Michigan Sample Letter regarding Discharge of Debtor

Description

How to fill out Sample Letter Regarding Discharge Of Debtor?

US Legal Forms - one of several largest libraries of legitimate types in America - gives a wide range of legitimate document templates you can down load or produce. While using website, you can get a huge number of types for organization and individual functions, categorized by types, claims, or keywords and phrases.You will discover the most up-to-date variations of types such as the Michigan Sample Letter regarding Discharge of Debtor within minutes.

If you have a registration, log in and down load Michigan Sample Letter regarding Discharge of Debtor from the US Legal Forms collection. The Obtain option will appear on every single type you view. You get access to all earlier acquired types from the My Forms tab of your own profile.

If you want to use US Legal Forms initially, listed here are simple instructions to help you began:

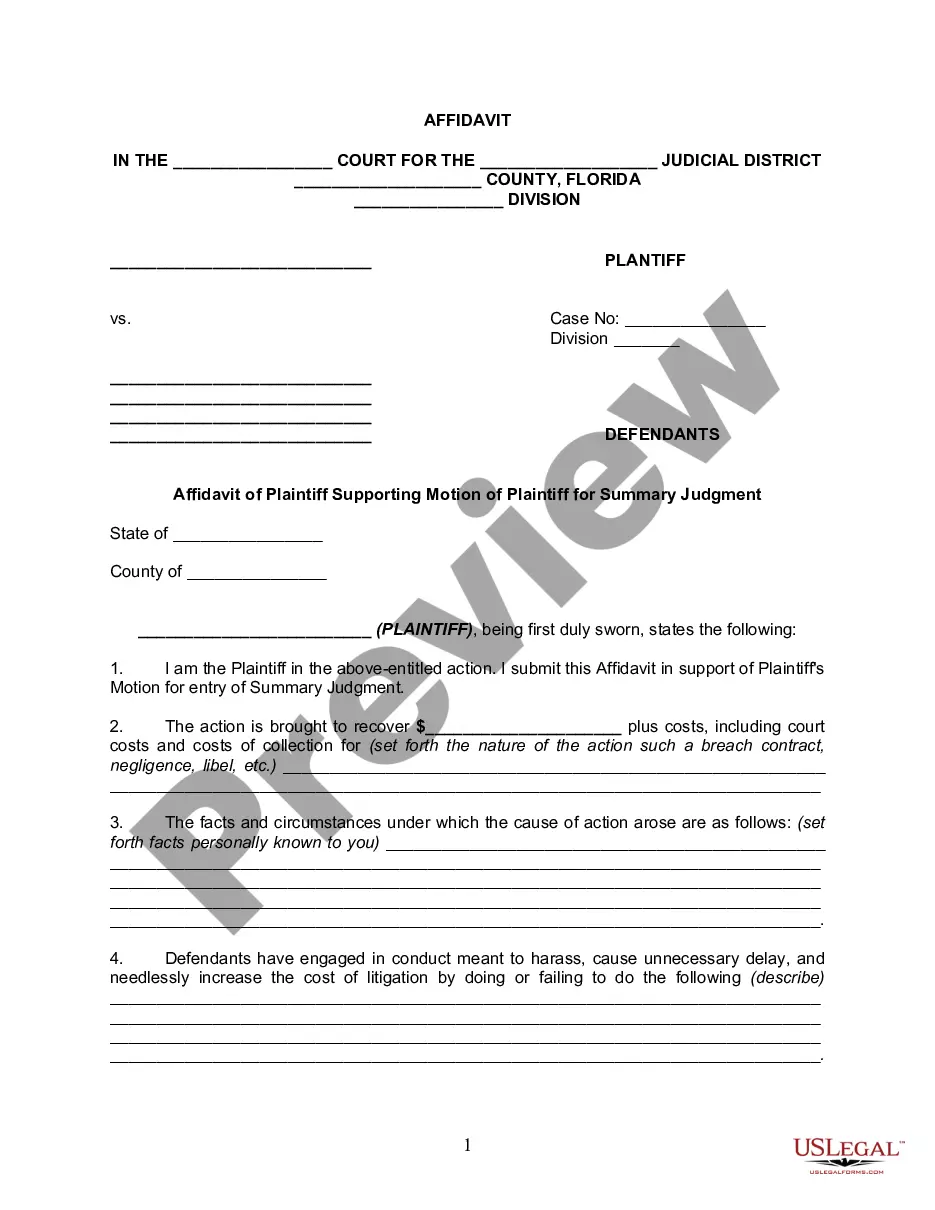

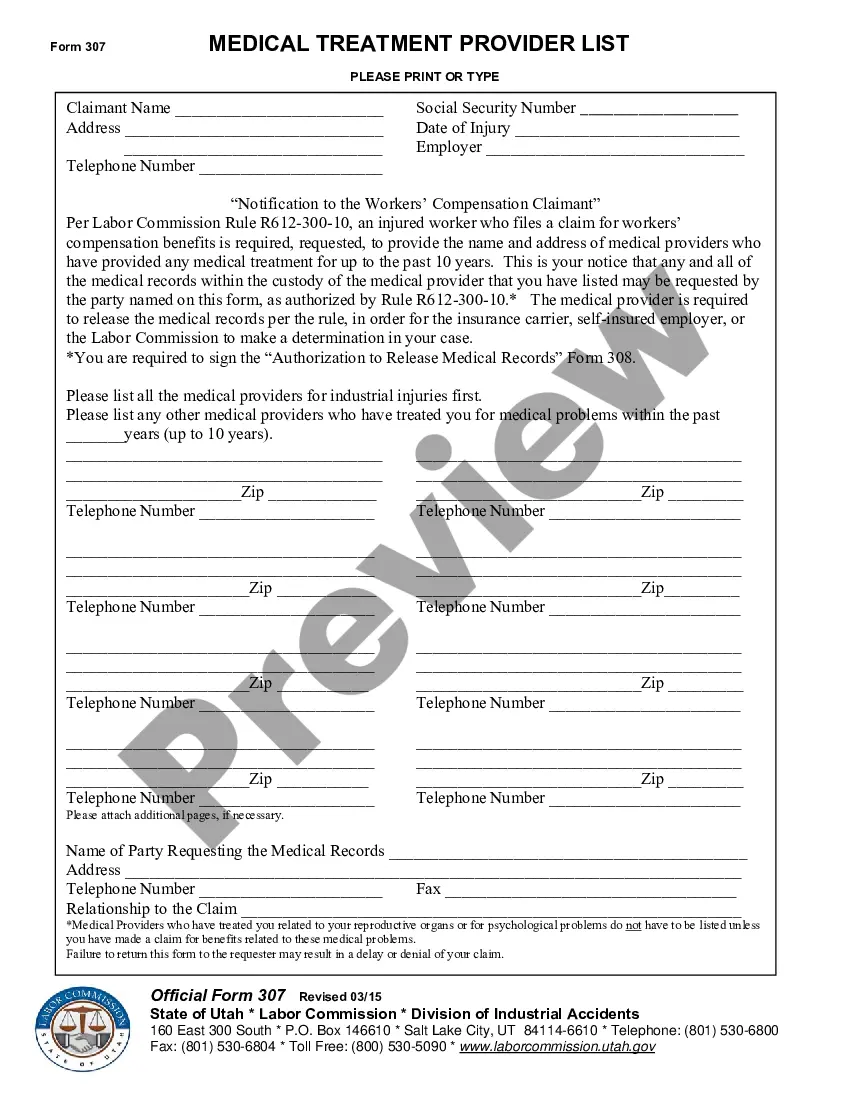

- Make sure you have picked out the proper type for your personal town/county. Select the Preview option to analyze the form`s content. Browse the type information to actually have chosen the correct type.

- When the type does not suit your demands, take advantage of the Search industry near the top of the monitor to obtain the one who does.

- In case you are satisfied with the form, validate your choice by clicking the Buy now option. Then, pick the pricing plan you like and provide your accreditations to register for the profile.

- Approach the deal. Make use of your credit card or PayPal profile to complete the deal.

- Find the format and down load the form on your own system.

- Make modifications. Complete, edit and produce and indicator the acquired Michigan Sample Letter regarding Discharge of Debtor.

Every web template you put into your money does not have an expiration time and is also your own property permanently. So, in order to down load or produce one more backup, just go to the My Forms section and then click in the type you want.

Get access to the Michigan Sample Letter regarding Discharge of Debtor with US Legal Forms, one of the most comprehensive collection of legitimate document templates. Use a huge number of skilled and status-certain templates that satisfy your business or individual needs and demands.

Form popularity

FAQ

You can fill out a form asking the Friend of the Court (FOC) to discharge support debt you owe to the State of Michigan only. You can also file a motion asking the court for a payment plan for your arrears and to have some of your arrears discharged. You can do this if you owe the debt to a person, the state, or both.

May the debtor pay a discharged debt after the bankruptcy case has been concluded? A debtor who has received a discharge may voluntarily repay any discharged debt. A debtor may repay a discharged debt even though it can no longer be legally enforced.

Debt discharge is the cancellation of a debt due to bankruptcy. When a debt is discharged, the debtor is no longer liable for the debt and the lender is no longer allowed to make attempts to collect the debt. Debt discharge can result in taxable income to the debtor unless certain IRS conditions are met.

Courts can issue a discharge ruling when the debtor meets the discharge requirements under Chapter 7 or Chapter 11 of federal bankruptcy law, or the ruling is based on a debt canceling. A canceling of debt happens when the lender agrees that the rest of the debt is forgiven.

Completion of a course in financial management. For obvious reasons, this is also known as debtor education. Discharge of the case. At the completion of your plan, which typically takes 3-5 years, the judge will discharge the remaining qualified debts.

Chapter 7 Bankruptcy Discharge Wipes Out Most Debts Forever credit card debt. medical bills. personal loans and other unsecured debt. unpaid utilities. phone bills. your personal liability on secured debts, like car loans (if there's no reaffirmation agreement) deficiency balances after a repossession or foreclosure.