Michigan Assignment of Profits of Business

Description

How to fill out Assignment Of Profits Of Business?

If you need to be thorough, acquire, or create official document templates, utilize US Legal Forms, the largest collection of official forms available online.

Take advantage of the site's straightforward and user-friendly search feature to locate the documents you require.

A selection of templates for business and personal applications are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you require, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction. Step 6. Select the format of the official form and download it to your device. Step 7. Complete, modify and print or sign the Michigan Assignment of Profits of Business.

- Utilize US Legal Forms to find the Michigan Assignment of Profits of Business in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click on the Download button to retrieve the Michigan Assignment of Profits of Business.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the appropriate city/state.

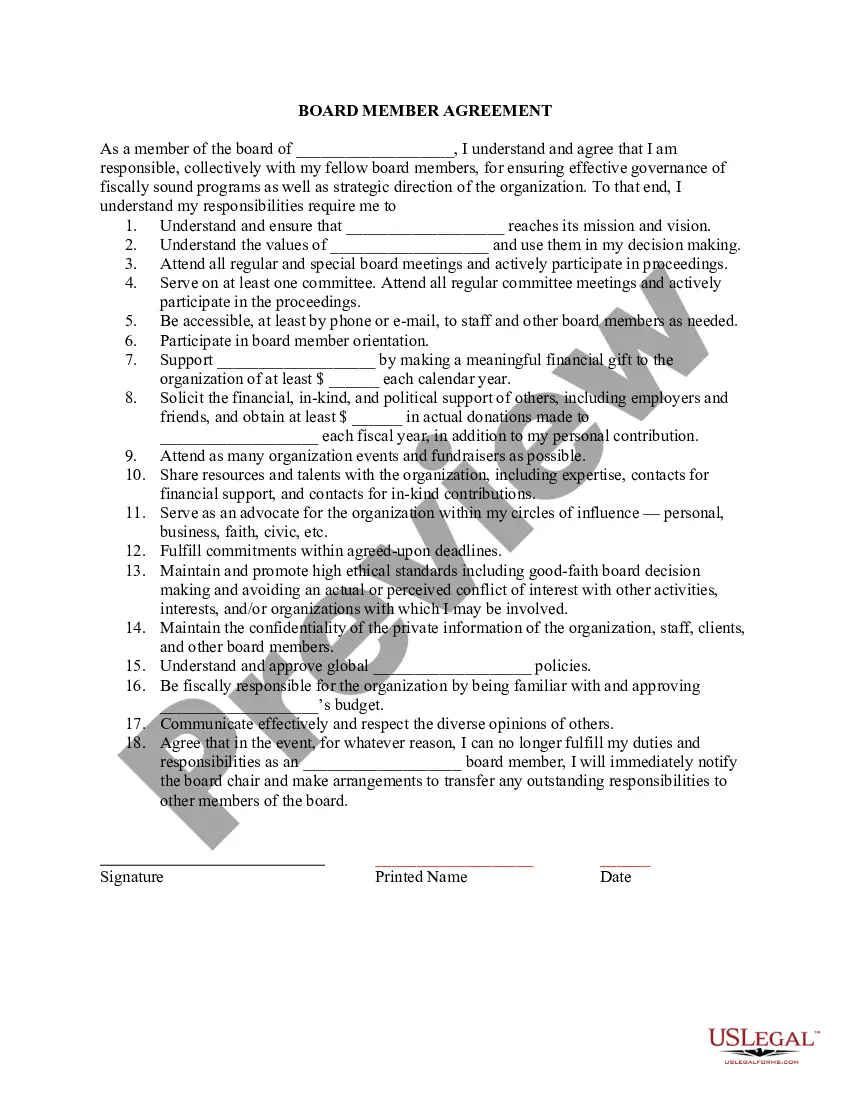

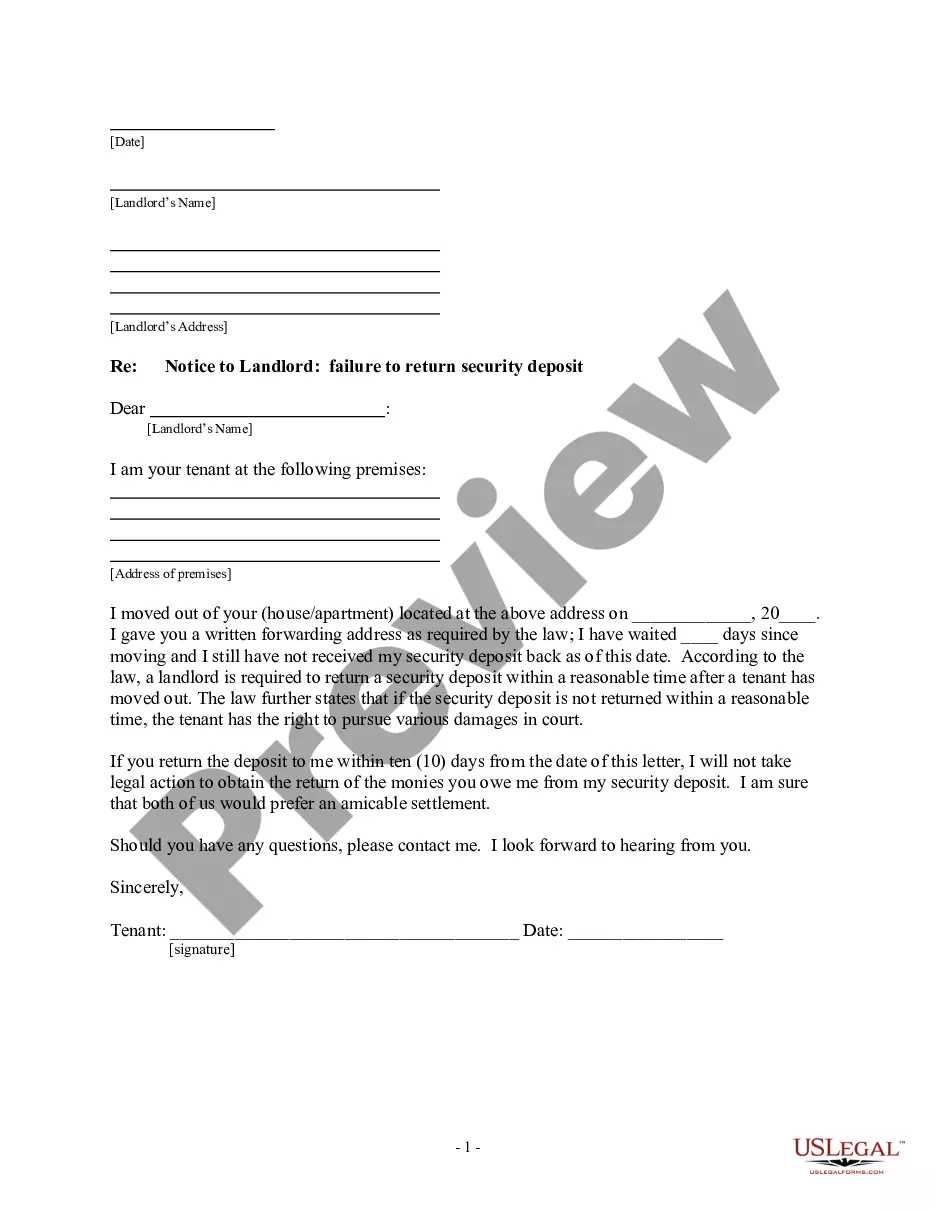

- Step 2. Use the Review option to examine the contents of the form. Don’t forget to check the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the official form layout.

Form popularity

FAQ

The term 'Income from business and profession' means any income shown in profit and loss account after taking into account all the allowed expenditures by an assessee. The income also includes both positive (profit) and negative incomes (loss).

Taxable income refers to any individual's or business' compensation that is used to determine tax liability. The total income amount or gross income is used as the basis to calculate how much the individual or organization. Organizational structures owes the government for the specific tax period.

Income earned through your profession or business is charged under the head 'profits and gains of business or profession. ' The income chargeable to tax is the difference between the credits received on running the business and expenses incurred.

Business income is earned income and encompasses any income realized from an entity's operations. For tax purposes, business income is treated as ordinary income. Business expenses and losses often offset business income.

The main difference between business and professional income is that businesses have inventory and sales, while professionals have work-in-progress and charge fees. Normally, those earning professional income are governed by a licensing body (e.g., architects, dentists, doctors, engineers, lawyers etc.).

Five main Income tax headsIncome from Salary.Income from House Property.Income from Profits and Gains of Profession or Business.Income from Capital Gains.Income from Other Sources.

Presumptive taxation for businesses is covered under section 44AD of the income tax act. Any business which has a turnover of less than Rs 2 crore can opt to be taxed presumptively. They must declare profits of 8% for non-digital transactions or 6% for digital transactions, whichever one is applicable.

Interest received on Compensation or Enhanced Compensation : Profits derived from the aforesaid business activities are not taxable under section 28, under the head Profits and gains of business or profession.

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Under section 28, the following income is chargeable to tax under the head Profits and gains of business or profession: profits and gains of any business or profession; any compensation or other payments due to or received by any person specified in section 28(ii);