Michigan Separation Notice for 1099 Employee

Description

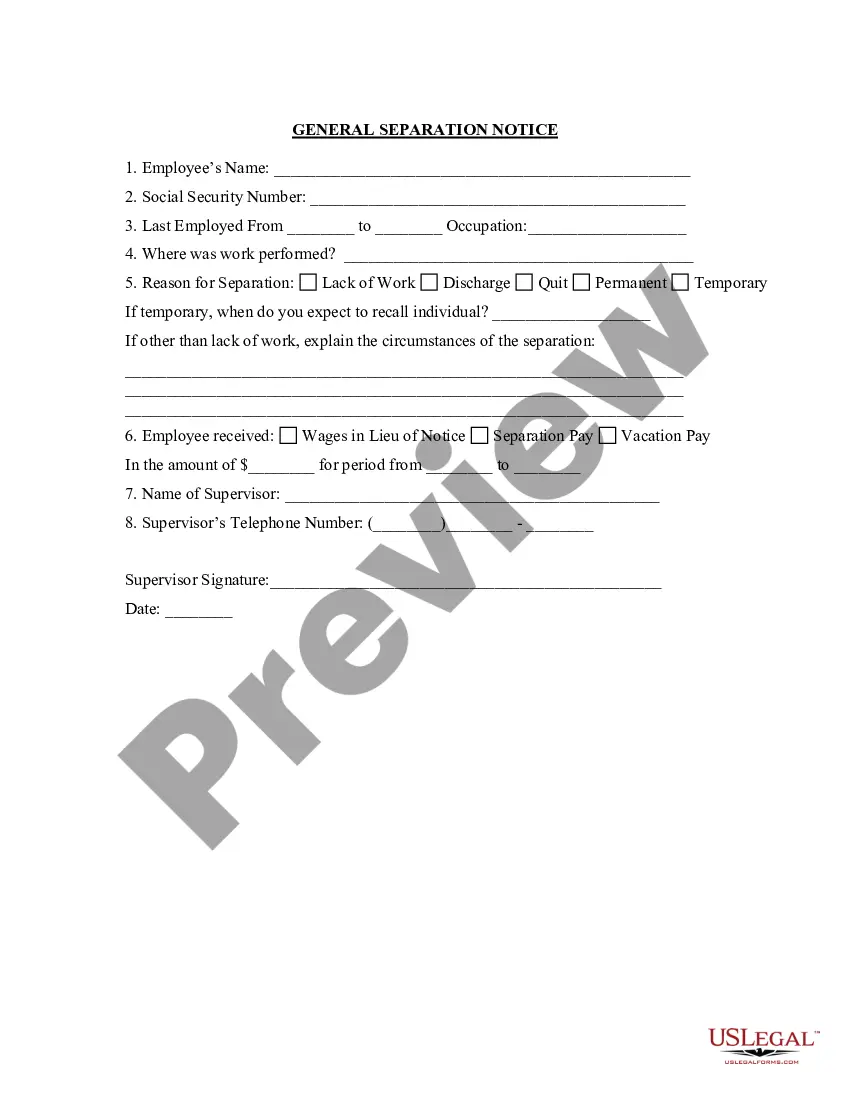

How to fill out Separation Notice For 1099 Employee?

Are you in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust isn’t simple.

US Legal Forms offers a vast selection of form templates, including the Michigan Separation Notice for 1099 Employee, which are designed to comply with federal and state regulations.

Utilize US Legal Forms, one of the most comprehensive collections of legal forms, to save time and avoid mistakes.

The service offers expertly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Michigan Separation Notice for 1099 Employee template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/region.

- Use the Preview button to view the document.

- Review the details to ensure you have selected the right form.

- If the form isn’t what you are looking for, use the Search box to find the form that meets your needs and requirements.

- Once you locate the correct form, click Get now.

- Choose the payment plan you want, enter the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Find all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the Michigan Separation Notice for 1099 Employee at any time, if needed. Just select the necessary form to download or print the document template.

Form popularity

FAQ

As an employer, you have legal obligations when you terminate an employee. For example, if you are an employer terminating an employee, you must complete an employment separation certificate upon request. Indeed, it is important that as an employer you take such obligations seriously to avoid issues in the future.

Beginning Monday, April 13th, 2020, Michigan's self-employed workers, gig workers, 1099-independent contractors, and low-wage workers affected by COVID-19 can apply for PUA benefits online. Filing online at Michigan.gov/UIA is the fastest and easiest way to access these benefits.

employed person is not entitled to unemployment benefits. What court cases have said: The fact that both the employer and the employee state that there is an independent contractor relationship, or the fact that there is actually a written contract, is not binding.

When a company ends an employee's job, they typically provide a termination letter, also called a letter of separation, stating the reason for termination and next steps. A termination letter is an official and professional way to document and describe the separation between the employee and employer.

Working as an independent contractor gives you a number of freedoms that include allowing you to end a working relationship if you don't like your client.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

UIA 1711 Authorized by (Rev. 03-17) MCL 421.1, et seq. Rule R 421.204 of the Michigan Administrative Rules requires that a completed copy of this form, or an equivalent written notice, be given to each employee before, or when he/she is separated from your employ.

1099 Worker Defined A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

With Pandemic Unemployment Assistance (PUA), many people, including those who don't typically qualify for unemployment benefits, such as self-employed workers, independent contractors, low-wage workers and those with limited work history may qualify for PUA.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.