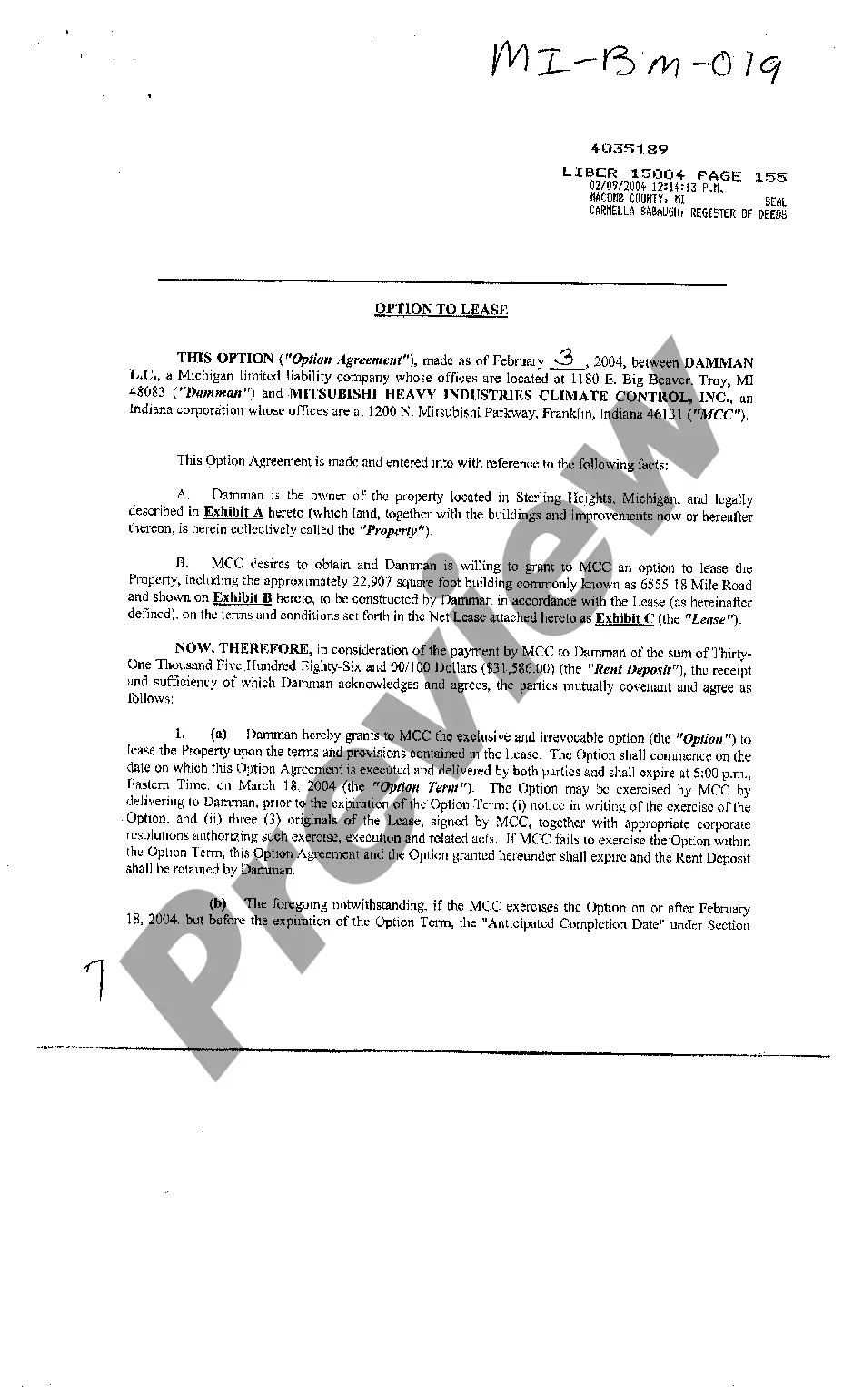

Michigan Option to Lease

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Option To Lease?

Obtain any type from 85,000 legal templates including Michigan Option to Lease online with US Legal Forms. Each form is crafted and refreshed by state-certified lawyers.

If you already possess a subscription, Log In. Once you’re on the document’s page, click the Download button and go to My documents to retrieve it.

If you haven’t subscribed yet, follow the instructions listed below.

With US Legal Forms, you will consistently have instant access to the correct downloadable template. The service grants you access to forms and organizes them into categories to streamline your search. Use US Legal Forms to acquire your Michigan Option to Lease quickly and effortlessly.

- Check the state-specific criteria for the Michigan Option to Lease you need.

- Review the description and view the sample.

- As soon as you’re assured the template is what you require, click Buy Now.

- Select a subscription plan that truly fits your budget.

- Establish a personal account.

- Make a payment in one of two convenient ways: by credit card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

- Once your reusable template is ready, print it or save it to your device.

Form popularity

FAQ

A lease with an option to buy can be a good strategy for both buyers and sellers in Michigan. It offers a way for buyers to secure a property they like while still deciding on a long-term commitment. Nevertheless, be sure to weigh the terms and conditions, as the agreement can vary widely based on individual circumstances and property conditions.

The 554.134 law in Michigan pertains to lease agreements and outlines rights and responsibilities for both landlords and tenants. This law ensures that both parties have clear expectations regarding their agreement. If you're exploring a Michigan Option to Lease, understanding this law is vital to protecting your interests. You can find valuable resources and templates on platforms like uslegalforms to help you navigate these agreements smoothly.

The 3x rent rule in Michigan states that your gross monthly income should be at least three times the rent amount. This rule aims to ensure that tenants can comfortably afford their housing costs. If you're considering a Michigan Option to Lease, this rule plays a crucial role in your rental application process. Always check your income levels before signing any agreements.

A lease-option-to-buy arrangement can be a solution for some potential homebuyers, but it's not right for everyone. If you're not certain that you're going to be able to purchase the rental home at the end of the lease period, you might be better served with a standard rental agreement.

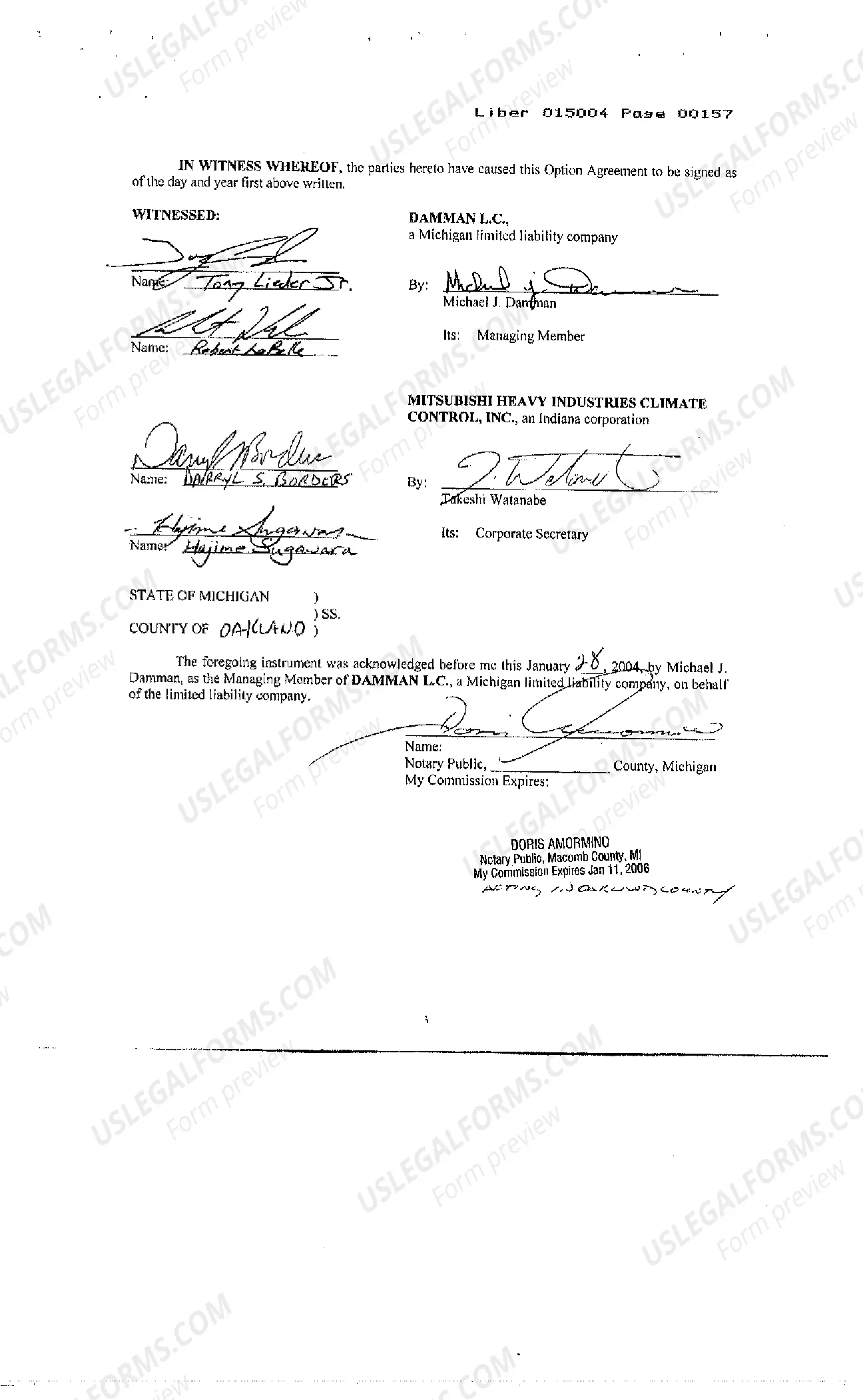

Officially record the lease agreement and purchase option. The easiest way to do this is have the paperwork notarized and then recorded in your local public real estate records. Escrow the deed. Record a mortgage.

Rent-to-own schemes (also known as rent-to-buy schemes) are leasing agreements that afford renters the right to buy a home at the end of a pre-determined rental period, at a price agreed prior to signing the agreement.

The difference between a lease option and lease purchase agreement is that the lease option only obligates the seller to sell. A lease purchase agreement commits both parties to the sale barring breach of contract or the buyer's inability to secure a mortgage.

A lease-option is a contract in which a landlord and tenant agree that, at the end of a specified period, the renter can buy the property. The tenant pays an up-front option fee and an additional amount each month that goes toward the eventual down payment.

A lease-option-to-buy arrangement can be a solution for some potential homebuyers, but it's not right for everyone. If you're not certain that you're going to be able to purchase the rental home at the end of the lease period, you might be better served with a standard rental agreement.

Sellers agreeing to lease option deals arguably have more to lose than buyers. If house prices rise they're likely to regret agreeing a price at the time the option was taken out. If prices fall there's a risk the buyer or investor will not exercise their option to buy, and they'll still be stuck with the property.