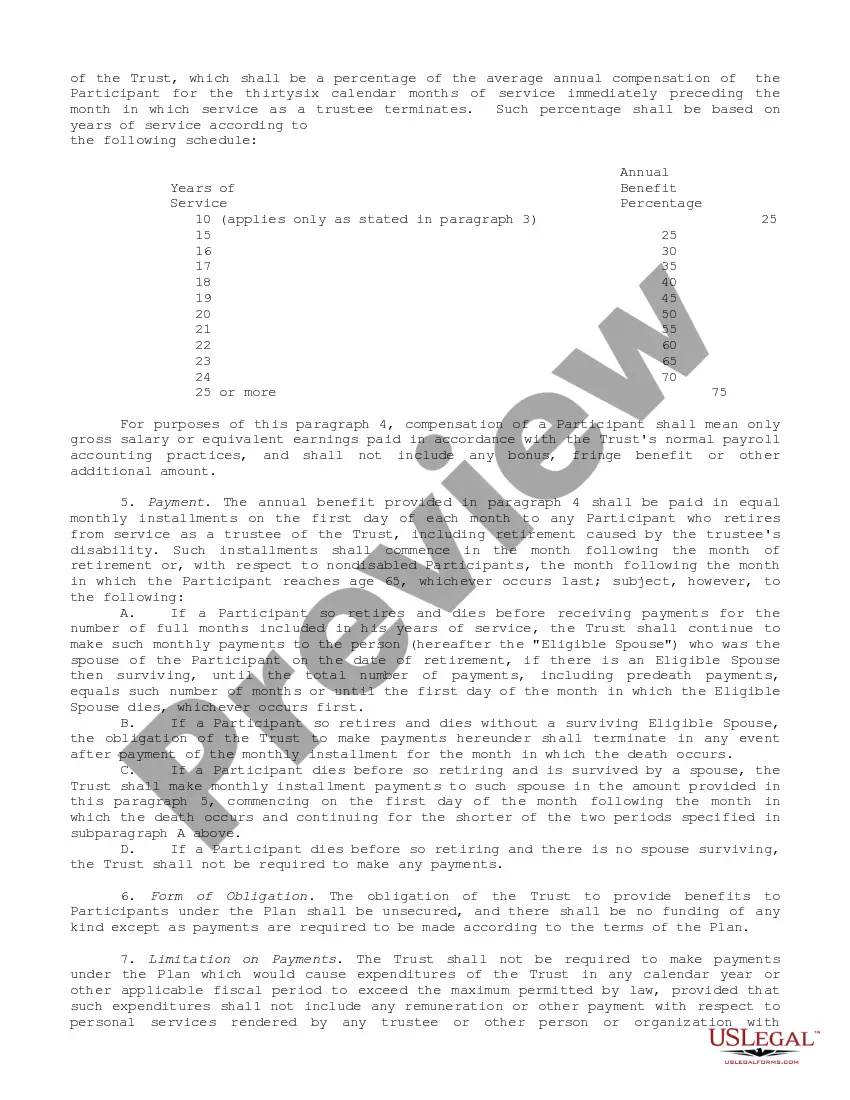

You will qualify for full retirement at age 60 with at least 10 years of service (YOS), or age 55 with 30 YOS. (Exception: If you are an unclassified legislative branch, executive branch, or judicial branch employee, you are vested for a full retirement benefit at age 60 with 5 YOS.)

Unless a participant elects otherwise, benefits under a qualified plan must begin within 60 days after the close of the latest plan year in which the participant: turns 65 (or the plan's normal retirement age, if earlier); completes 10 years of plan participation; or. terminates service with the employer.

You are vested when you have enough service to qualify for a pension though you may not yet meet the age requirement, when you have the equivalent of 10 years of full-time public school employment.

Your annual pension is based on a formula that multiplies your final average compensation (FAC) under the Defined Benefit (DB) plan by a pension factor times your years of credited service under the Defined Benefit (DB) plan. Note: There are different pension formulas for covered employees and conservation officers.

In 2018, 386,072 residents of Michigan received a total of $8.9 billion in pension benefits from state and local pension plans. The average pension benefit received was $1,924 per month or $23,090 per year.

For the 2026 tax year and after, all retirees, no matter when they were born, will be able to deduct their retirement or pension benefits up to 100% of a set amount that typically would have only applied to those born in 1945 and earlier. The maximum set amount changes each year.