Michigan Approval of employee stock purchase plan for The American Annuity Group, Inc.

Description

How to fill out Approval Of Employee Stock Purchase Plan For The American Annuity Group, Inc.?

Are you presently in the placement that you need files for possibly company or specific reasons almost every time? There are a variety of legitimate document themes available on the Internet, but locating versions you can depend on isn`t simple. US Legal Forms provides thousands of kind themes, like the Michigan Approval of employee stock purchase plan for The American Annuity Group, Inc., which are composed in order to meet federal and state requirements.

Should you be already knowledgeable about US Legal Forms internet site and possess your account, simply log in. Following that, you are able to acquire the Michigan Approval of employee stock purchase plan for The American Annuity Group, Inc. design.

Should you not provide an profile and wish to begin using US Legal Forms, adopt these measures:

- Find the kind you require and ensure it is for the proper town/county.

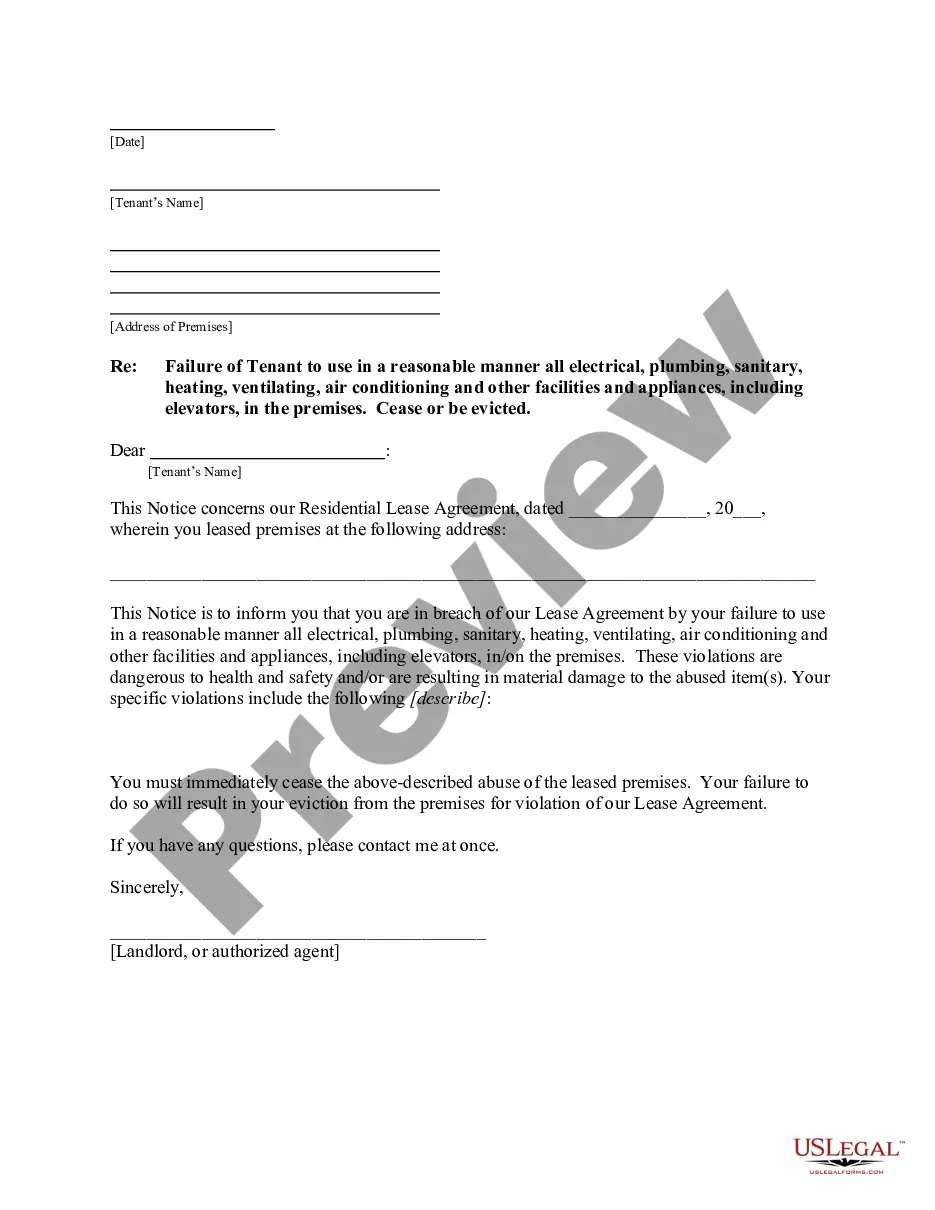

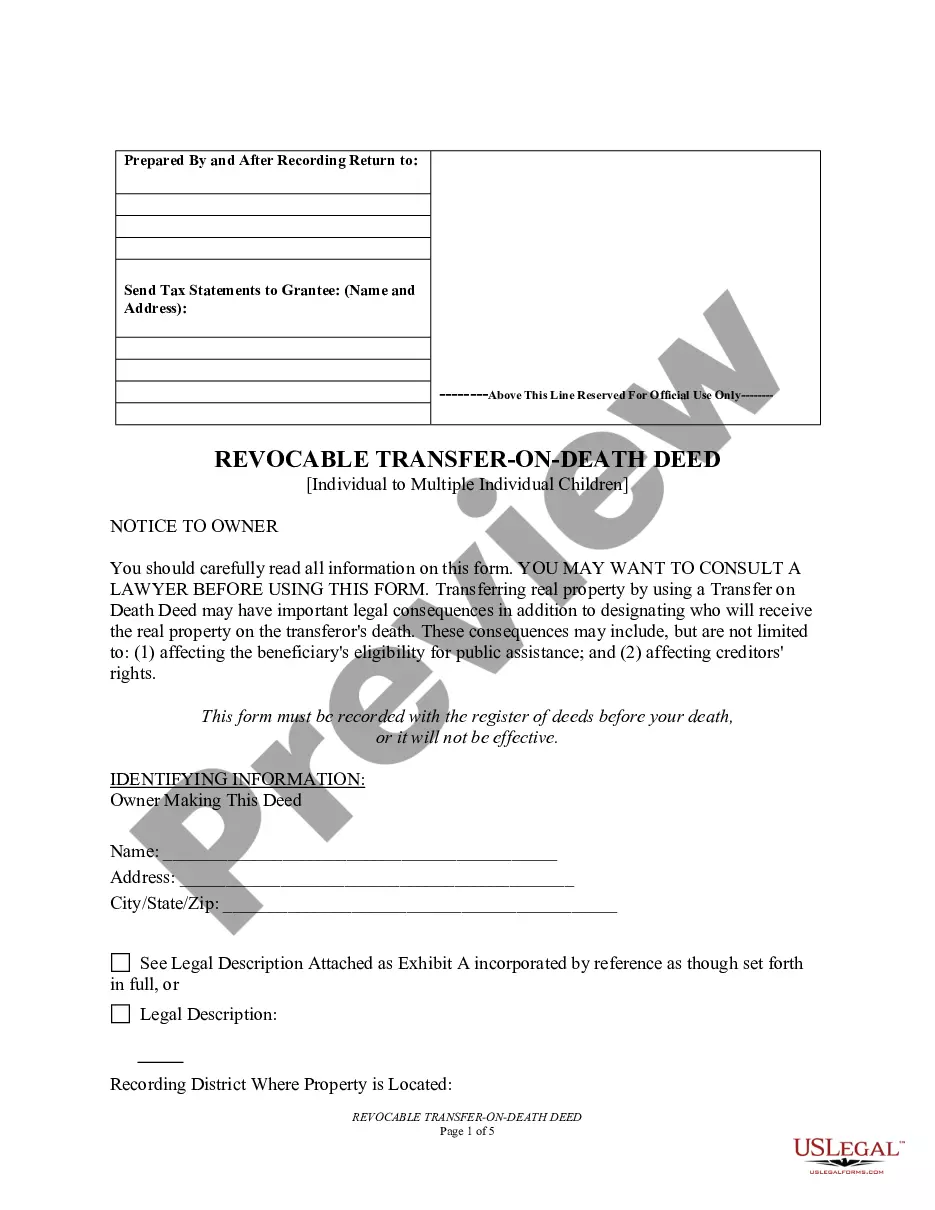

- Take advantage of the Preview button to check the shape.

- Browse the description to actually have selected the correct kind.

- In case the kind isn`t what you are seeking, use the Research industry to discover the kind that suits you and requirements.

- If you get the proper kind, click Get now.

- Pick the prices program you need, complete the desired information to generate your bank account, and pay money for the transaction making use of your PayPal or bank card.

- Decide on a hassle-free file file format and acquire your version.

Get every one of the document themes you might have bought in the My Forms menus. You can obtain a additional version of Michigan Approval of employee stock purchase plan for The American Annuity Group, Inc. anytime, if necessary. Just click the needed kind to acquire or print the document design.

Use US Legal Forms, the most substantial selection of legitimate varieties, in order to save some time and avoid mistakes. The service provides appropriately made legitimate document themes that can be used for a range of reasons. Make your account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

How is the $25,000 limit calculated? The basic rule is that each employee cannot purchase more than $25,000 per year, valued using the fair market value on the date he/she enrolled in the current offering.

How to offer your employees equity compensation Decide which equity options you will offer. Choose which type of equity compensation you want to offer to employees and contractors. ... Create an employee option pool. ... Allocate equity based on seniority and market salary rates. ... Establish a vesting schedule and terms.

An employee stock purchase plan (ESPP) is a company-run program in which participating employees can purchase company stock directly, at a discounted price. Employees contribute to the plan through payroll deductions which build up between the offering date and the purchase date.

10 Steps for Creating an Employee Share Purchase Plan Determine the plan's purpose. ... Conduct external and internal research. ... Establish a budget. ... Pick the right components for the company. ... Seek stakeholder buy-in. ... Prepare early for shareholder approval. ... Select a provider. ... Create a robust implementation plan.

With qualified Section 423 employee stock purchase plans, you are not taxed at the time the shares are purchased, only when you sell. Depending on whether the shares were held for the required holding period, a portion of your gain may be taxed as capital gains or as ordinary income.

In this situation, you sell your ESPP shares more than one year after purchasing them, but less than two years after the offering date. This is a disqualifying disposition because you sold the stock less than two years after the offering (grant) date.

Maximum contributions: Tax rules cap the amount of company stock an employee can accrue in an ESPP at $25,000 of the fair market value of the stock per year. Most plans allow employees to elect a payroll deduction between 1% and 15%.

A: To participate in the ESPP, you must enroll during the enrollment period which is offered 2 times a year: ? December 1 ? December 15 for the offering period beginning January 1; and ? June 1 ? June 15 for the offering period beginning July 1.