Michigan Credit Inquiry

Description

How to fill out Credit Inquiry?

Are you presently in a circumstance where you need paperwork for potentially corporate or personal purposes nearly every day.

There are numerous legal document templates accessible on the internet, but finding forms you can trust isn't straightforward.

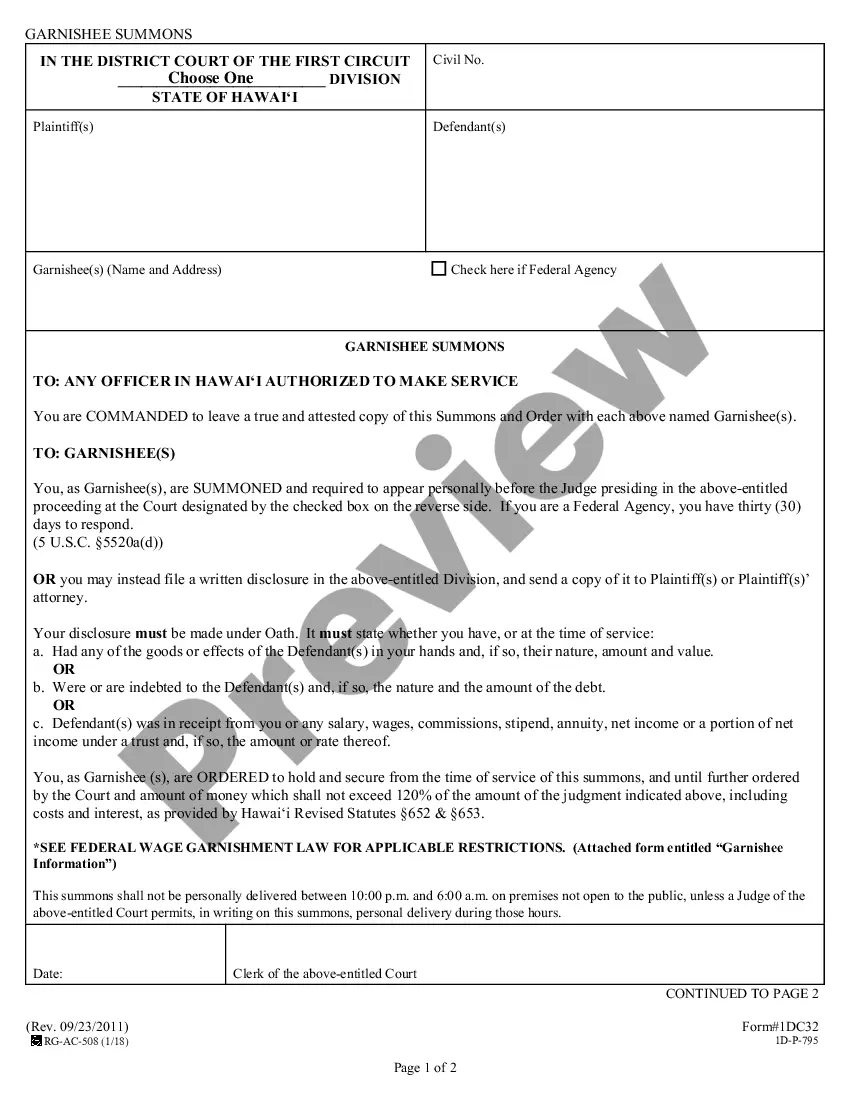

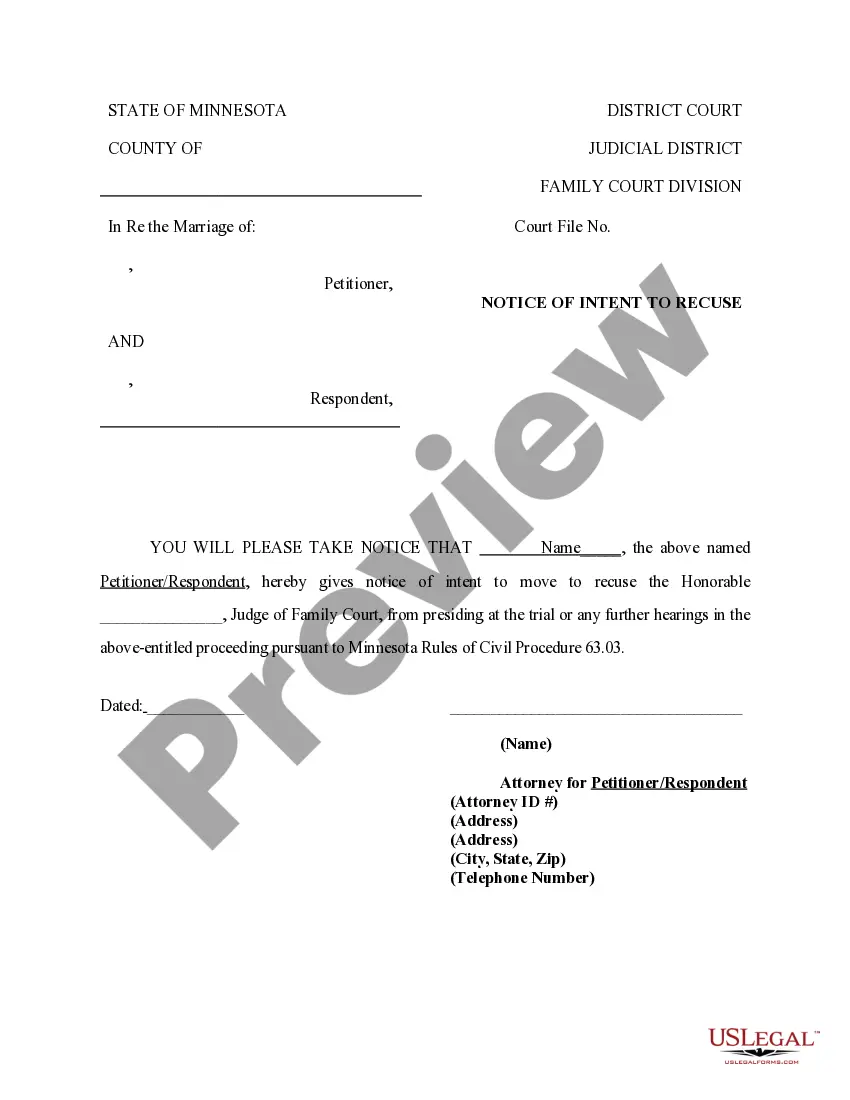

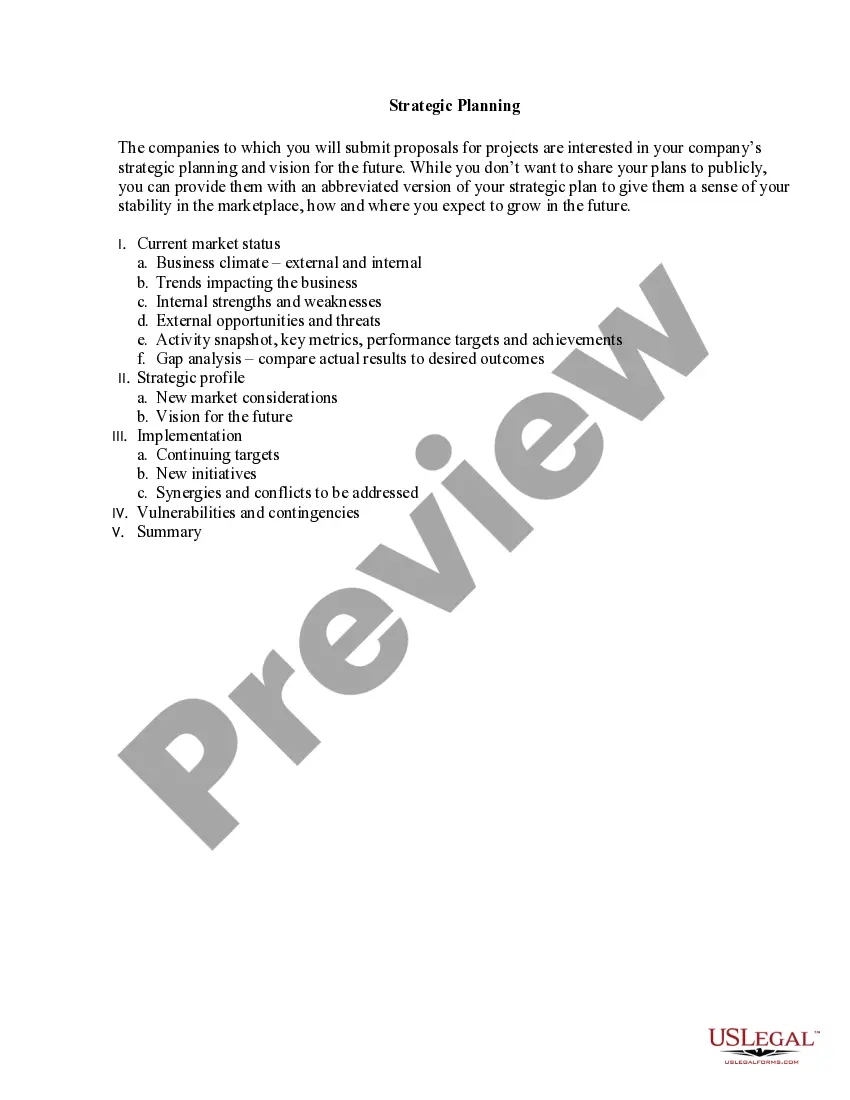

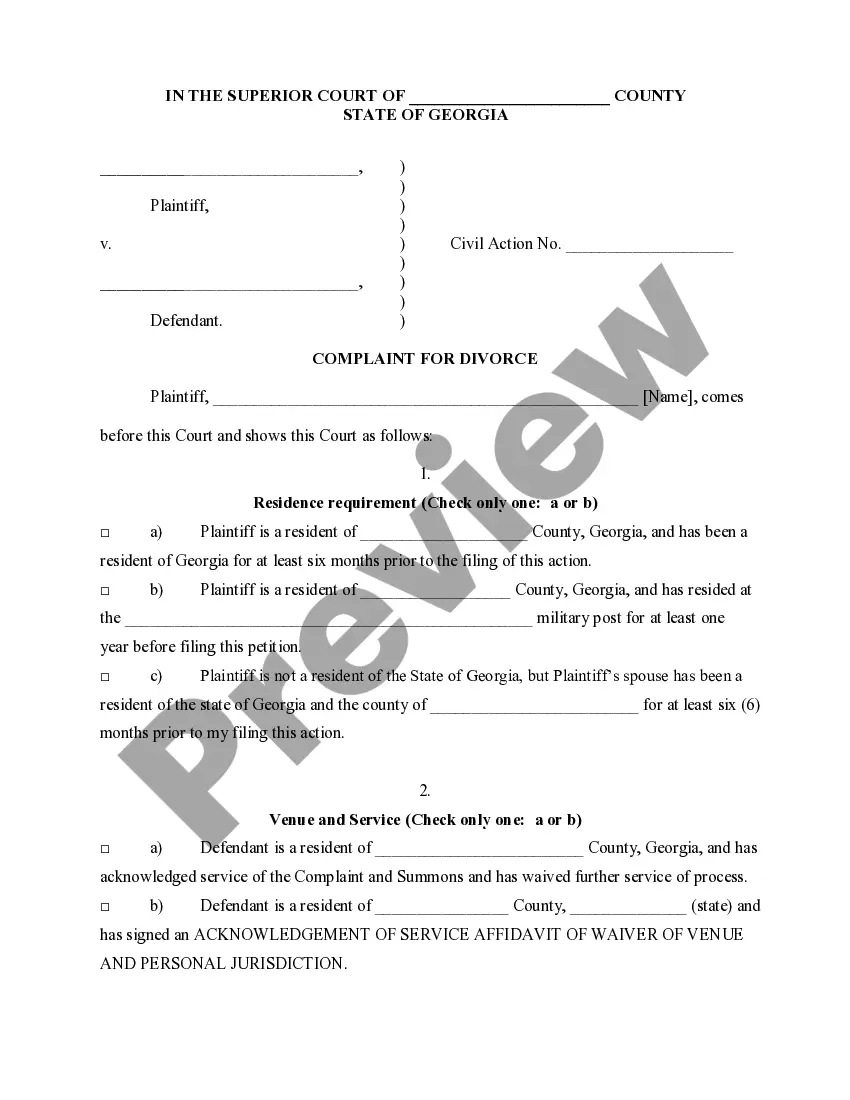

US Legal Forms offers a vast collection of form templates, including the Michigan Credit Inquiry, crafted to comply with federal and state regulations.

When you find the correct form, click Acquire now.

Select the payment plan you prefer, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Michigan Credit Inquiry template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Acquire the form you need and ensure it is for the correct city/state.

- Use the Review button to evaluate the form.

- Check the description to confirm that you have picked the right form.

- If the form isn't what you require, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

Though prospective employers don't see your credit score in a credit check, they do see your open lines of credit (such as mortgages), outstanding balances, auto or student loans, foreclosures, late or missed payments, any bankruptcies and collection accounts.

All new auto or mortgage loan or utility inquiries will show on your credit report; however, only one of the inquiries within a specified window of time will impact your credit score. This exception generally does not apply to other types of loans, such as credit cards.

According to FICO, a hard inquiry from a lender will decrease your credit score five points or less. If you have a strong credit history and no other credit issues, you may find that your scores drop even less than that. The drop is temporary.

Hard inquiries have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report for two years, it will usually only impact your credit for a few months.

In general, credit inquiries have a small impact on your FICO Scores. For most people, one additional credit inquiry will take less than five points off their FICO Scores. For perspective, the full range for FICO Scores is 300-850. Inquiries can have a greater impact if you have few accounts or a short credit history.

This information is reported to Equifax by your lenders and creditors and includes the types of accounts (for example, a credit card, mortgage, student loan, or vehicle loan), the date those accounts were opened, your credit limit or loan amount, account balances, and your payment history.

How Many Hard Inquiries Per Year Until Your Credit Score Drops? Six or more inquiries are considered too many and can seriously impact your credit score. If you have multiple inquiries on your credit report, some may be unauthorized and can be disputed.

According to FICO, a hard inquiry from a lender will decrease your credit score five points or less. If you have a strong credit history and no other credit issues, you may find that your scores drop even less than that. The drop is temporary.

According to FICO, a hard inquiry from a lender will decrease your credit score five points or less. If you have a strong credit history and no other credit issues, you may find that your scores drop even less than that.

The impact of a single hard inquiry is relatively small, usually dinging your FICO® Score five points or less. You can gain those points back over just a few months' time, however, with positive credit habits such as paying down debt and making all your payments on time.