This contract deals specifically with construction cranes, but could be used in preparation of most any heavy equipment maintenance agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment

Description

How to fill out Contract With Self-Employed Independent Contractor For Maintenance Of Heavy Equipment?

Have you ever been in a situation where you need documents for business or personal use almost every time.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of template forms, including the Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment, which are designed to comply with federal and state regulations.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment whenever necessary. Just select the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is appropriate for your city/state.

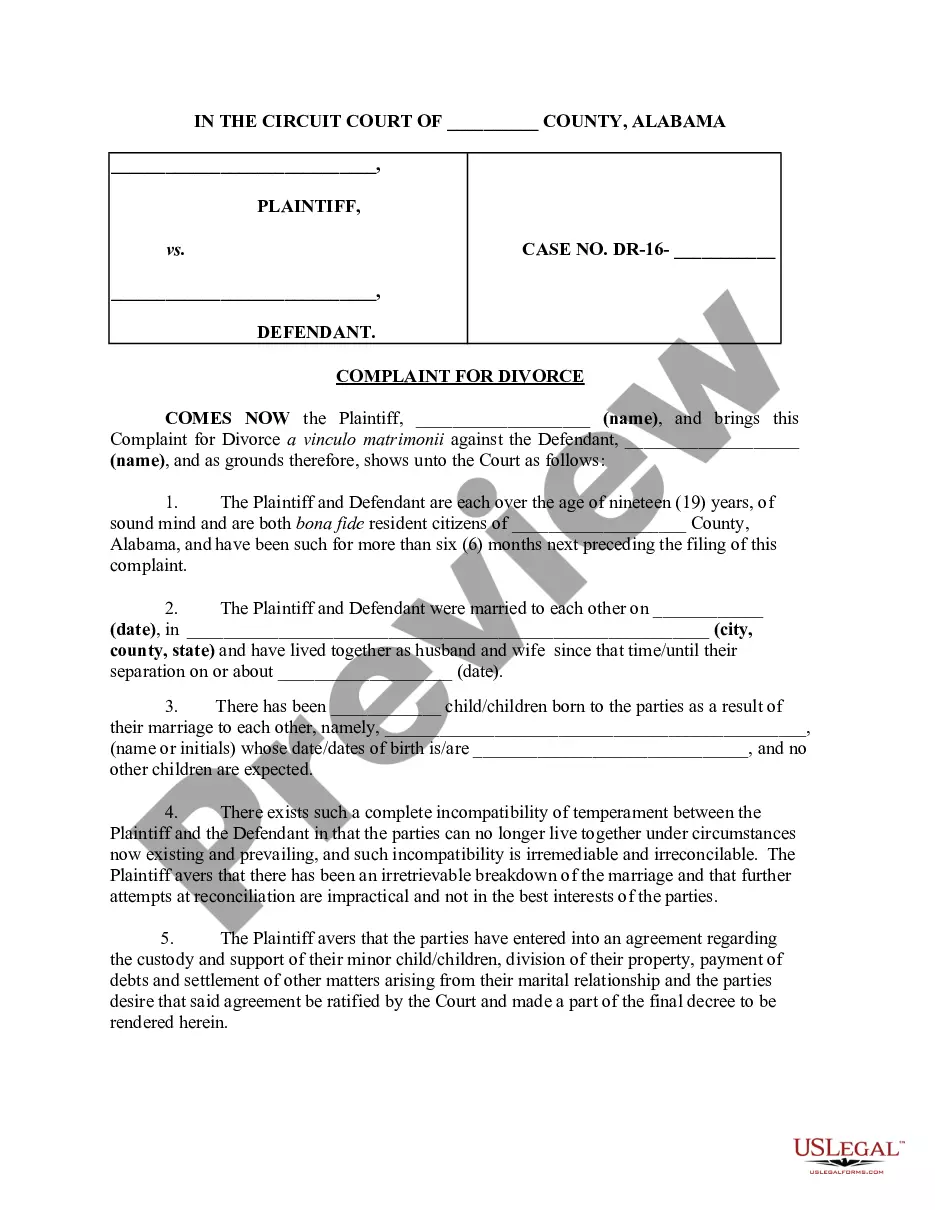

- Use the Review button to examine the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you require, use the Lookup section to find the form that meets your needs and preferences.

- Once you find the correct form, click on Get now.

- Choose the pricing plan you desire, enter the necessary information to create your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

Self-employed individuals must report all income, but some may not owe taxes if their earnings are below certain thresholds. For instance, if your net earnings are less than $400, you typically do not need to file. However, if you are working under a Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment, it's prudent to consult with a tax professional to ensure compliance with tax laws and understand your specific circumstances.

If you earned less than $5000 as a self-employed individual, you may still need to file a tax return. The IRS requires most self-employed individuals to report income, regardless of the amount. When you enter into a Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment, it's important to keep accurate records of your earnings for tax purposes. This documentation can help clarify your tax obligations.

Independent contractors can make a certain amount before triggering tax obligations, but the specific threshold may vary by situation. Generally, any income above $600 earned from a business requires reporting taxes. If you're considering entering into a Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment, it's wise to consult a tax professional to understand your financial responsibilities fully. Furthermore, keeping thorough records can help manage your tax liability efficiently.

The purpose of an independent contractor agreement is to establish clear expectations between the contractor and the hiring business. This contract lays out payment structures, deadlines, and responsibilities, which are crucial for a successful partnership. Specifically, a Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment serves to protect both parties from misunderstandings that could arise during the project. Additionally, it provides a framework for resolving any issues should they occur.

An employment agreement for an independent contractor is a document that defines the terms of engagement between the contractor and the hiring entity. Unlike traditional employment agreements, it emphasizes that the contractor operates independently and is responsible for their own taxes and benefits. In the context of a Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment, this agreement ensures clarity about project specifications and timelines. This clarity can lead to a smoother collaboration and mutual satisfaction.

An independent contractor agreement in Michigan outlines the working relationship between a business and a self-employed independent contractor. This legally binding document specifies the responsibilities, payment terms, and duration of the contract. Importantly, a Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment includes specific clauses that address equipment usage, liability, and safety standards. By using this agreement, both parties can clearly understand their commitments and avoid potential disputes.

An independent contractor generally needs to fill out a W-9 form for tax purposes and may require a contract that stipulates the arrangement with the client. Depending on the nature of the work, additional documentation such as service agreements or confidentiality agreements may also be beneficial. Proper paperwork supports a successful relationship under a Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment.

Independent contractors fill out a W-9 form to provide their tax identification information to clients. The 1099 is typically filled out by the client after payments are made, particularly for income reporting purposes. Understanding this documentation is vital when entering into a Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment.

Writing an independent contractor agreement involves outlining the scope of work, payment terms, and other essential elements like confidentiality and termination clauses. It’s beneficial to include specific details about the responsibilities tied to the Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment. For assistance in drafting a thorough agreement, you might consider using resources from uslegalforms.

An independent contractor should typically fill out a W-9 form to provide their taxpayer information. Depending on their business structure and local regulations, they may also need to file additional forms for licensing or registration. Proper documentation is essential to ensure compliance when working under a Michigan Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment.