Maine Deed and Assignment from Trustee to Trust Beneficiaries

Description

How to fill out Deed And Assignment From Trustee To Trust Beneficiaries?

You may spend hrs online looking for the lawful file web template which fits the state and federal specifications you require. US Legal Forms gives thousands of lawful forms which can be examined by experts. It is simple to down load or print out the Maine Deed and Assignment from Trustee to Trust Beneficiaries from the support.

If you currently have a US Legal Forms bank account, it is possible to log in and click on the Down load switch. Next, it is possible to total, revise, print out, or indication the Maine Deed and Assignment from Trustee to Trust Beneficiaries. Each and every lawful file web template you get is your own property forever. To have an additional backup of the acquired kind, proceed to the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms website for the first time, keep to the straightforward recommendations under:

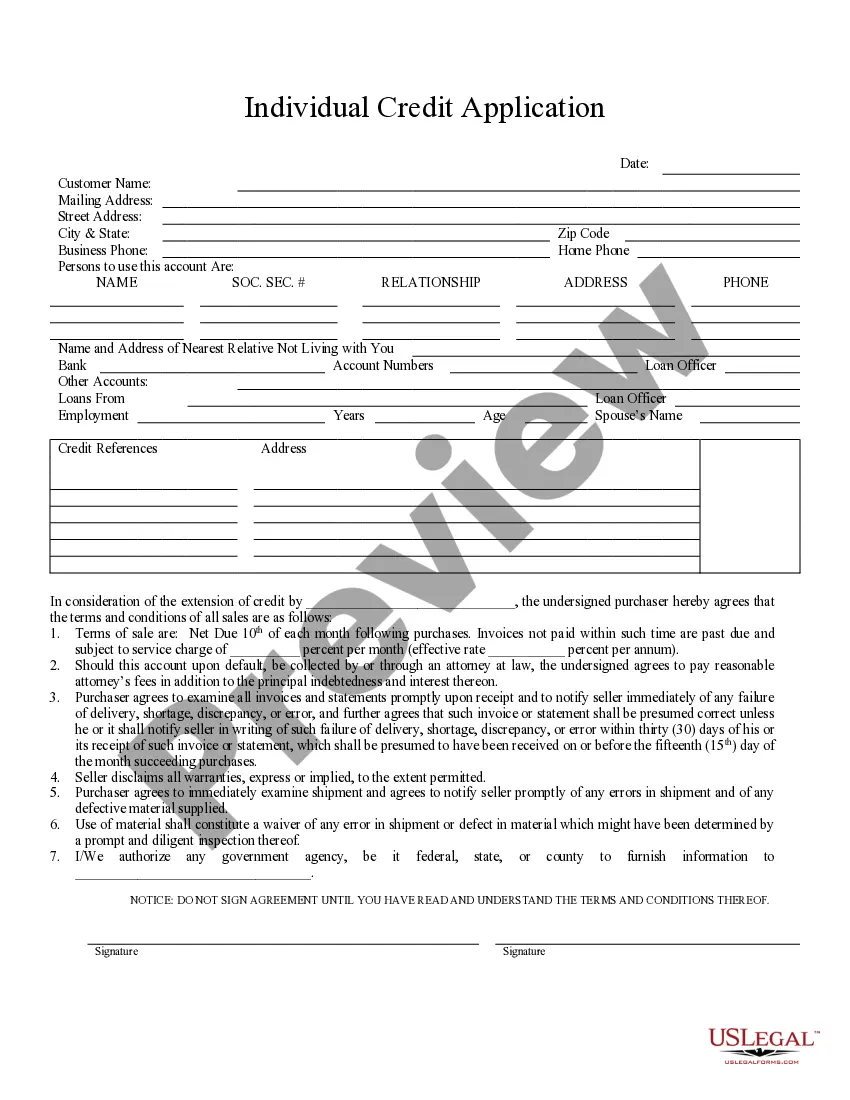

- Initial, be sure that you have chosen the best file web template for the state/city of your choice. Look at the kind information to make sure you have picked the right kind. If available, make use of the Review switch to search from the file web template at the same time.

- If you wish to locate an additional model from the kind, make use of the Lookup discipline to get the web template that suits you and specifications.

- After you have found the web template you would like, click Acquire now to carry on.

- Pick the pricing program you would like, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You can use your charge card or PayPal bank account to purchase the lawful kind.

- Pick the structure from the file and down load it in your system.

- Make modifications in your file if possible. You may total, revise and indication and print out Maine Deed and Assignment from Trustee to Trust Beneficiaries.

Down load and print out thousands of file web templates making use of the US Legal Forms Internet site, that offers the largest assortment of lawful forms. Use specialist and condition-specific web templates to deal with your company or personal demands.

Form popularity

FAQ

To name a special needs trust as a beneficiary, use the name of the trustee and the full legal name of the trust as beneficiary: For example: Chris Lee as the trustee of The Pat Lee Special Needs Trust"

To transfer cash or securities, the trustee will open an account in the trust's name, and the grantor will instruct his or her bank or broker to move the funds from his or her account to the trust's account. For real estate, a deed is used to transfer legal title of the property from the grantor to the trust.

Administer the Trust: Per the Trust direction, a Trustee would need to distribute and/or administer assets to any beneficiaries. Make ongoing decisions: As needed, Trustees should be willing and able to make decisions about how and when beneficiaries receive payment, as well as decide on other provisions of the trust.

A trustee has all the powers listed in the trust document, unless they conflict with California law or unless a court order says otherwise. The trustee must collect, preserve and protect the trust assets. Probate Trusts - The Superior Court of California, County of Santa Clara scscourt.org ? self_help ? probate ? property scscourt.org ? self_help ? probate ? property

One example of when the trustee and beneficiary are the same is when a grantor has multiple children and creates a trust for them. All their children may be beneficiaries, but the grantor may choose one of them to be the trustee. Trustee vs. Beneficiary: What's the Difference? - Haven Life havenlife.com ? blog ? trustee-vs-beneficiary havenlife.com ? blog ? trustee-vs-beneficiary

A beneficiary of trust is the individual or group of individuals for whom a trust was created. The person who creates a trust also determines the trust beneficiary and appoints a trustee to manage the trust in the beneficiary's best interests. Beneficiary of Trust: Definition and Role in Estate Planning investopedia.com ? terms ? beneficiary-of-tr... investopedia.com ? terms ? beneficiary-of-tr...

Trustees are required to make decisions in the beneficiary's best interests and have a fiduciary responsibility to them, meaning they act in the best interests of the beneficiaries to manage their assets. What Is a Trustee? Definition, Role, and Duties - Investopedia investopedia.com ? terms ? trustee investopedia.com ? terms ? trustee

For instance: A trustee holds property for the beneficiary, and the profit earned from this property belongs to the beneficiary. If the customer deposits securities or valuables with the banker for safe custody, banker becomes a trustee of his customer.