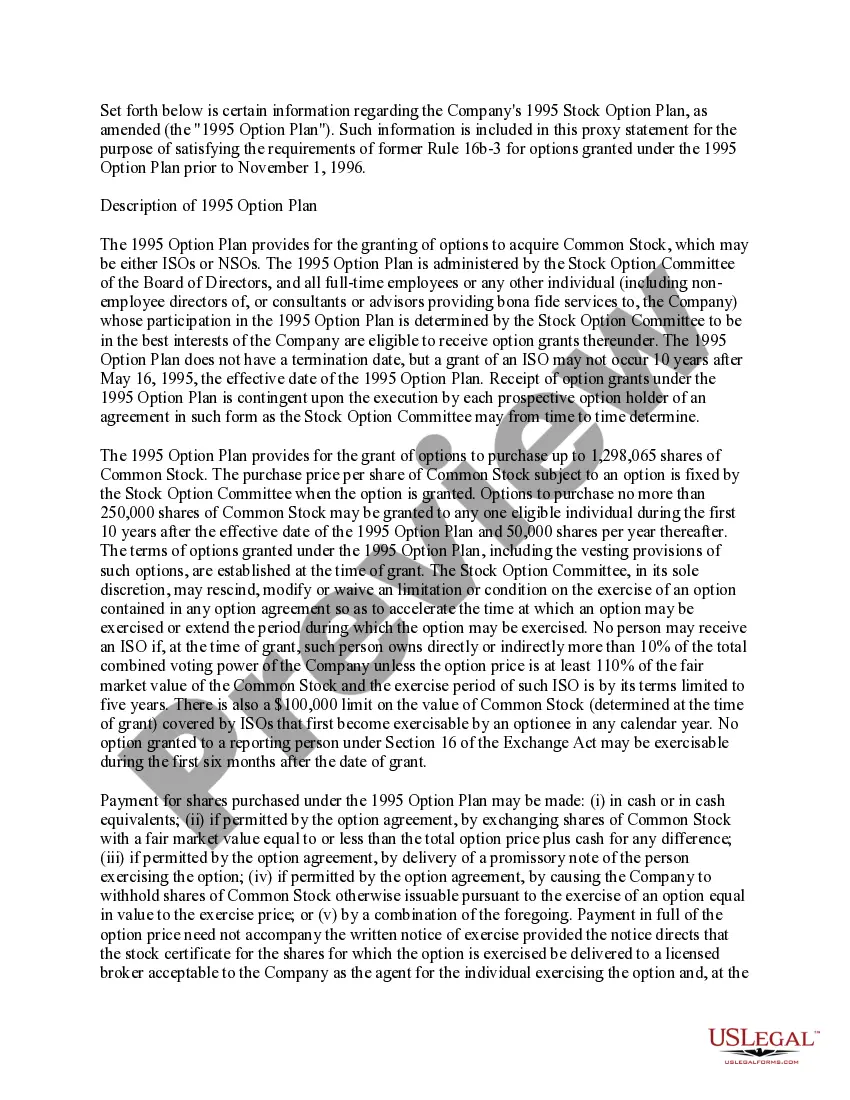

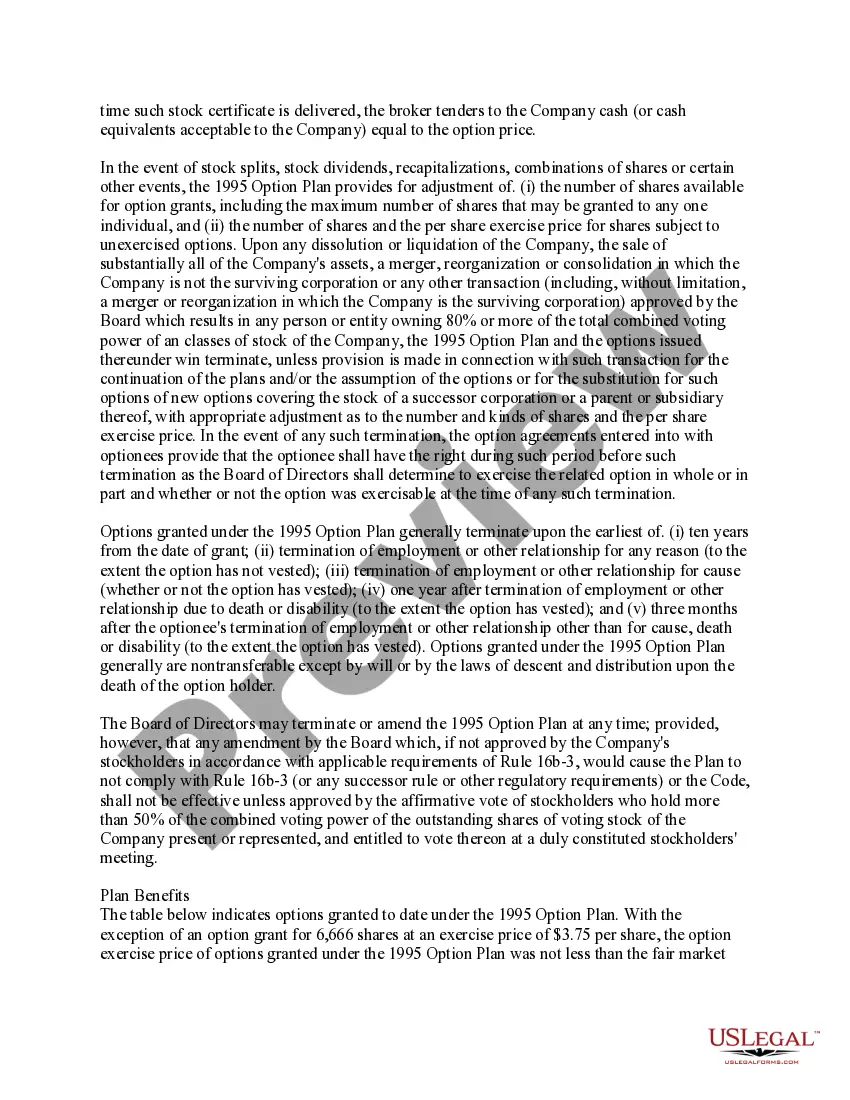

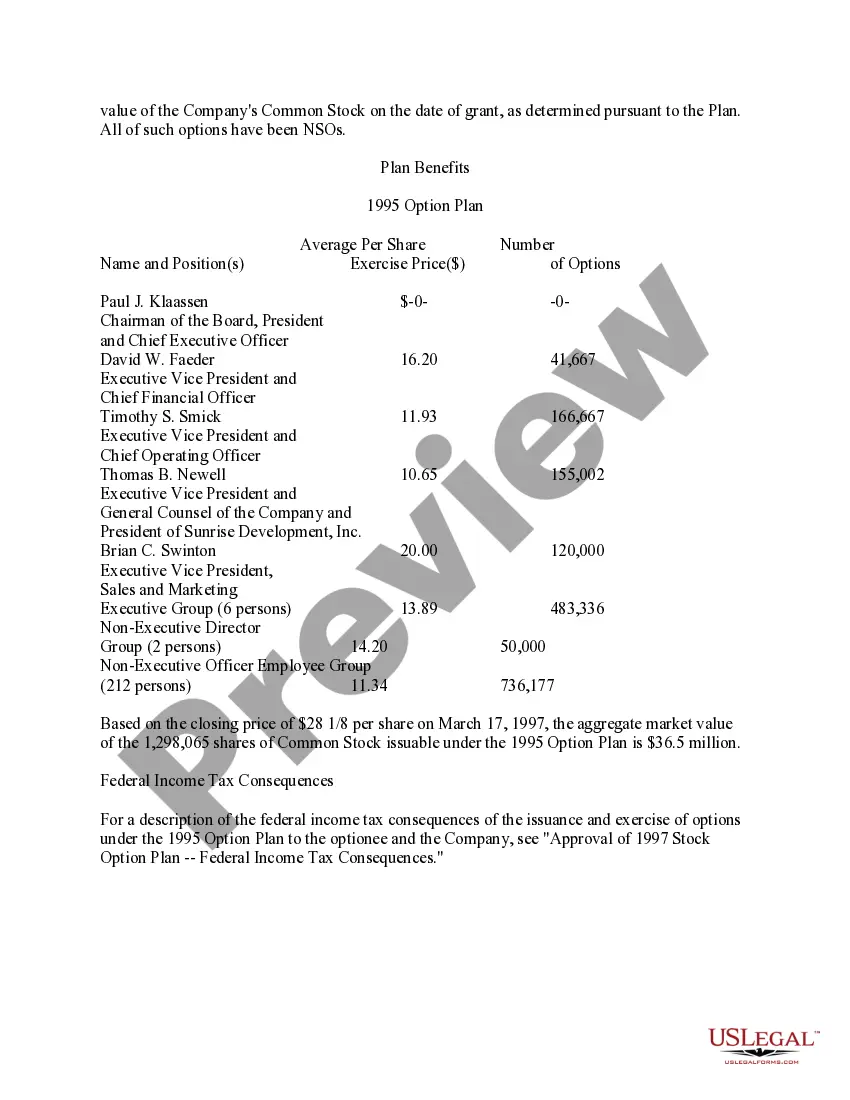

Michigan Approval of Stock Option Plan

Description

How to fill out Approval Of Stock Option Plan?

US Legal Forms - among the biggest libraries of legal forms in the USA - provides a variety of legal document templates you may download or printing. Utilizing the website, you may get a huge number of forms for company and personal uses, sorted by categories, states, or search phrases.You can find the most recent versions of forms just like the Michigan Approval of Stock Option Plan within minutes.

If you already have a subscription, log in and download Michigan Approval of Stock Option Plan through the US Legal Forms local library. The Download button will show up on every single develop you view. You gain access to all previously downloaded forms within the My Forms tab of your account.

If you want to use US Legal Forms the first time, listed here are easy guidelines to help you began:

- Be sure you have selected the correct develop for the area/county. Click on the Preview button to examine the form`s articles. Read the develop explanation to ensure that you have selected the correct develop.

- When the develop doesn`t satisfy your requirements, make use of the Look for area at the top of the screen to obtain the the one that does.

- Should you be pleased with the shape, validate your choice by clicking on the Acquire now button. Then, choose the rates plan you favor and offer your credentials to sign up for an account.

- Procedure the financial transaction. Use your bank card or PayPal account to accomplish the financial transaction.

- Select the structure and download the shape on the system.

- Make changes. Fill out, edit and printing and indication the downloaded Michigan Approval of Stock Option Plan.

Each web template you put into your account lacks an expiry time which is your own property permanently. So, in order to download or printing another version, just go to the My Forms area and then click in the develop you want.

Obtain access to the Michigan Approval of Stock Option Plan with US Legal Forms, the most considerable local library of legal document templates. Use a huge number of specialist and status-particular templates that meet your organization or personal requires and requirements.

Form popularity

FAQ

(2) "Business activity" means a transfer of legal or equitable title to or rental of property, whether real, personal, or mixed, tangible or intangible, or the performance of services, or a combination thereof, made or engaged in, or caused to be made or engaged in, whether in intrastate, interstate, or foreign ...

The exemption amount is $5,400 per year times the number of personal and dependency exemptions allowed under Part 1 of the Michigan Income Tax Act. An employee may not claim more exemptions on the MI-W4 than can be claimed on the employee's Michigan income tax return.

The CIT replaces the Michigan Business Tax; however, MBT taxpayers who have received or been assigned certain certificated credits may elect to continue to file under the MBT rather than the new CIT in order to claim such credits. Filing Requirements 2. Who must file CIT quarterly estimates?

The exemption amount is $5,400 per year times the number of personal and dependency exemptions allowed under Part 1 of the Michigan Income Tax Act. An employee may not claim more exemptions on the MI-W4 than can be claimed on the employee's Michigan income tax return.

What Is the Additional Standard Deduction for People Over 65? Filing StatusAdditional Standard Deduction 2023 (Per Person)Married Filing Jointly or Married Filing Separately ? 65 or older OR blind ? 65 or older AND blind$1,500 $3,000Single or Head of Household ? 65 or older OR blind ? 65 or older AND blind$1,850 $3,700 5 days ago

These exemptions include: ? $5,000 personal exemption . $5,000 for each dependent . $5,000 if you were the parent of a stillborn child delivered in 2022 and have a certificate of stillbirth from the Michigan Department of Health and Human Services .

Michigan Tax Rates, Collections, and Burdens Michigan has a flat 4.25 percent individual income tax rate. There are also jurisdictions that collect local income taxes. Michigan has a 6.00 percent corporate income tax rate. Michigan has a 6.00 percent state sales tax rate and does not levy any local sales taxes.

Taxpayers born January 1, 1953 through January 1, 1956 should not file Form 4884. Instead, taxpayers may be eligible for a Tier 3 Michigan Standard Deduction. This deduction is up to $20,000 for a return filed as single or married filing separately, or up to $40,000 for a married filing jointly return.